Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP), the three largest hyperscaler cloud service providers, reported single digit Year-on-Year (YoY) growth in deal win by annual contract value (ACV) in the fourth quarter of 2022, signalling weakness after the industry’s rapid growth during the pandemic.

This was largely driven by decline in cloud spending of technology companies across key markets including the US and Europe. But industry analysts highlighted that demand for cloud continued to be resilient in emerging markets including India and Asian countries coming from new-age technology firms in these regions.

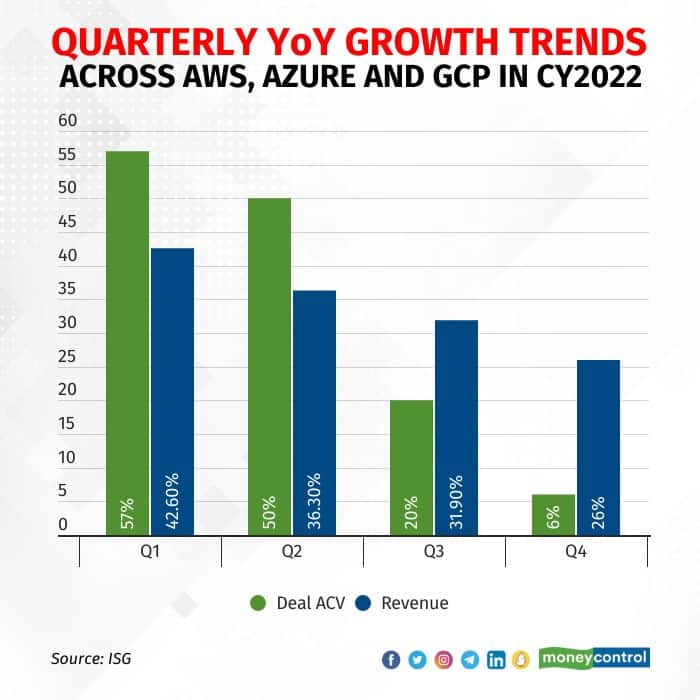

According to data accessed from technology research firm ISG, the three cloud service providers together had only 6 percent YoY growth in ACV in the fourth quarter ended December 2022, down from 57 percent in Q1, 50 percent in Q2 and 20 percent in Q3 respectively.

Revenue growth too continued to taper for these companies over the quarters.

Infrastructure-as-a-service (IaaS), which includes hyperscalers, consequently reported the lowest annual growth ever at 8 percent.

Industry experts said the single-digit growth was a result of reduction in technology spending on cloud across major global social media companies, startups and Over The Top (OTT) content companies that use cloud services the most.

This comes amidst increasing macro-economic uncertainty after hefty interest rate hikes to combat inflation in the US and Europe that have raised the spectre of recession and the war in Ukraine leading to supply chain disruptions have dented technology spending.

Cracks have already started to show even at tech giants like Google, Microsoft, Meta, Amazon among many others both on the corporate and startup side, laying off employees in big numbers, restructuring businesses in an attempt to cut costs.

While the US and European markets are taking the biggest beating, emerging markets including India and the Asian countries have remained comparatively better in terms of demand for the hyperscaler cloud services, analysts said.

According to Gaurav Vasu, founder and CEO of IT market intelligence firm UnearthInsights, if one had to consider Chinese hyperscalers such as Alibaba Cloud in this mix, the dip would be much bigger.

“Cloud and tech spending for startups, especially in the e-commerce, edtech and fintech segments, started to slow down 2-3 quarters back in the US. Global social media and major OTT companies too are significantly cutting costs on cloud spending. AWS, Azure and GCP still managed the dip in India,” Vasu told Moneycontrol.

Individually, ISG said, Google’s revenue growth slowed to 36 percent YoY in the fourth quarter from almost 42 percent in the third quarter. Google saw enterprise momentum in the fourth quarter, but margins in its cloud business continue to be negative, it said.

AWS’ revenue growth was down to 20 percent from 28 percent in Q3, primarily driven by customers focused on optimising existing workloads. Meanwhile, Azure and its other cloud services reported 31 percent growth YoY in Q4, down from 35 percent. Azure’s commercial bookings growth rate is its lowest in five years, ISG said.

India demand“The US and Europe markets are seeing much bigger dips in spending. But India, Asian countries and other emerging markets are saving them. CEOs of these big tech firms will continue to invest more in India,” Vasu said, referring to the CEOs of companies like Microsoft, Google and Amazon.

Both Google and Microsoft CEOs, Sundar Pichai and Satya Nadella visited India in the past few months. Nadella, during his visit in January, emphasised the importance of the cloud and Artificial Intelligence (AI) among the six imperatives he believes will drive tech-led economic growth in India.

“Cloud is 70-80 percent energy efficient on workload. You hedge against the demand cycle, you consume it only when you need it. We are investing in 60-plus regions, 200 plus data centres worldwide. In India alone, we are expanding and setting up our fourth region in Hyderabad. We want to make the cloud available everywhere,” Nadella said.

Stabilising growthMrinal Rai, principal analyst at ISG, called the deceleration in the December 2022 quarter a stabilisation of growth following two years of exaggerated demand and growth driven by the pandemic and remote working.

“The kind of demand they (hyperscalers) were to achieve in three years, they got that in 10 months. The growth rates are now showing a meaningful deceleration as client companies are going from expansion to optimization of existing cloud spends, given that the current environment demands focus on efficiency and capital preservation,” he said.

Rai added: “Client companies are now focusing on optimising present applications and making them more cloud-ready. That pace of optimisation is now also getting faster as the macro view incrementally deteriorated. Clients are refactoring existing workloads to run more efficiently on public cloud infrastructure.”

Analysts said that there has been a reduction in spending on more discretionary analytics and research and development.

Vasu expects this slowdown to continue at least until the April-June quarter of 2023 and some pressure may also spill over into the July-September quarter.

“Technology companies had already predicted this slowdown and that’s why the layoffs are happening within the engineering sciences teams. Hopefully, we should start seeing some recovery in the Q3 deal wins."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.