The Nifty50 on February 1 clocked healthy rally and moved closer to psychological 18,000 mark after the Finance Minister Nirmala Sitharaman delivered good budget with announcement of increase in capital expenditure by 33 percent to Rs 10 lakh crore for FY24 and tax benefits to rural economy & taxpayers, with unchanged capital gains tax, but the selling in Adani Group, life insurance and bank stocks in last couple of hours of trade wiped out all those gains of more than 300 points.

The index has formed bearish candle with long upper and lower shadow on the daily charts, which resembles High Wave kind of pattern formation, indicating the indecisiveness among buyers and sellers about further market trend.

But the Nifty50 strongly defended 200 DEMA (daily exponential moving average - 17,550) for fourth day in a row. Also it has taken a strong support at 200 DMA (daily moving average - 17,300). Further it has still respected long upward sloping support trendline adjoining lows of March 2020 and June 2022, while on the weekly scale, it has so far defended 50 WEMA (weekly exponential moving average - 17,400).

Overall it was a volatile session for the market and the index has been rangebound. Unless and until above support levels get decisively broken, there is no cause of worry, but volatility is likely to continue with resistance at 17,800-18,000 area, experts said.

"The pivotal zone of 17,500 was firmly safeguarded, which implies the significance of the support, followed by the sacrosanct support of 200 SMA which is placed around 17,300. On the higher end, 17,800 is likely to act as a stiff resistance, followed by the crucial hurdle of the 18,000 mark," Osho Krishan, Sr. Analyst - Technical & Derivative Research at Angel One said.

Going forward, he feels the market is likely to remain volatile ahead of the aftermaths of the Budget. Meanwhile, traders should keep a close tab on the mentioned levels and avoid aggressive bets till the trend gets clear, he advised.

Here are top 10 stock ideas after the Union Budget. Returns are based on the February 1 closing prices:

Expert: Ajit Mishra, VP - Technical Research at Religare Broking

HCL Technologies: Buy | LTP: Rs 1,132 | Stop-Loss: Rs 1,050 | Target: Rs 1,270 | Return: 12 percent

Only a handful of sectors are holding strong in the recent correction and IT is among the top performing names. Within the pack, HCL Tech is leading from the front as it has been rebounding strongly after the breakout from the consolidation range and currently hovering around the previous swing high. Indications are in the favour of the prevailing move to continue.

Mahindra & Mahindra: Buy | LTP: Rs 1,352 | Stop-Loss: Rs 1,240 | Target: Rs 1,550 | Return: 15 percent

The auto index has almost retested the record high budget day while the majority of sectors are struggling for sustainability. And, M&M is trading largely in sync with the trend.

It has witnessed a fresh breakout from a consolidation range of Rs 1,200-1,350, after spending nearly four months and currently trading around its record high. We expect the gradual up move from hereon.

Bandhan Bank: Sell | LTP: Rs 237 | Stop-Loss: Rs 252 | Target: Rs 210 | Return: 11 percent

The banking index is also witnessing a roller coaster ride in line with the benchmark index and a few stocks like Bandhan Bank have been consistently underperforming the pack.

After a breakdown from a consolidation range, it has been hovering in a narrow band, which has resulted in the formation of a fresh shorting pivot. The chart pattern is pointing towards the retesting of the previous swing low soon.

Expert: Viraj Vyas, Technical & Derivatives Analyst | Institutional Equity at Ashika Stock Broking

ITC: Buy | LTP: Rs 361 | Stop-Loss: Rs 340 | Target: Rs 400 | Return: 11 percent

The stock has been in a strong uptrend since February last year and after a brief consolidation of 2 months, the stock looks ready for the next upmove.

Even on the relative strength vs Nifty 50, the RS (relative strength) line continues to trend higher and we expect the stock to outperform in the coming weeks as well.

Mahindra & Mahindra: Buy | LTP: Rs 1,352 | Stop-Loss: Rs 1,270 | Target: Rs 1,500 | Return: 11 percent

The stock has been in a secular uptrend since March 2022 and since the last 5 months, has been consolidating (Blue highlight) in a range with positive bias.

On the relative strength front too, the stock appears strong and such outperformance is likely to continue going forward.

Polycab India: Buy | LTP: Rs 2,995 | Stop-Loss: Rs 2,820 | Target: Rs 3,300 | Return: 10 percent

The stock has witnessed a stupendous run since pandemic lows, post which, the stock entered a phase of time-price consolidation for a period of 16 months. A breakout of such consolidation zone supported by volumes augurs well for further incremental move towards Rs 3,300-level.

Expert: Rohan Shah, Head of Technical Research at Stoxbox

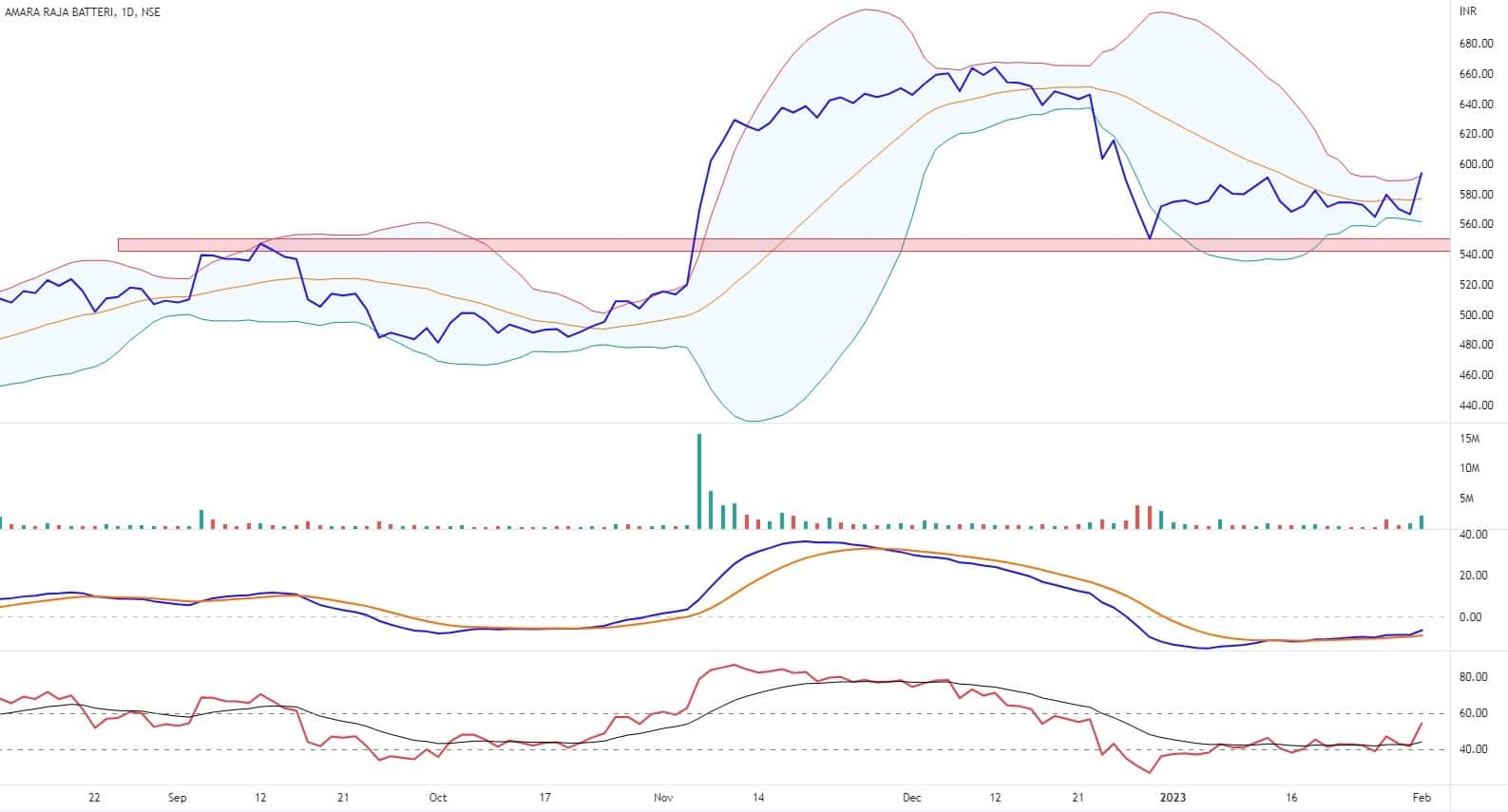

Amara Raja Batteries: Buy | LTP: Rs 594 | Stop-Loss: Rs 568 | Target: Rs 644 | Return: 8 percent

The stock has generated a breakout from the multi-week base formation with strong volumes highlights upward momentum in price. The multi-week base formation formed at the polarity support which shows bullish price action.

Furthermore, the stock has staged a breakout from Squeeze Bollinger bands denotes expansion in the volatility on the higher side. The stock is trading above all the key daily moving averages (20, 50, 100 and 200) indicates inherent strength in price.

MACD inching higher after converging its average validates bullish bias in price. Moreover, RSI (relative strength index) shows a range shift at the elevated levels signals momentum in price.

Carborundum Universal: Buy | LTP: Rs 975 | Stop-Loss: Rs 937 | Target: Rs 1,050 | Return: 8 percent

The stock has resolute a breakout from multi-week volatility contraction pattern (VCP) which denotes a bullish price structure. Also, the stock has staged a breakout from multi-day consolidation range (Rs 950-800) adding further confirmation to the bullish price action.

The breakout has accompanied with surge volume and strong candle. The Relative Strength line against Nifty is heading north and trading at 52-week high level indicates inherent strength in price.

MACD trading at multi-month high readings and heading higher after converging around its averages compliments bullish bias on price.

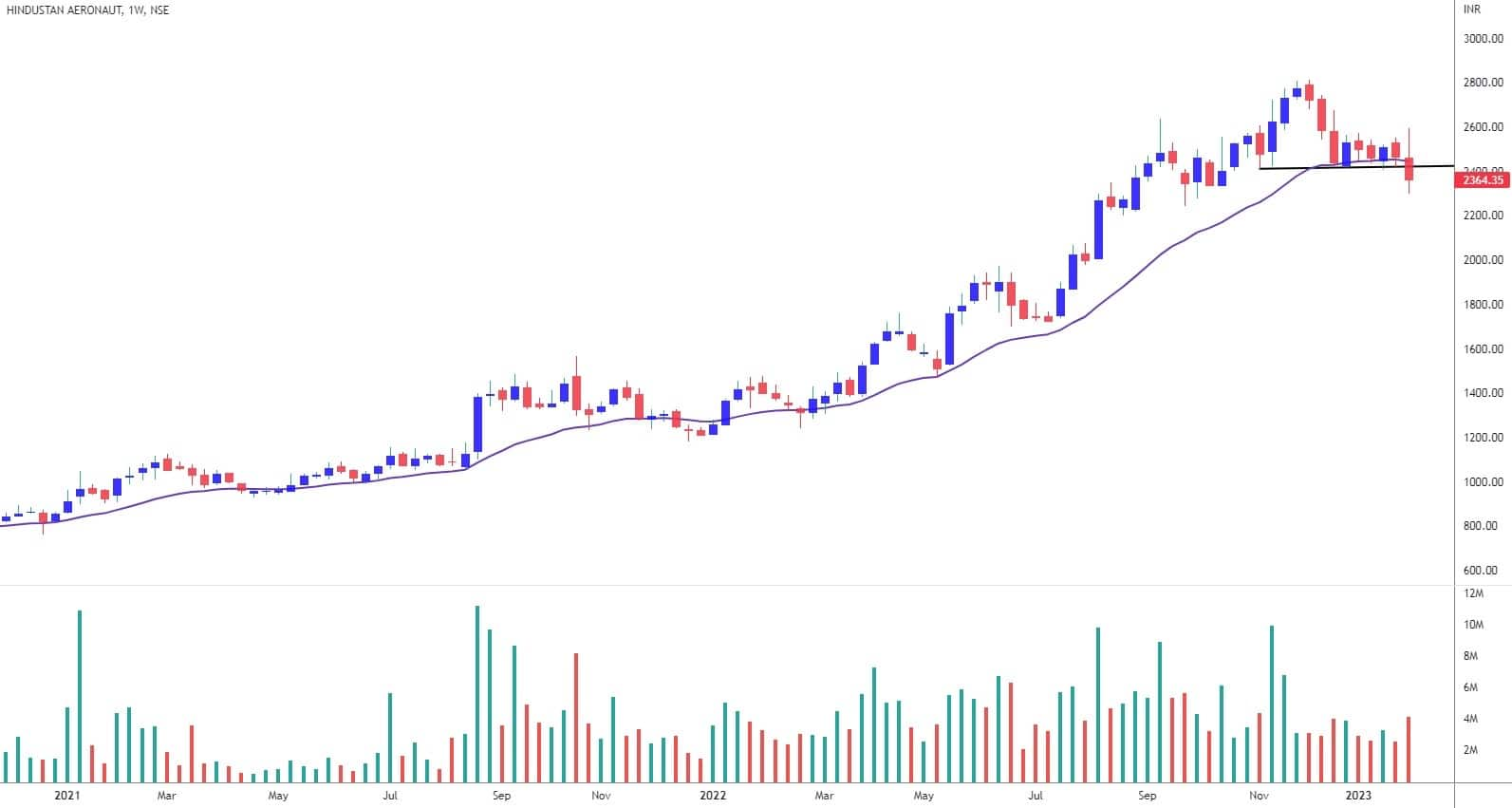

Hindustan Aeronautics: Sell | LTP: Rs 2,364 | Stop-Loss: Rs 2,450 | Target: Rs 2,200 | Return: 7 percent

The stock witnessed aggressive profit booking in December 2022 after printing a new life high of Rs 2,811.80. Post sharp selloff, stock consolidated in the tight range for couple of weeks and this week, price registered breakdown from the same indicating further weakness in

On the price pattern front, stock has registered breakdown from bearish Inverted Cup and Handle pattern which indicates bearish signal for medium term trend. Furthermore, stock has surpassed 20 weekly EMA (exponential moving average) which has provided key support historically at every intermediate decline validating bearish bias in price.

Expert: Bharat Gala, Technical Analyst at Ventura Securities

GNA Axles: Buy | LTP: Rs 798 | Stop-Loss: Rs 620 | Target: Rs 1,200 | Return: 33 percent

GNA Axles showed symmetrical triangle breakouts supported by volumes, with bullish weekly candlestick pattern. It is trading above averages which itself are trending upward.

MACD, Demand Index & ADX Indicators suggest a Possibility of upmove. Hence, one can buy in the area of Rs 785-695, with a stop-loss of Rs 620 and for a target of Rs 1,200.

Kabra Extrusion Technik : Buy | LTP: Rs 563 | Stop-Loss: Rs 430 | Target: Rs 900 | Return: 60 percent

The stock has seen rectangle pattern breakouts supported by volumes and has also seen one year range consolidation pattern breakout.

The trading above averages which itself are trending upward.

The MACD, Demand Index & ADX indicators suggest a possibility of move on positive side. So one can buy in the range of Rs 531-485, with a stop-loss of Rs 430 and for a target of Rs 900.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.