BUSINESS

IT earnings can grow 15% in 2024 as AI spending rises, says Vikas Gupta of Omniscience

The CEO and Chief Investment Strategist of Omniscience Capital says IT companies will surprise the streets with higher earnings as global players' fat budgets will benefit Indian companies as well

BUSINESS

FMCG shares take a beating after Q3 business update points to flat sales

Volume projections too, failed to impress. Godrej Consumer Products’ volumes are set to grow in high-single digits in Q3FY24, while Marico’s volumes are expected to grow in low-single digits.

BUSINESS

Why are analysts not too happy with Nestle India?

At the current price of Rs 26,620, the stock is trading at a forward PE of 80x for FY24, having gained close to 20 percent in the past three months. The valuation is much higher as compared to other FMCG companies

BUSINESS

This PMS manager has contra view on market: Siddhartha Bhaiya reveals Aequitas’ best and worst bets

Siddhartha Bhaiya reveals his investing thesis, secret sauce, best and worst bets, and much more in an all-encompassing interview with Moneycontrol.

BUSINESS

7 tips for investors in 2024: Best PMS managers spill the beans

From focusing on fundamentals to avoiding leverage and trading tips, market mavens share tips for successful investing in the New Year.

BUSINESS

ED arrests Viraj Patil in TP Global illegal forex case

Viraj Patil was arrested from Mumbai on arrival on December 25 from Mumbai before which he was staying in Dubai.

BUSINESS

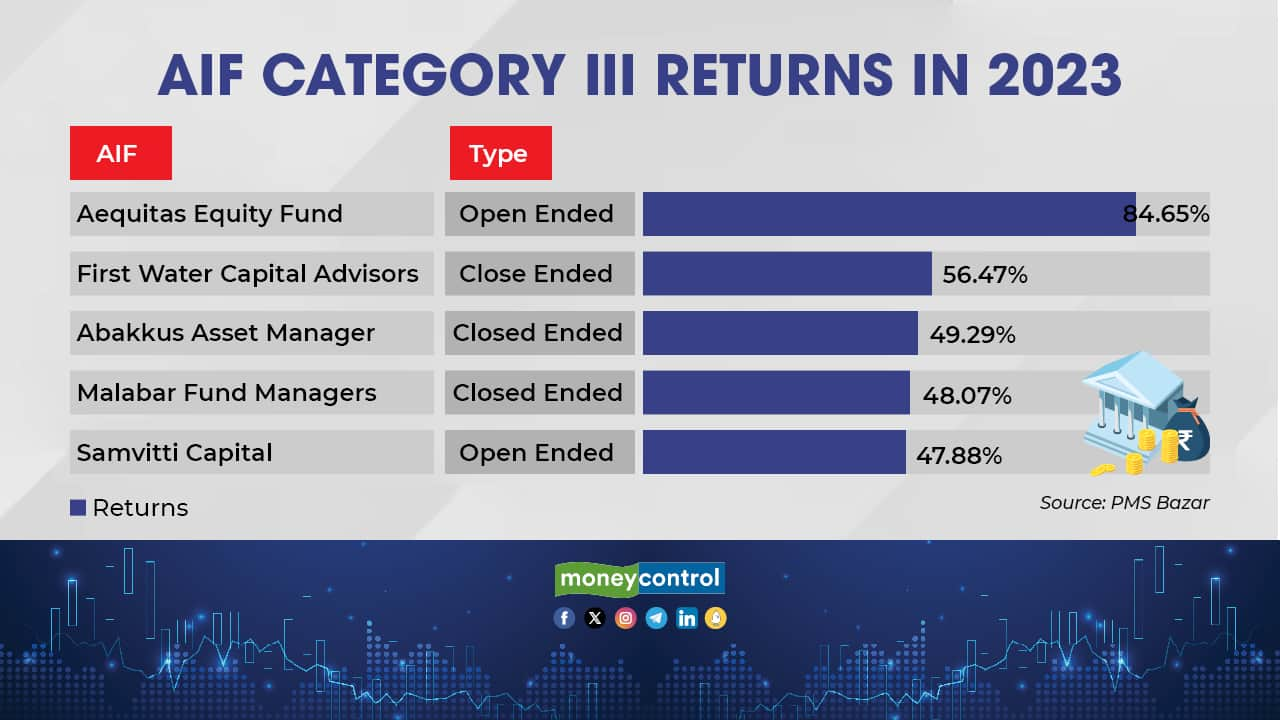

Top 5 AIFs of 2023: Aequitas and First Water tops the Category III list

The best Alternative Investment Funds (AIF) Category III performers in 2023 were long-only funds.

BUSINESS

Top 5 PMS of 2023: Aequitas, Shepherd's Hill, others gained the most this year

Aequitas, Shepherd's Hill, Investsavvy, Samvitti Capital, and Invasset were the top five PMS in 2023.

BUSINESS

Meet the manager who believes in small-cap monopolies, be it mango pulps or kitchen sink

Sagar Lele, manager and co-founder of Rupeeting, follows what he calls the monopolies approach. This is one of the six approaches the firm believes in, and it alone has given 33% returns in the last one year.

BUSINESS

Smallcap rally forces Aequitas to suspend new inflows into PMS

The current frenetic and euphoric rally in the small and midcap index over the last six months has reduced the number of stocks that fit within the firm's valuation framework, managing director and CIO Siddhartha Bhaiya has said

BUSINESS

Saurabh Mukherjea’s Little Champs turns worst performer in the PMS pack over the past year

Marcellus Little Champs delivers negative returns over the past year dragging down its return since inception below benchmark

BUSINESS

Bank Nifty soars past 48,000 for first time as HDFC Bank jumps on FTSE rejig

HDFC Bank is the biggest beneficiary of the FTSE rebalance as the stock's weightage increased in the index. This will bring flows from passive funds

BUSINESS

Here are the top-performing PMS in November; Molecule Ventures and Capital Mind take the first two spots

A few of these PMS funds are as new as three-month old, while some others have been operating for as long as four years.

BUSINESS

MC Under 40: With 60% return over the past year, this manager avoids ‘hot picks’ and bats for the old and staid

Anirudh Garg, founder and fund manager at Invasset PMS, believes in the ‘two run’ theory and says whatever has happened in the last three years, won’t take off now, like IT and chemicals. He is now bullish on railway, defence and OMC stocks.

BUSINESS

Nifty PE higher than 10-year average but markets not 'expensive', say analysts

Markets right now are in a value zone and not in an expensive zone, say experts.

BUSINESS

Eye on MPC: 5 things markets to watch out for in RBI governor's speech

RBI MPC meeting: Market participants largely expect the RBI to keep the repo rate unchanged while taking a cautious approach to food inflation. The market is also keen to know about the RBI plan of action to withdraw excess liquidity from the system

BUSINESS

Why Metro Brands stock jumped 50% while Bata, Relaxo, Campus languished?

Except for Metro Brands, footwear companies had a bleak year as rising input costs hit their bottomline.

BUSINESS

November records the best Nifty 50 returns of 2023

Nifty 5o index gave 5.4 percent returns in November, while Sensex recorded a 4.7 percent gain in the same period.

BUSINESS

With Nifty above 20k, time to move money from smallcap to large stocks, say fund managers

A consensus seems to be emerging in the investment community to move money to largecaps due to high vulnerability, valuations and moderate growth expectations from smallcaps

BUSINESS

Rs 3 lakh-crore fund manager bullish on auto, discretionary names, says defence, PSUs pricey

Mahesh Patil, chief investment officer, Aditya Birla Sun Life Mutual Fund, says investors should not expect any big rally in the short term as the market will show a ‘reasonable growth’ in line with the GDP growth here on

BUSINESS

Will Trent’s super success with value retailing get dented by Reliance Retail and Shoppers Stop?

Trent’s success with value-fashion arm Zudio has not gone unnoticed. Not only have stock market participants, other retailers too have taken note, as they are now hungry to tap this segment.

BUSINESS

IRRA platform like a safety net, hope we never use it: SEBI's Madhabi Puri Buch

The Bombay Stock Exchange inaugurated IRRA platform on November 20, which is a platform that helps investors square off or exit their positions when their broker’s platform faces a technical glitch.

BUSINESS

Why HUL is not an analyst darling at the moment

The company remains watchful on crude prices, geopolitical instability, and the effect of the monsoon on crop output for the next quarter.

BUSINESS

Dabur India spent Rs 65 cr in legal costs as hair relaxer cancer case continues in US

The company will spend Rs 20 crore every quarter on legal expenses going ahead. Legal expenses are insured but not fully covered under insurance so the company will have to bear a part of the expense