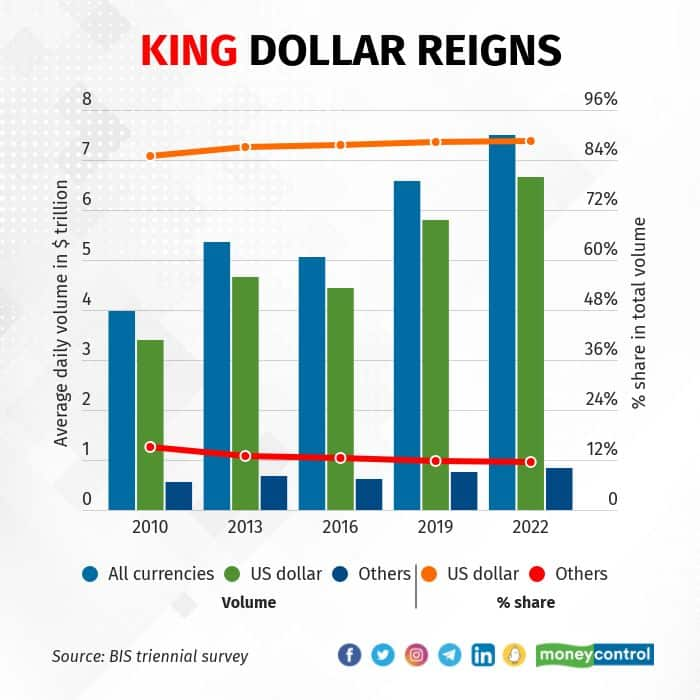

As the world grappled with the COVID-19 pandemic and trade came perilously close to a halt, foreign exchange pipelines mellowed. The average trading volume in the global foreign exchange market grew by 14 percent between 2019 and 2022, according to the Bank for International Settlements’ triennial survey. To put that in perspective, the growth in average volume during the previous three-year period was 30 percent.

The growth in volume has been driven by the dollar and its share has increased in contrast to the rising narrative of its demise during the pandemic.

The dollar is the indisputable king in the forex market, despite the growing public discourse that the US currency’s hegemony is under siege. Its share has actually grown in overall volume, to 88 percent by April 2022 from 85 percent three years before. This means that the dollar is the underlying currency in which most trade is billed. Since every other currency is pegged to the dollar, there is little to defy its reserve unit status. Its ascent against all other currencies underscores this. But a bunch of currencies have defied gravity and are giving the much-needed resistance to the greenback.

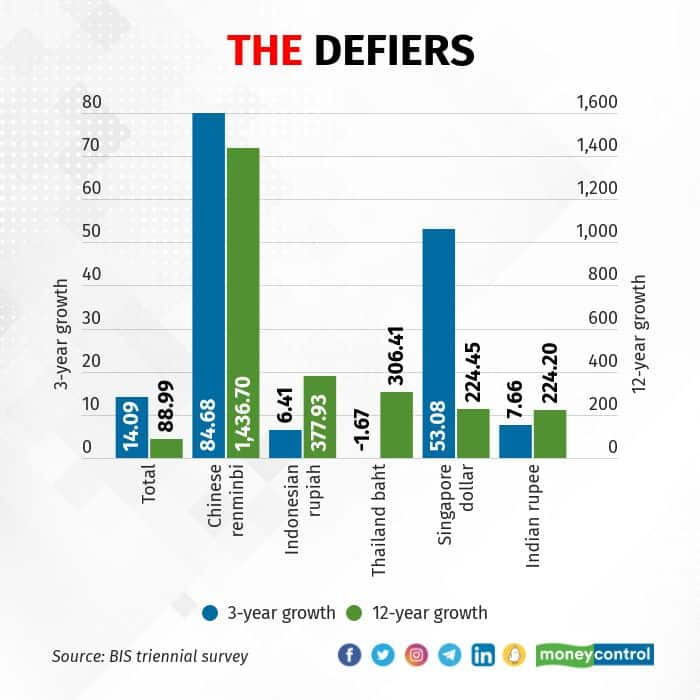

Unsurprisingly, the Chinese renminbi has dominated the non-dollar currency group. The currency’s share in the daily forex volume surged to 7 percent by 2022 from 4 percent in 2019 and below 1 percent in 2010. Indeed, the past decade has been that of the Chinese yuan with manifold growth in volume in forex trading. Trading volume for the currency grew faster at 85 percent in the three-year 2019-2022 period. The growth in daily volume of all currencies was a modest 14 percent. The Singaporean dollar, too, has emerged as a sought-after currency with volume growth at a cool 53 percent.

For all the aspirations of the government and the markets, the Indian rupee hasn’t made much of a dent. Its share remains a mere 1.6 percent in the overall volume. A 12-year period scan shows some new up and comers too. The Thai baht and the Indonesian rupiah have increased their heft in forex markets too.

Those who fell off

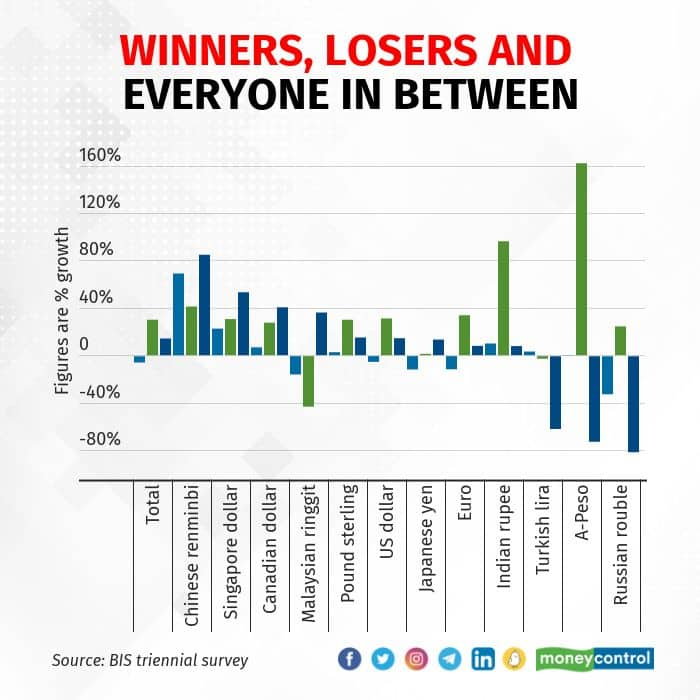

Three currencies fell from grace during the three-year period, mainly led by the troubles in their own economic and political milieu. The Turkish lira, Argentinian peso and Russian rouble saw daily volume growth shrink massively. The rouble’s troubles arose directly from the sanctions that Russia attracted after it declared war on Ukraine. The trading volume in the rouble fell a whopping 81 percent. Inflation and political crises have also been key factors in the erosion of the value of the currencies of these economies. Argentina’s government has been unable to gain credibility amid a surging inflation problem that has stretched for one too many years. Turkey’s president Recep Erdogan’s economic experiments have led to soaring inflation and a run on the lira. That explains it falling out of favour among international foreign exchange dealers.

In between the big winners and losers are the moderates. The pound sterling, Indian rupee and the Japanese yen have managed to keep a stable footing. The euro, on the other hand, has lost ground fast with its share collapsing by almost 10 percentage points within a 12-year period.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.