BUSINESS

How would Budget changes affect those earning Rs 50 lakh?

Despite the new income tax regime being made more popular, taxpayers should still calculate their taxes before choosing one.

BUSINESS

Budget 2023 for NRI: Share issuance and TDS norms tightened

Share issuance to non-residents and gifts given to not-ordinarily residents of India impacted

BUSINESS

Budget 2023 has made almost every payment abroad costlier

The only exemptions are in education and medical treatment where your expenses on foreign shores will be safeguarded

BUSINESS

What may have forced the government to make new tax regime the default

System-driven tax returns at higher slabs due to ignorance of new tax regime is likely behind the move

BUSINESS

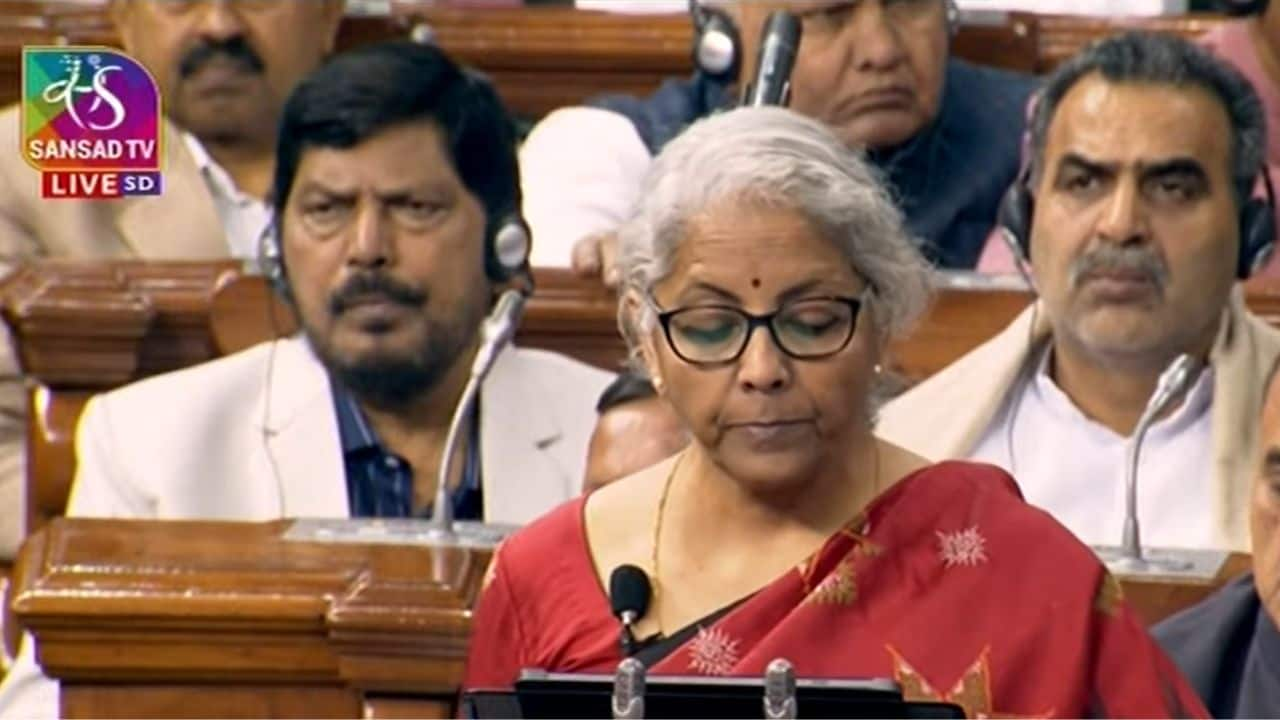

Taxpayers note — New income-tax regime will be default tax regime now

Budget 2023 has given a significant boost to the new income-tax regime. It has made the new income tax regime as the default regime, but the old tax regime with exemption will also continue.

BUSINESS

Union Budget 2023: FM proposes to simplify Know Your Customer norms

Union Budget 2023: Digital lockers will facilitate faster updation of identity documents and easier investment process

BUSINESS

Planning to buy a house? Harvest your capital gains & avoid taxes

The Capital Gains Account Scheme allows you to avoid taxes on your capital gains from the sale of mutual funds, stocks, gold, etc., provided you buy a house.

BUSINESS

What should you do if your jeweller offers you digital gold, instead of jewellery?

Apart from gold accumulation plans, jewellers offer self-funded digital gold options that may not be backed by refiners

BUSINESS

Buying gold from Dubai to avoid import duty? Think again

On the face of it, gold sourced from Dubai appears cheaper, but customs duty and making charges will eat into your savings, as will the currency conversion fee. In addition, you will need to comply with various rules if you want to bring the yellow metal into India.

BUSINESS

Collecting art and vintage jewellery is no child’s play but wealthy Indians don’t mind

When the pandemic derailed many investment avenues, ultra-rich Indians acquired art. Here’s a closer look at what’s involved, if you are planning to acquire an expensive piece, especially overseas.

BUSINESS

Poof! Did you know that your income-tax benefits can be reversed too?

While drawing up a chart of tax-saving investments for the year, don’t forget about the conditions that could nullify the tax benefit under Section 80C. Exiting investments too early could lead to reversal of taxation benefits.

BUSINESS

People who sought a new low-tax regime in trouble over belated returns

The math turns difficult for late tax-return filers who opted for a new regime that lowered tax in return for them not claiming deductions; these are taxpayers who made no investments to claim tax breaks during the year while having lower taxes deducted from their salaries by employers.

BUSINESS

Failed refunds, income tax queries… Things to check after filing returns

Your tax refund due might be delayed this year if you have failed to link your Aadhaar with your PAN in your bank account or haven't complete KYC formalities.

BUSINESS

India@75 | Taxation benefits for those born in the Independence year

Stringent conditions make taxation benefits for those above 75 years of age pointless.

BUSINESS

How to become a crorepati with just Rs 7,500?

The key to long-term wealth building is through regular and systematic savings. This can be accomplished by smaller amounts that systematic investment plans of mutual funds allow

BUSINESS

RBI hikes repo rate by 50 bps: EMIs to shoot up for borrowers, interests to rise for depositors

Typically, when interest rates goes up, banks tend to extend loan tenure and not EMI first, pushing up the interest outgo for home loan borrowers significantly over long tenures of 15-30 years

BUSINESS

ITR Filing | Missed filing your tax returns? You can still file them

The bad news about filing delayed income-tax returns is that you won’t be able to claim certain tax breaks

BUSINESS

ITR filing | More than 37.3 million returns filed so far this year: I-T department

Delays in accessing Form16 and some glitches on the official e-filing portal have prompted demands to extend the July 31 deadline for filing of tax returns

BUSINESS

Here's how different inflation measures impact your financial goals

An overall inflation rate of, say, 7 percent means nothing much if you are drawing up your financial plan. Cost of education, holidays and even key medical treatments don’t just go up by that much. They go by a whole lot more.

BUSINESS

ITR Filing | Mistakes to be avoided while filing income-tax returns

Blind belief in pre-filled details, hiding Form 16 from previous employers, and failure to declare details of property transactions, even though there is nil tax, are some of the pitfalls to avoid while filing I-T returns

BUSINESS

Saddled with taxation, income tax notices add to confusion for crypto investors

Unaware of total transaction amount, crypto investors face information powered notices

BUSINESS

Couldn’t file a belated income-tax return? You can now use the updated tax return facility

Many new expenses are being reported and mismatches can be a hassle. Updated returns can be filed within 24 months of the end of an assessment year

BUSINESS

Financial planning made easy: Government to share income data with intermediaries in real time

Tax planning for individuals may get a boost as the government prepares to share the income and tax liability data of individuals with tax and investment planning portals on a real-time basis. But first, there might be a privacy hurdle to cross.

PERSONAL-FINANCE

Can’t afford gold jewellery? This jeweller may have an alternative

Fractional ownership might just become an option to buy gold jewellery. Nishit Nanda, executive director at Khimji Jewels, says jewellers may soon start co-ownership schemes to make gold jewellery more affordable