Have you always believed that gold is cheaper in Dubai? Well, if you were to go merely by the sticker price of the yellow metal, you might be right. But there’s a lot more to it. Enough to make you think twice about buying gold in the emirate and bringing it back to India.

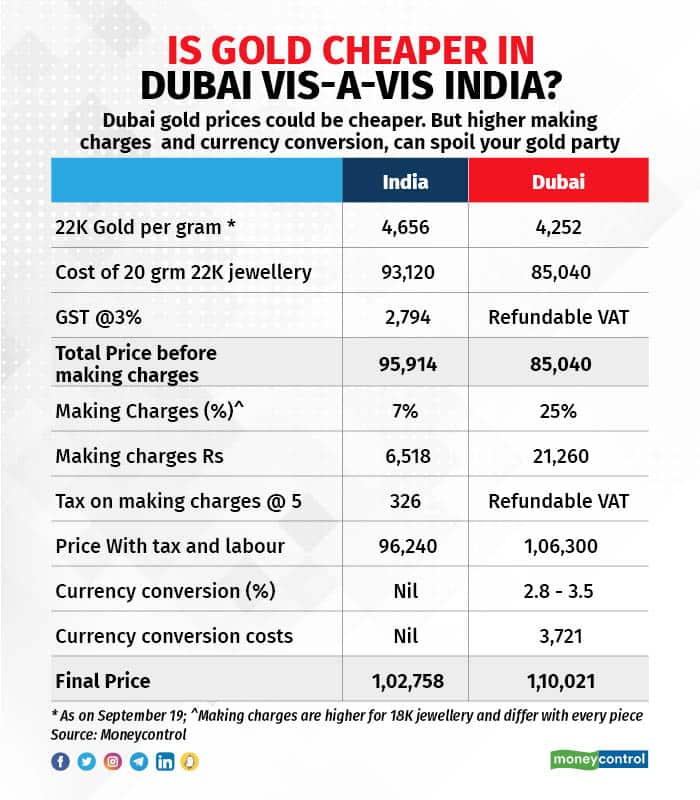

On September 19, when Dubai markets were selling 1 gram of 22K gold at AED 196.50 or Rs 4,252 — Indian markets were quoting a price of Rs 4,656 per gram (Mumbai). This difference is largely because of the import duty hike by the Indian government, to 15 percent (excluding 3% cess), in July 2022 from 10.75 per cent earlier. India’s fetish for gold is costing the Indian Government dearly — the rupee has slid due to imports going through the roof, surging 790% in May to $6 billion vis-à-vis $670 million a year ago. This forced the government to hike the import duty.

This festive season, jewellers in India have tough competition from Dubai, where import duty is not levied. The import duty results in a significant cost advantage for buyers in Dubai, at least on the face of it.

But if this tempts you to pick up gold from Dubai on your next holiday there, it won’t really work.

That’s because there are duty charges to be paid if you bring gold from Dubai into India. Moreover, making charges are higher in Dubai.

With festivals such as Dusshera, Dhanteras and Diwali coming up — they are considered to be auspicious for gold buying — gold fever is raging again. Nothing spells festive cheer for Indians as much as gold does, especially when the prices have mellowed to a level not seen in the past 30 months.

However, in the wake of the import duty hike, non-resident Indians in Dubai are receiving requests from many relatives back home to pick up gold jewellery on their way home this Diwali. “My cousin is getting married in November and has already sent us a list of items to be purchased before our October-end visit,” says 38-year-old Akil Kurian, who works for a risk-management firm in Dubai.

Also read | Inflation pressure sends gold prices down. Should you dump your gold now?

The multiple stores lining the Meena Bazaar, Gold Souk and Baniya Street in Dubai are flush with Indian clientele. Indian jewellery brands such as Malabar Gold, Joyallukas, Kalyan Jewellers, Popley, Tanishq and Atlas Jewellers also have a presence in Dubai.

“Sales to Indian passport holders have increased 30% over last quarter. Most are looking at necklace and pendant sets in 18K and we have demand for 22K jewellery also,” said a salesperson from Damas, which runs three large-format jewellery stores within Dubai’s Meena Bazaar, one of the city’s oldest and most traditional shopping areas.

Syncing with reality One more reason Dubai’s gold is more alluring is due to its more accurate pricing.

Also read | Buy all the gold jewellery you want. Just remember, getting cash when you want to sell it, will be tough

In India, gold prices change at the start of the day based on the (previous day’s) closing price on the London Metal Exchange and again in the evening at around 4 pm based on the index opening. However, in Dubai, the ticker price changes based on the same day’s market movement.

“In Dubai, gold sellers charge the price that gets displayed on the ticker based on the time stamped on the receipt. Any discrepancy in pricing based on the day and the date is taken up seriously by the authorities,” said Malvika Malik, a real-estate consultant, in a telephonic interaction from Dubai. Malik moved to Dubai few years ago. She exchanged all of her wedding jewellery for fresh designs in Dubai.

Why Indian gold still makes sense Traditionally, the popular opinion was that gold in Dubai is cheaper and its purity is higher.

But the mandatory hallmarking regulations in India, which address purity concerns, have brought about more confidence in gold sold in India.

“Hallmarking is mandatory in 282 districts in India. On a net basis we see a 15% import duty and 3% GST as a total price differential of 18.45%. But the actual difference is much lower as the stores in Dubai have higher operational costs,” says Ashish Pethe, Chairman, All India Gem & Jewellery Domestic Council.

Also read | Did you know that you could get insurance for your gold purchases?

While India has its BIS certification, Dubai has a Bareeq Award as assurance of product quality.

Hefty labour costs: Necklaces are imported from India and hence the making charges applicable in India are low, but the pieces sent to Dubai attract a higher making charge.

“The making charges in India would be about 7 percent of the overall cost of jewellery. But in Dubai, identical designs will vary in pricing when they are sourced from global pockets such as Istanbul (Turkey), Malaysia or Italy. The making charges differ based on the country a piece is imported from — 25 percent for Malaysia, 20 percent for Istanbul and higher for Italy,” says Rajiv Popley, director of the Popley Group of Jewellers, which runs a store in Dubai.

The making charges in India would be about 7% of the overall jewellery cost. But in Dubai, these charges can go up to 25%

The making charges in India would be about 7% of the overall jewellery cost. But in Dubai, these charges can go up to 25%

Malik, who has negotiated with Dubai jewellers around making charges, said that there are deals on offer sometimes and you can get jewellery with no making charges if you are lucky. “The jewellery under 18K has the best designs as it has more alloy, but the making charges are hefty, in the range of 15-25%,” she says.

Taxes: While the 5 percent value added tax in Dubai is refunded to tourists upon passport declaration, Indian consumers cannot escape a 3 percent goods and services tax (GST) on the value of gold and 5 percent GST on making charges.

For those travelling to Dubai as tourists and picking up gold jewellery during the trip, currency conversion charges will also be applicable. Rupee conversion to Dirhams would cost 2.8-3.5 percent, based on the mode of forex payment.

So, are you actually saving? Due to all the additional expenses, such as higher making charges and the currency conversion fee, there will barely be any cost saving in purchasing gold, even though you see a net difference of Rs 6,000-7,000 per 10 grams in the price of the yellow metal.

“There is no net saving, honestly, as the cost of labour is very low in India,” says Popley of the Popley group.

Additionally, the entire range of jewellery available in India isn’t offered in stores in other countries. “The local flavours in traditional jewellery, such as the Kolhapur collection, aren’t available in other markets,” says Pethe.

Quantity restrictions

Indian customs norms also place restrictions on Indian passengers carrying gold back into the country.

Returning male passengers can bring up to 20 grams of gold jewellery, not exceeding Rs 50,000, while female passengers are allowed to bring home double the amount. So, a couple can carry a total of 60 grams of gold jewellery, not exceeding Rs 1.5 lakh in value, back home. Popley says these limits are negligible and doesn’t get you good stock.

But here’s the dampener: You need to have resided in Dubai for at least a year if you want to bring purchased jewellery into India. Additionally, you are also allowed to carry gold up to 1 kg in your bags after the one year period. Be sure to carry valid documents, receipts and bills. Else, you will be stopped at the airport and penalised.

This also means that if you visit Dubai on a holiday (for a few days or even months), you cannot buy jewellery and come back. If caught, you might be required to pay the customs duty of 36.05 percent, an import duty of 15 percent, and also face penal action. Your jewellery, too, could be confiscated if you fail to provide valid supporting documents about your gold’s weight, purity and source.

Also, only gold jewellery is permitted to be brought into India. Gold studded with gems, diamonds and pearls is not allowed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.