Nearly one and half years after the launch of Reserve Bank of India’s (RBI) retail direct platform, the platform is now witnessing a jump in customer usage.

Over the last six months, the total number of registrations has risen by over 43 percent, according to data from the central bank.

Experts attributed the rise in registrations to rising awareness among investors and search for better returns over traditional banking products.

“Investors are opting for retail direct platform due to increased awareness since the launch of this option, the volatility in the equity market, and the desire to generate better return over traditional banking products due to higher accrual and lower base effect showing a significant jump,” said Sanjay Pawar, fund manager, fixed income, LIC Mutual Fund Asset Management.

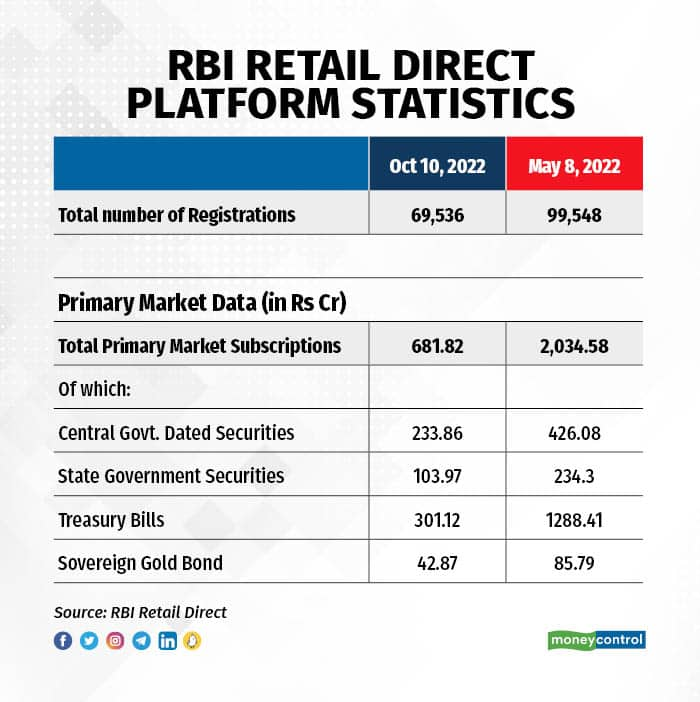

According to RBI data, the total number of registrations stood at 99,548 as on May 8, 2023, compared to 69,536 on October 10, 2022.

Earlier, retail investors had shown lukewarm interest in the platform meant for investing in government securities. The slow response during the first year of its inception was partly because of a lack of awareness among investors.

The RBI retail direct platform was launched on November 12, 2021.

“Other alternative investment products like FD (fixed deposit) and mutual funds (MFs) are offering the same returns or rather less taking into mind the short duration and tax implications, so the sovereign bond yields look attractive to investors,” said Ajay Manglunia, managing director at JM Financial.

Pawar added that the RBI retail direct platform provides easy access to safer assets like treasury bills, government securities and state development loans at an affordable minimum investment ticket size of Rs 10,000 with zero fees charged for opening/maintaining a retail direct gilt (RDG) account.

Increase in primary market investmentAccording to the data, total primary market subscriptions rose to Rs 2,034.58 crore as on May 8, 2023, from Rs 681.82 crore as on October 10, 2022.

Retail investors have increased their total primary market subscription in the last six months and a significant portion of the investment was witnessed in treasury bills (T-bills).

Also read: India's booming bond rally may be over with sales deluge on the cards

T-bills find favourWithin the primary market subscription, investments in T-bills jumped sharply from Rs 301.12 crore on October 10, 2022, to Rs 1,094.41 crore on March 27, 2023. This was the period when the cut-off yield on T-bills across maturities rose by 52-69 basis points (bps).

One basis point is one-hundredth of a percentage point.

“The fixed-income market seems to be back on the investor's radar, especially with the yields having moved up in the recent past. The returns on 6- and 12-month T-bills were in sync with the returns on FD rates or rather were even better in certain cases in the past six months. These factors contributed to investors flocking to these instruments,” Manglunia said.

However, since April, some moderation has taken place in T-bills cut-off yields, which led to slowing investment by retail investors in the instruments through the retail direct platform.

From March 27 to May 8, the investment in T-Bills rose just by Rs 194 crore to Rs 1,288.41.

Dealers are of the view that retail investors have started moving towards the debt market in search of better returns and this trend will pick up in the coming days.

Manglunia said, “More importantly, with tax benefits going away in debt MF schemes post amendment to the Finance Bill, all fixed income products across the market now stand at a level playing field, having the same tax treatment and, accordingly, investment by retail and HNI (high net-worth individual) investors would depend on liquidity, pre-tax returns and the associated time horizon of investments.”

The Lok Sabha on March 24 passed the Finance Bill 2023 with amendments. The bill proposes that income from investments in debt MFs that do not invest more than 35 percent of their corpus in stocks, i.e., debt funds, will now be liable to short-term capital gains tax.

Also read: Stocks slide on Chinese data, US debt ceiling worries hit treasury bills

How this platform work?The RBI retail direct scheme was meant to be a one-stop solution to facilitate investment in government securities by individual investors.

Retail investors can open and maintain an RDG account with the RBI and trade in these securities. Individual investors were able to use the RDG account to invest in T-bills, coupon-bearing government bonds and state development loans through primary and secondary market transactions besides buying sovereign gold bonds.

The online registration process was user-friendly with a video KYC (know your customer) facility.

Way aheadMoney market dealer are of the view that retail investors may now move towards longer-tenure government securities to lock in higher rates.

“With the current interest rate outlook, investors may shift from T-bills to longer maturity G-sec/SDL to lock in rates,” Pawar said.

Also, as investors get more tech savvy and familiar with the interface, both corporate bond platforms which are privately managed and the RBI retail direct subscription platform are going to get higher investments.

Manglunia said timely regulations have ensured standardisation and operational ease for retail clients to invest directly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.