BUSINESS

Interview | Will make a serious attempt to look at inorganic growth options now, says Ageas Federal Life Insurance CEO Vighnesh Shahane

Although the company has been open for inorganic options for a few years, it will make a serious attempt now, said Shahane.

BUSINESS

Banking Central | What’s the message from HDFC twins' merger to NBFCs?

NBFCs need to rethink their industry positioning going ahead. The primary reason why many NBFCs chose to be so—the benefit of lighter regulations vis-à-vis banks—no longer exists.

BUSINESS

Exclusive | Spandana Sphoorty founder Padmaja Reddy buys Rajshree Tracom, signals return to small loan business

The new NBFC, which will be renamed Keertana Finserve, will focus on gold loans, MSME loans and loans against property. Reddy is slated to be the MD & CEO of the new company

BUSINESS

Banking Central | Where have all the woman CEOs in Indian financial services gone?

Over years, more women have risen to the top in financial services. Yet, there are very few of them compared with their male counterparts.

BUSINESS

Analysis | What does high WPI inflation mean for interest rates?

The spike in WPI will put more pressure on the rate-setting body to initiate a tight policy stance

BUSINESS

Banking Central: RBI's oldest and mightiest enemy is back

Persistently high inflation is worrying in an economy as it hurts low-income groups the most.

BUSINESS

Retail inflation shoots up to 6.95% in March. Will MPC go for a rate hike in June?

The sharp rise in retail inflation puts the MPC in a tight spot. A change in stance is likely soon, followed by a rate hike.

BUSINESS

Banking Central | Big, corporate-led NBFCs need to make a choice

The RBI approach to big NBFCs have been very clear—either operate with tougher, bank-like rules or convert to become banks after rejigging the ownership structure. It is up for the non-banks to decide which way to take

BUSINESS

RBI monetary policy analysis| Das finally picks inflation over growth, how soon will MPC hike rates?

RBI monetary policy | Till now, the MPC has largely focused on growth recovery alone but the attention has now clearly shifted to inflation

ECONOMY

RBI Policy | MPC keeps repo rate unchanged at 4%, retains accommodative stance

The Monetary Policy Committee has so far remained on a growth-supportive stance to guard the economy from the ill-effects of the COVID-19 pandemic.

BUSINESS

RBI policy tomorrow. Will the MPC shift gears?

Growth is likely to remain the guiding mantra for the rate-setting panel this time as well but the policy stance could change and that’ll be the beginning of a new cycle

BUSINESS

Deepak Parekh exclusive interview | HDFC and HDFC Bank need to have a common culture

Deepak Parekh said over the years, tight RBI regulations have removed the arbitrage between a bank and NBFC. This was a vital reason why HDFC chose to merge with the bank.

BUSINESS

Banking Central | Why did HDFC decide to merge with HDFC Bank now?

The RBI has been tightening regulations on the NBFC sector over years, grouping these entities into different categories based on size and interconnectedness and making capital norms stricter.

BUSINESS

Banking Central | What should Supertech homebuyers do?

Both banks and homebuyers have a long battle ahead at the bankruptcy court

BUSINESS

Banking Central | Will latest RBI framework dilute the spirit of MFI model?

Microfinance has always been an avenue for economically weaker sections, especially women borrowers. The new framework poses some important questions.

BUSINESS

Some MFIs, banks need more time to comply with RBI framework

The RBI, on March 14, issued the Framework for Microfinance Loans, which ensures that entities including banks and seven NBFC-MFIs have been brought under similar regulation.

BUSINESS

RBI Bulletin: Ukraine conflict has heightened uncertainty in global economy

The Indian monetary policy committee (MPC) has been on a prolonged accommodative stance to support growth recovery in the economy.

BUSINESS

Paytm Payments Bank asked to appoint IT auditor on RBI’s terms

On March 11, the RBI said it had asked the payments bank to stop onboarding customers. The regulator also ordered a comprehensive IT system audit. This is the second such ban on a prominent banking institution in the last two years.

BUSINESS

Banking Central | After HDFC Bank, Paytm Payments Bank runs foul of RBI

Paytm Payments Bank ban once again shines the spotlight on how lenders need to get a fix on their digital banking channels

BUSINESS

RBI directs Paytm Payments Bank to stop onboarding new customers, orders IT audit

The bank has also been directed to appoint an IT audit firm to conduct a comprehensive System Audit of its IT system, the RBI said in a release.

BUSINESS

RBI governor Shaktikanta Das launches UPI for feature phones, says move will bump up digital adoption

This comes after the central bank in December announced a plan to introduce UPI in feature phones, which has remained confined to smartphones as a payment platform ever since rolling out in 2016, limiting its use among people in rural areas having feature phones

BUSINESS

Banking Central| Don't ignore cooperative bank depositors

There is a strong case to up the DICGC insurance cover from the present Rs5 lakhs.

BUSINESS

Extended accommodative stance weakens the credibility of MPC’s inflation-fighting credentials: Jayanth Varma

"If MPC’s credibility is diminished, then the MPC might have to take more drastic and painful measures to have the desired impact on inflation," says the MPC member.

BUSINESS

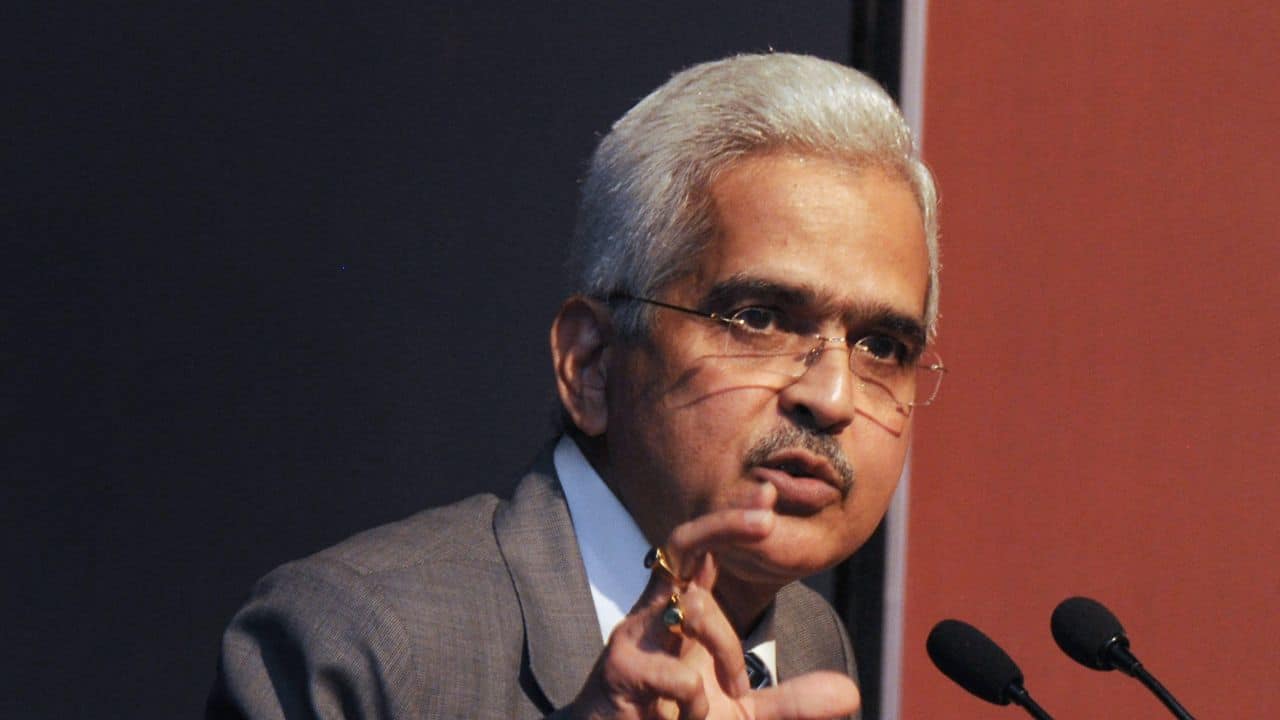

Central bank's communications need to be backed by actions to build credibility, instil confidence: RBI's Das

With the declaration of COVID-19 as a pandemic in March 2020, communication became more challenging as the RBI had only digital interface with media and market participants while at the same time the central bank had to undertake several emergency conventional and unconventional measures as the crisis unfolded, Das said.