BUSINESS

Would it benefit the economy if RBI surprises market with a rate cut in October policy?

The MPC meeting which has started on September 29, will deliver its decision on the rate action on October 1.

BUSINESS

This year, priority is smooth merger integration, before we accelerate loan growth again: Tata Capital's Rajiv Sabharwal

Going forward, the board will decide the best way to raise money, be it through rights issues or other routes, Sabharwal said.

BUSINESS

Best for RBI to save the bullet on rate action, says ANZ Research's Dhiraj Nim

The MPC, which has cut rates by 100 bps this year, is expected to hold the rates on October 1, a Moneycontrol poll of economist, fund managers and treasury heads has said

BUSINESS

RBI MPC meet today: Will rate panel go for a cut amid growth uncertainty?

Moneycontrol had earlier reported that bankers have ruled out a rate cut in the upcoming monetary policy review but they do expect one more cut in the current fiscal

BUSINESS

Groww grabs double-digit share in public issue of three bonds within few months of debut

Currently, Groww platform has an active bond subscription open for Edelweiss Financial Services, which will end on October 16.

BUSINESS

RBI skips dollar purchases in July for first time in over a decade as rupee pressure mounts

India’s foreign exchange reserves were down $10.87 billion at $688.871 billion on August 1. On July 4, they stood at $699.736

BANKING

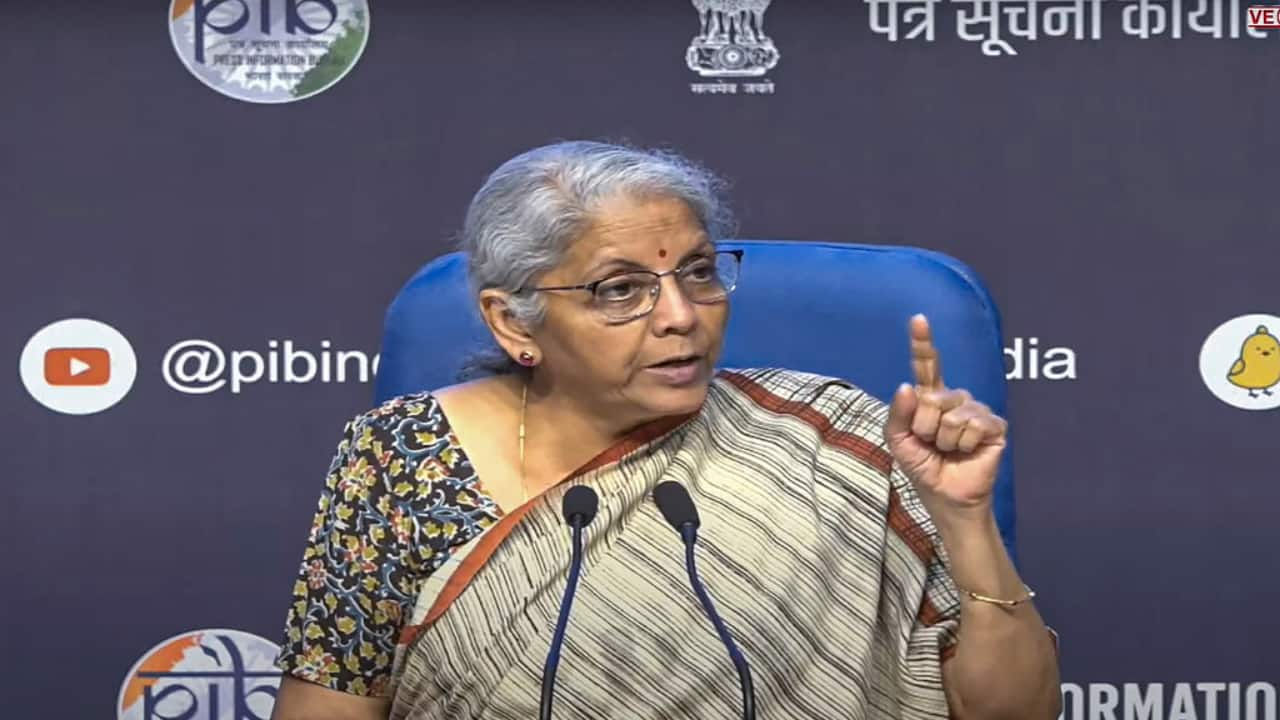

Financial institutions must maintain strong balance sheet to fund infra investments: Sitharaman

Sitharaman said state-owned banks need to engage proactively with NBFCs on co-lending for priority sector lending to enhance credit flow to the underserved sectors

BUSINESS

MPC Poll | RBI likely to hold rates in October amid growth comfort, GST reforms impact eyed

The MPC,which meets from September 29 and October 1, has reduced the benchmark repo rate by 100 basis points since February

BUSINESS

RBI Bulletin: Private banks sees faster decline in weighted average lending rate than PSU banks

The weighted average lending rate on fresh and outstanding rupee loans of scheduled commercial banks declined by 53 bps and 49 bps, respectively, in the current easing phase.

BUSINESS

RBI Bulletin: GST reforms to result in gains in ease of doing business, strengthening of consumption

RBI says GST reforms will boost ease of doing business, cut prices, and spur consumption, with MSMEs and startups set to gain from simplified rules.

BUSINESS

Mumbai Police EOW records statement of IndusInd Bank's ex-CEO Sumant Kathpalia in accounting lapses probe

This is the third such statement recorded by the Mumbai Police's EOW in this week. Prior to this, the police have recorded the statement of former IndusInd Bank Chief Financial Officer (CFO) Gobind Jain, and Deputy CEO Arun Khurana, this week.

BUSINESS

RBI making selective intervention in spot market despite rupee hitting all-time low: Experts

Rupee has been under severe pressure amid external shocks from start of this financial year. INR has depreciated around 3.73 percent in FY26 so far

BUSINESS

Banking system liquidity turns deficit after 6 months on tax outflows

The RBI has conducted two variable rate repo auctions to inject liquidity in the banking system

BUSINESS

Erratic rainfall in some states may dampen asset quality of banks’ farm loans in Q2

In the last few months, some states has recorded excess to 'large excess rainfall' leading impact on kharif output. The heavy downpours have caused flooding and waterlogging in fields, especially during the critical growth stages of the kharif crop

BUSINESS

Rupee ends record low of 88.76/USD as H-1B visa fees adds to worries over FPI outflow

The hike in fresh H-1B visa fee from next year has sparked worries over lower remittances, and potential equity outflows from India’s IT sector, which could be a double hit that the rupee could ill afford, at a time when foreign inflows have already been weak.

WORLD

H1B Visa cost hike could further dampen demand for overseas education loans

Industry experts say the sector has witnessed decline since Trump’s Presidency and demand for US education loans for the Fall 2025 academic year has plunged compared to a year ago

BUSINESS

CCIL to explore infrastructure to facilitate trading, settlement for currency beyond USD/INR, says RBI Governor

He also advised CCIL to keep pushing at the frontiers of technology, be ahead of others and provide world-class experience and world-class facilities, world-class risk management and improve upon the trust which they have already built for themselves.

BUSINESS

NaBFID is supporting municipal corporations with access to capital market, says MD Rajkiran Rai

In recent months, multiple urban bodies, including tier-II cities, have successfully closed bond issuances for infrastructure projects like water supply augmentation, sewage treatment, and urban transport, with NaBFID playing a strategic underwriting role.

BUSINESS

SEBI, RBI in discussion to encourage trading in corporate bond index derivatives, says Ananth Narayan

On the municipal bonds front, he said that from 2017 till date, just 16 issuances have happened amounting to Rs 3,134 crore, which is a mere 0.02 percent of GDP.

BUSINESS

Trump tariffs and FII outflows keeping Rupee weak despite dollar's sharp decline this year

The Indian rupee has depreciated around 3 percent in FY26 so far, but experts believe it is not yet a concern for India amid strong external position underpinned by record forex reserves and ample tools with the Reserve Bank of India to stabilise currency.

BUSINESS

RBI unlikely to rush into rate cuts despite US Federal Reserve easing, say experts

The RBI is likely to focus on domestic cues such as inflation and growth numbers before taking a decision. The next policy review is due October 1

BUSINESS

NaBFID is a success story by combining the right timing, institutional maturity, and strategic clarity, says MD Rajkiran Rai

Our cumulative sanctions to date have crossed Rs 2.5 lakh crore. We’re projecting this to increase to around Rs 3.2 lakh crore by March 2026. These are projects that have already been appraised and committed to, but disbursement happens progressively, especially in infrastructure, Rai said.

BUSINESS

Asset monetisation plan needs to be accelerated, says SEBI Chairman

Pandey said that relying solely on the banks and government budgets for infrastructure financing exposes the concentration risk.

BUSINESS

NBFCs see festive credit growth in top gear, riding on auto loans after GST cuts

Analysts estimate the GST cuts to spur a strong demand for vehicles during Navratri - between September 22 and October 2 - and benefit automakers as well as financiers.