BUSINESS

Oswal Pumps taps solar opportunity with IPO-backed expansion

Through its Rs 890 crore issue, OPL will deploy Rs 360 crore to scale up its solar pump production from 2 lakh to 5 lakh units annually

BUSINESS

PowerGrid: Moderate quarter, but project pipeline strong

Outlook looks good on the back of capex plans and diversification drive

BUSINESS

Engineers India: Consistent execution and expanding opportunities

Is the stock ripe for a rerating as the company sets the stage for sustained growth and visibility?

BUSINESS

Ion Exchange: Why you should look at this company despite disappointments in FY25

A strong order book, global chemical opportunities, and prudent cost management offer earnings visibility

BUSINESS

Cummins rides on global tailwinds despite Q4 blip

The company has enough headroom to scale up operations without additional capex

BUSINESS

NTPC: Execution lags, but strong pipeline, subsidiaries support growth

The power utility is in a crucial transition phase and the stock looks undervalued

BUSINESS

India Inc to benefit from Aatmanirbharta goal in stealth aircraft procurement

The AMCA is designed to fill a gap in India's air force, which currently lacks a fifth-generation stealth fighter. The opening up of the field for private companies should lend impetus to the programme and to indigenous capabilities

BUSINESS

Hindalco: Should one look at this stock, post a strong Q4?

Downstream aluminium demand continues to be strong and the company is focusing on capacity expansion

BUSINESS

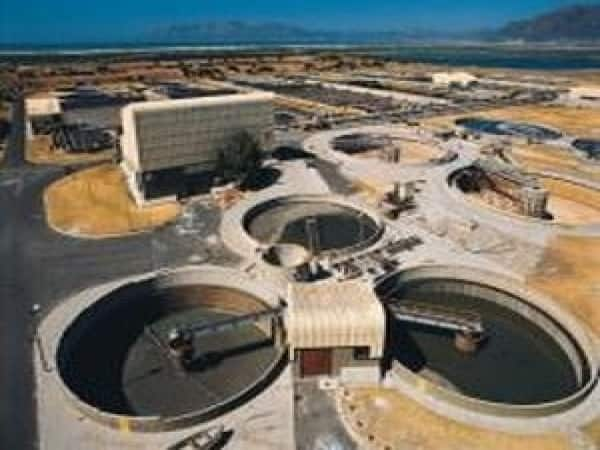

Va Tech WABAG: Strong execution, financial turnaround power growth

With a net cash position, improved profitability, and a strong order book, WABAG is now well-positioned to deliver healthy growth

BUSINESS

Aegis Vopak banks on LPG boom, capex push for growth, should you subscribe to its IPO?

Based on fiscal 2024 numbers, the issue at the upper end of the price band is valued at 65 times its EV/EBITDA and 41 times EV/sales

BUSINESS

ABB India navigates uncertainty with strong order inflows

The expected easing of global and domestic uncertainties should help the company perform better

BUSINESS

Why the changes in Tata Steel are worth a look

Tata Steel is now focusing on capital allocation. It is undertaking capex, based on the merits of the business and the regions concerned

BUSINESS

Tata Steel’s Q4 earnings take a hit from pricing erosion

Higher volume sales partly offset headwinds

BUSINESS

Coal India: A sequential rise in volume off-take in Q4 in an overall challenging year

Recent price increases, expected production growth, and other factors augur well for the current fiscal

BUSINESS

L&T: Navigating external risks with strong order book, robust balance sheet

The company enjoys a robust order book, and diversified business portfolio. The company’s consolidated order book reached Rs 5.8 lakh crore, reflecting a 22 percent YoY increase.

BUSINESS

Jindal Steel and Power: Worth a look amid the volatile global backdrop?

There is a supply glut in China, and this has led to a surge in cheap Chinese steel entering India. While India’s 12 percent safeguard duty on imports may curb low-cost imports, it falls short of the stronger tariffs in other countries

BUSINESS

Why this renewable energy stock deserves a serious look

Project pipeline, access to capital, and other factors should help in long-term value creation

BUSINESS

JSW Energy plugs into strategic renewable power acquisitions

The company is emerging as a dominant play in the power sector, with a strong balance sheet and the most efficient operational assets in the renewable and thermal power space

BUSINESS

Weekly Tactical Pick: KEC International is plugging into the opportunities in power T&D

Earnings visibility is improving, so is execution

BUSINESS

ION Exchange: Will the two-pronged strategy work?

The company has a multi-faced revenue stream and it is focused on international markets

BUSINESS

Will Germany’s fiscal boost fire up Indian defence stocks?

Germany’s upper house late last week voted in favour of reforming the German “debt brake”, paving the way for a €1-trillion defence and infrastructure investment package

BUSINESS

KEC International: A spike in order book improves medium-term earnings outlook

The company’s order book is healthy and with better execution, particularly in the T&D segment, the management is optimistic about achieving double-digit margins from Q4FY25

BUSINESS

EMS: Strong execution, order book to drive growth

The company follows an asset-light model, maintaining relatively low fixed assets and minimal reliance on debt for working capital. This disciplined approach has allowed it to sustain healthy margins and a strong balance sheet

BUSINESS

IEX: Good bet with earnings visibility; industry environment positive

A favourable industry environment and new ventures like coal exchange position IEX well, making it one of the safe bets in the current environment