BUSINESS

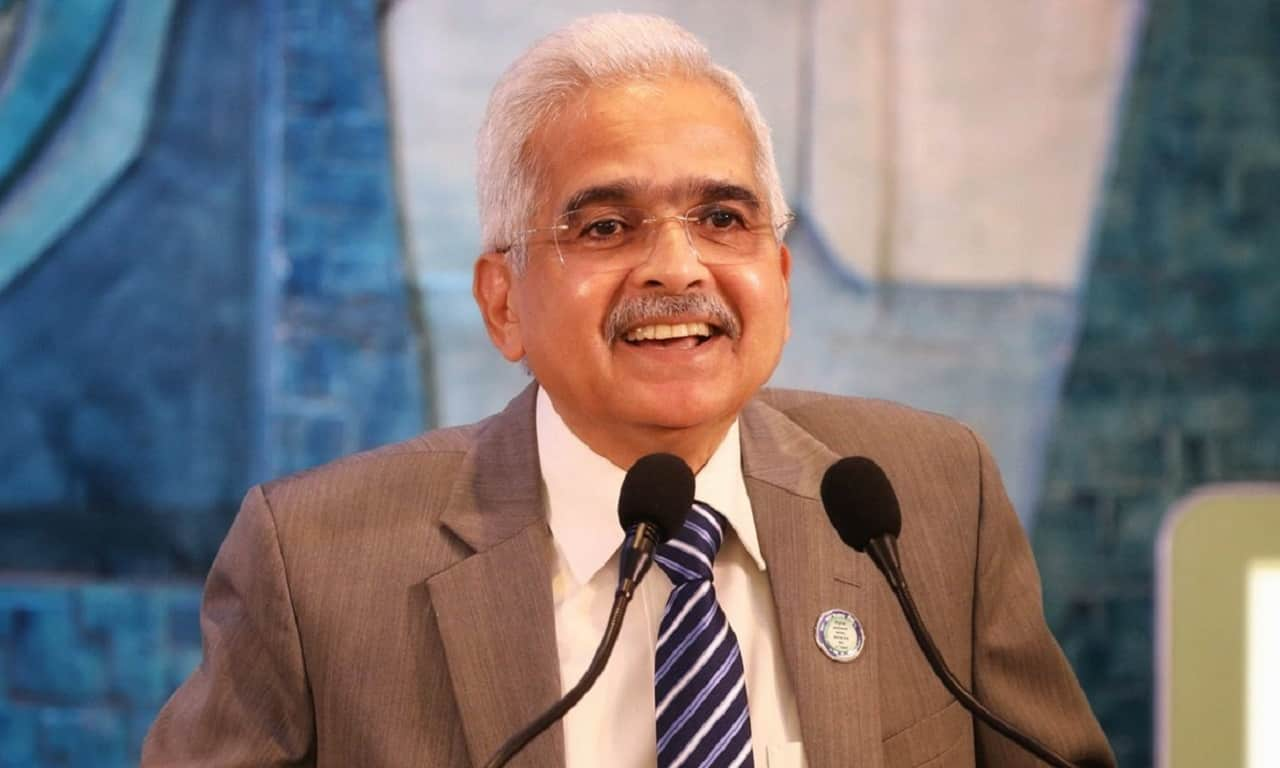

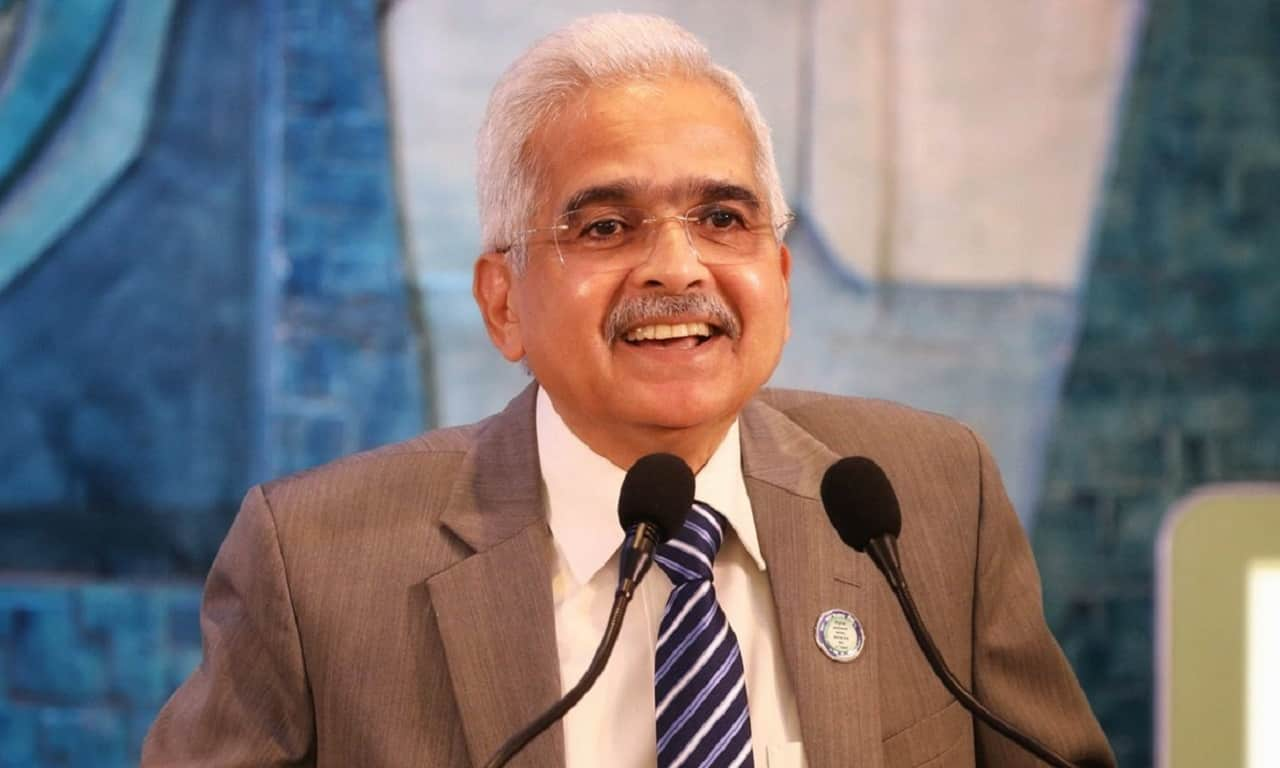

Optimistic that growth will be close to our projection of 6.5%: RBI governor Shaktikanta Das

The central bank in its April monetary policy projected real GDP growth for 2023-24 is projected at 6.5 per cent.

BUSINESS

Trade volume in corporate debt market hits near-12-month high in March: SEBI data

The total number of trades settled on BSE and NSE added up to 25,706, the data showed.

BUSINESS

RBI retail direct scheme finally picking up, registrations up 43% in six months

According to RBI data, the total number of registrations stood at 99,548 as on May 8, 2023, compared to 69,536 on October 10, 2022.

BUSINESS

MC Explains | The RBI’s latest rule on levy of forex card charges

The central bank said charges or fees on international debit cards and certain other instruments payable in India must now be settled in rupees.

BUSINESS

MC Explains | 10-year G-Sec, US Treasury yield difference narrows. How it will impact FPI flows into debt

The difference between benchmark US and Indian securities narrowed to 3.53 percent on May 8 from 3.96 percent on April 6.

BUSINESS

Bond yields to trade at 6.75-6.90% in the near term; will it sustain at these levels?

The yield on the benchmark 7.26 percent 2033 bond fell to 7.0338% on May 8 from 7.3056% on April 3.

BUSINESS

Bank of India expects advances to grow 11-12% in FY24

In the reporting quarter, gross domestic advances of the bank grew 1.18 percent on-quarter, and 9.56 percent on year.

BUSINESS

Corporate bond issuances nosedive in April on low requirement of funds

Companies and banks raised Rs 57,032 crore in April as compared to Rs 1.16 lakh crore in March, according to Prime Database.

BUSINESS

I expect RBI to pause in June policy given CPI trajectory: Baroda BNP Paribas CIO Prashant Pimple

We expect inflation to remain closer to the 5-5.50 percent band, which is within the RBI’s comfort zone, says Pimple.

BUSINESS

Benchmark bond yield sinks to one-year low on crude slide, dip in US Treasuries

The 10-year benchmark 7.26 percent 2033 bond yield was trading at 7.0199 percent during afternoon trade, as compared to 7.09 percent close on the previous trading session.

BUSINESS

CP rates down 8-17 bps in last one month; will they sustain at these levels?

Rates on commercial papers issued by NBFCs fell by 17 bps and those on papers issued by manufacturing companies fell by 8 bps; all eyes on US Fed meet outcome for further rate trajectory.

BUSINESS

Uday Kotak's reappointment in best interest of stakeholders: Kotak Mahindra Bank

The private lender has not received any communication from the Reserve Bank of India (RBI) on the reappointment front, said Group CFO Jaimin Bhatt

BUSINESS

Sebi ban on pledging clients' funds to take a toll on bank guarantees: Analysts

However, bank guarantees issued to stock brokers and clearing members form a miniscule 2.5-3% of the total bank guarantees issued by banks.

BUSINESS

RBI reassessing quality, coverage of branch audit in private banks, says Governor Das

The comments come at a time when several instances if of accounting irregularities have been reported in some large banks

BUSINESS

RBI wants banks to firm up capital buffers, assess risks regularly: Governor

Das was addressing at the Global Conference on Financial Resilience.

BUSINESS

Uday Kotak may not face RBI hurdle for appointment in non-executive role as cooling-off period may not apply, say experts

Earlier, shareholders of Kotak Mahindra bank voted 99 percent in favour of Uday Kotak taking up as the non-executive non-independent director of the bank after he steps down as the MD and CEO.

BUSINESS

States' borrowing cost via SDL falls tracking moderation in G-sec yield

The cut-off yield on the 10-year SDL eased by 13 basis points (Bps) on-week while the 7-year SDL fell by 8-9 bps on weekly basis. One basis point is one hundredth of the percentage point.

BUSINESS

MC Exclusive| SBI Capital, Trust Investment, 2 others in race for merchant banking roles in Varanasi, Kanpur municipal bond issues

Both local bodies have invited bids to appoint the merchant bankers-cum-transaction advisors for their municipal bonds issue planned in the next few months.

BUSINESS

RBI ups gold reserves post pandemic as risk aversion sets in

According to the Reserve Bank of India, gold reserves stood at Rs 3.75 lakh crore as on Mar 24, 2023, as against Rs 2.09 lakh crore as on Mar 20, 2020.

BUSINESS

Intraday high of call money rates continues uptrend over repo rate since April 17

According to Bloomberg data, between April 17 and April 21, the intraday high of India’s call money rate stood at 6.75-85 percent.

BUSINESS

RBI Bulletin: Central bank net buys $254 million foreign currency in February

Net purchases of foreign currency in February was $4.381 billion and net sales was $4.127 billion.

BUSINESS

MC Explains | Here’s all you need to know why the dollar-rupee onshore forward premiums are falling again

One of the reasons is that the interest rate differential between the US and India is shrinking as a consequence of the US Fed tightening its monetary policy at a faster pace than the RBI, resulting in low forward points.

BUSINESS

MPC Minutes: Fight against inflation is far from over, says RBI governor

The central bank in its April monetary policy projected CPI inflation at 5.2 percent for 2023-24.

BUSINESS

Forward premium rates trend lower in April as interest rate differential narrows

The premium on the one-year dollar/rupee contract was 189.24 paise or 2.1527 percent on annual basis on April 19, against 211.64 paise or 2.2688 percent on annual basis, as per Bloomberg data