BUSINESS

OPINION | India’s High Cost of Capital: The hidden tax on growth

India’s cost of capital is the highest among large economies, which acts as structural drag on economic growth. Ways to lower capital cost are realisable and their introduction is a matter of urgency

BUSINESS

Tax Surveillance: A dangerous precedent for privacy and liberty

A system where tax officers have unchecked authority turns the state into the judge, jury, and executioner. Even if the intent is to curb tax evasion, the means must respect democratic principles and due process

BUSINESS

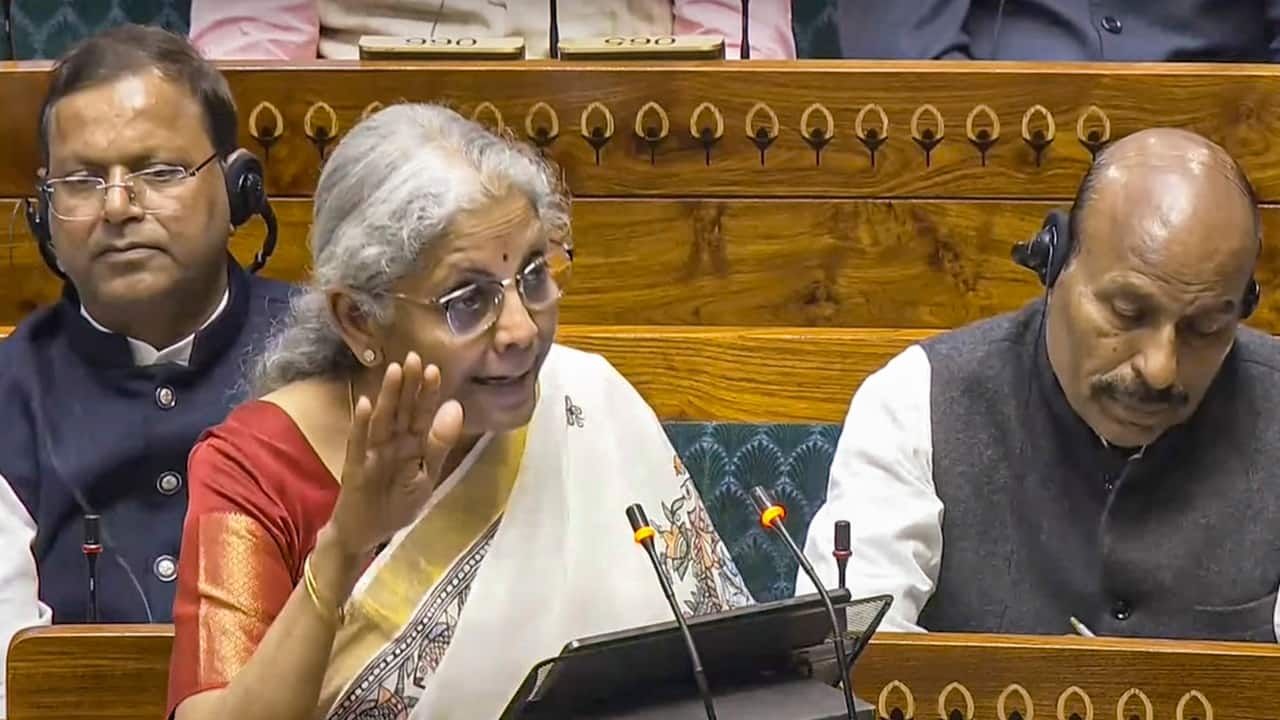

A landmark Budget for growth and middle class empowerment

There is a compelling need for further simplification of personal income tax, specifically in adopting a more streamlined three-slab system in place of the current complex structure, writes Mohandas Pai

BUSINESS

Budget shows a strong Indian economy on a high growth path

In terms of tax revenues, non-tax receipts, keeping the fiscal deficit in check, and improving the quality of expenditure, the government is on a strong wicket heading into the next fiscal. All the budget indicators point to high growth and massive job creation in the future

BUSINESS

With benefits of growth reaching almost every Indian, the future looks bright

This is the second article in a two-part series. The tech sector is going great guns, there is a visible uptick in job creation, social indicators are improving, and poverty is declining. Digital public goods are another unique Indian economic strength that is powering the startup ecosystem

BUSINESS

Why we are optimistic about India’s growth prospects

This is the first article in a two part series. With massive investments in infrastructure, bets on contract manufacturing fructifying, RBI ensuring the financial health of banks, corporates booking healthy profits, and equity flows into markets surging, India is positioned well for spectacular growth

BUSINESS

Mohandas Pai: A transformative budget that will ensure India’s GDP growth will stay on the fast lane

The increase in capex spending, focus on making sure that every Indian gets the necessities of life and focus on reducing the fiscal deficit to 5.9 percent will make sure India grows faster

BUSINESS

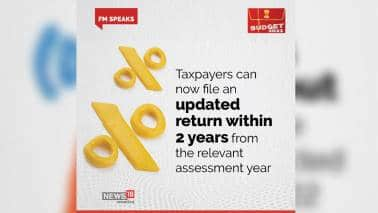

Budget 2023: An opportunity to make the Indian tax regime globally competitive

The government must seize the opportunity to resolve long-standing taxation issues in Budget 2023. The personal income tax regime needs to be simplified for all classes of taxpayers, capital gains taxes streamlined and policies made less litigious

BUSINESS

India needs judicial and administrative reforms that place citizen welfare at the centre

To accelerate job creation, expand the tax base, and eradicate poverty in an emerging country, India needs world-class processes and adequate judicial and administrative capacity with the necessary knowledge collateral

WORLD

Sunak's loyalty lies with the UK, Indians gain no more than a brief sense of pride: Mohandas Pai

As far as India is concerned, we can rejoice to say a person of Indian ethnicity has become the PM of a country that once colonized India. But we need to temper our enthusiasm and joy with the understanding that Rishi Sunak is a British Indian.

BUSINESS

Modi Govt @ 8 | Prime Minister Narendra Modi’s reforms have positively impacted every Indian

No Prime Minister in India’s history has done as much for the poor as Narendra Modi has done in the last eight years

BUSINESS

TV Mohandas Pai: Budget 2022 is disappointing for taxpaying middle class, but overall positive for economy

It appears the government has been very cautious, and conservative in calculating the tax for this year. The government could have made a more realistic assessment, and use that extra amount to give relief to people, which it has failed to do

BUSINESS

Five trends in 2022 that will supercharge India’s technology-enabled sector

Expect 2022 to build on the explosion of technology-enabled growth. The possibility of interest rate hikes in the US may dampen sentiments, but the momentum of technology-driven innovation is robust

BUSINESS

Mohandas Pai writes: India’s young start-up founders should be given the freedom to list anywhere

What India needs right now is a good, open regulatory system which encourages innovation, risk taking, investment and job creation, and facilitates the growth of the economy to $5 trillion by 2026. Barriers such as not allowing Indian companies to list directly overseas are unnecessarily holding up India’s growth