Did an illness, busy office hours or a holiday cause a delay in filing tax returns before the July 31 deadline? You can still file returns for income earned in financial year 2021-22. Tax returns can be filed up to three months before the end of the assessment year (2022-23), or December 31, 2022.

As per the Central Board of Direct Taxes, 57.8 million returns were filed as of 11 pm on July 31, with 6.79 million submitted on the last day. Even though the returns filed by the deadline this year are lower than the 59 million filed by December 31 for the previous assessment year, the final number of returns filed stood at 66.3 million by March 15, 2022.

These returns that were filed after the deadline, commonly called belated returns, attracted additional charges. Some taxation benefits too need to be forgone.

Penalties and charges

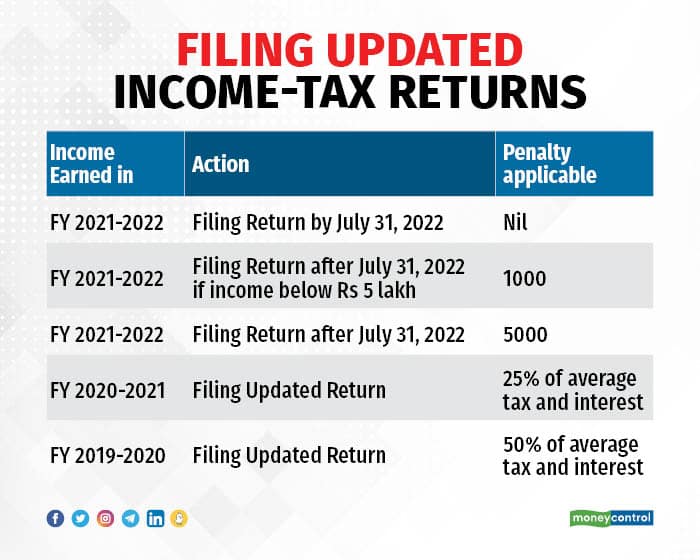

A penalty is applicable for tax returns filed after the due date. For those with an income of up to Rs 5 lakh, the late fine is Rs 1,000. If your income is more than Rs 5 lakh, the late-filing penalty is Rs 5,000.

However, if your gross income is less than the basic exemption limit of Rs 2.5 lakh for individuals (Rs 3-5 lakh for senior citizens) then you don’t have to pay the late fine.

Additionally, if your taxes have not been paid, then a late payment fee of 1 percent per month would be applicable. The clock starts ticking from April 1, 2022, if your tax dues are below Rs 10,000.

“Many individuals have filed returns with partial information or even nil returns on July 31 to avoid the late-filing penalty of Rs 5,000. These returns would be revised in the month of August,” said Karan Batra, founder of CharteredClub.com.

Benefits disallowed

Although one can file tax returns after the deadline, one cannot claim all the benefits.

For instance, you cannot carry forward any short-term or long-term losses if you have filed after the due date. If tax returns are filed by the deadline, one can carry forward such losses until assessment year 2030-31 or eight years. Usually, these losses are incurred on the sale of assets such as shares, mutual funds or even real estate. However, one can file a request for not filing returns by the deadline due to exceptional circumstances.

“You can file a condonation appeal with the Commissioner of Income Tax of your ward if you want to carry forward losses,” said Sudhir Kaushik, co-founder of TaxSpanner.com.

If the returns are filed late, one will not receive interest on the tax refund for the period of the delay. This is because the interest on the refund is calculated from the time that you file your tax return.

But revision of returns is permitted for belated returns. So, if you have forgotten to claim any deductions or want to declare any income after filing the returns, then it is allowed.

“Returns filed after the due date too can be revised up to December 31, 2022,” said Paras Savla, a partner at KPB & Associates.

Updated returns

Even with the penalty and taxation benefits that are denied, it still makes sense to file your tax returns by December 31 as the income tax department tracks transactions reported under permanent account numbers (PAN).

“During the Covid-19 outbreak, many new individuals invested in equity. Their annual information statement (AIS) reflects these and if they haven’t filed a tax return, they would shortly receive notices from the income-tax department,” said Kaushik.

Also, if you have failed to file returns, then the rate of tax deduction at source is doubled for money earned as fixed deposit interest, rent and sale of property or even commissions for various trades.

Irrespective of the taxable income, you have to file returns for spending more than Rs 2 lakh on foreign travel, for an electricity bill exceeding Rs 1 lakh, and for owning foreign income and assets. Those depositing Rs 50 lakh or more in savings bank accounts and Rs 1 crore or more in current accounts also need to file returns.

If you miss the December 31 deadline for filing returns, a steep rate of taxes is applicable later as one needs to file updated returns under ITR–U. “If you miss the deadline of filing tax returns by the end of the assessment year or March 31, 2023, then you can file updated returns by paying additional tax of 25-50 percent for two additional years,” said Savla.