BUSINESS

Banking Central | New overseas investment rules a winner for banks, jolt to wilful defaulters

The new rule addresses a long standing problem of fund diversion by loan defaulters across the boarder

BUSINESS

Banking Central | What MPC’s inflation failure means to common man

The rate setting panel is set to explain its failure in meeting the inflation target in a written statement to the government

BUSINESS

MPC resolution to remain focused on withdrawal of accommodation confusing: Jayanth Varma

The MPC hiked the repo rate, or key lending rate, by 50 basis points to 5.4 percent thereby effecting a total of 140 bps hike in a span of five months citing high inflation.

BUSINESS

Banking Central | Borrowers deserve freedom from harassment

The latest RBI directions are a step in the right direction but the problem lies with its implementation on the ground

BUSINESS

Banking Central | The wait for own money

There are a number of cases where depositors have parked a major part of their life savings, if not the entire amount, in cooperative banks eyeing higher interest.

BUSINESS

RBI Monetary Policy: Jayanth Varma disagreed with policy stance, shows statement

On earlier occasions also, Varma had dissented on MPC's view on policy stance an forward guidance arguing that guidance needs to be more realistic not to hurt the credibility of the panel.

BUSINESS

RBI Monetary Policy | Another 50 basis point hike done. So, what comes next?

With the latest rate hike, the monetary policy committee has taken the rates to pre-pandemic levels, something RBI Governor Shaktikanta Das had hinted at a while ago.

BUSINESS

RBI policy: MPC hikes repo rate by 50 bps, takes policy rate back to pre-pandemic levels

The hike came largely on expected lines as the RBI continues on a warpath against high inflation

BUSINESS

Banking Central | Another rate hike coming this week

The monetary policy committee, which begins its meeting bi-monthly review meeting on August 3, faces multiple headwinds but its biggest enemy is inflation

BUSINESS

Banks have much cleaner books now; where did all NPAs go?

There is a clear improvement in the bad debt numbers, but largely due to write-offs.

BUSINESS

Banking Central | What does a bigger HDFC Bank mean for its closest rival?

SBI has enjoyed a monopoly over Indian banking since 1955 but that’s about to change following HDFC Bank's merger with HDFC. With an asset book of Rs 17.86 trillion, not too far from SBI’s Rs 26.64 trillion, HDFC Bank can challenge the state-owned lender's dominance, especially in the big-ticket loan market

BUSINESS

MC Analysis | Rupee at 78: Is that the new normal for the currency?

Some analysts say the central bank may have no option but to let the rupee find its new normal.

BUSINESS

Government steps up bid to sell IDBI Bank stake, talks to potential suitors including Fairfax’s Prem Watsa

Fairfax already has a controlling stake in Kerala-based CSB Bank

BUSINESS

Banking Central | India's crypto double standard is hurting investors

For long, the RBI top brass has been warning against Crypto risks, calling for a ban even as the cash-starved Government is looking to tax such investments. The double standard doesn't add up and defies logic.

BUSINESS

Soaring US Inflation ups the heat in MPC’s rate chamber

Inflation – both in the US and at home – has emerged as the main villain for Indian policymakers. More increases in US interest rates will trigger another capital flight from emerging markets including India, hurting the rupee.

BUSINESS

RBI's desperate catch-up act on inflation may hurt the economy

It isn’t an exaggeration to say the RBI let loose the inflation genie for too long, in search of a stimulus-led growth. It is now playing catch-up with steep, consecutive rate hikes

BUSINESS

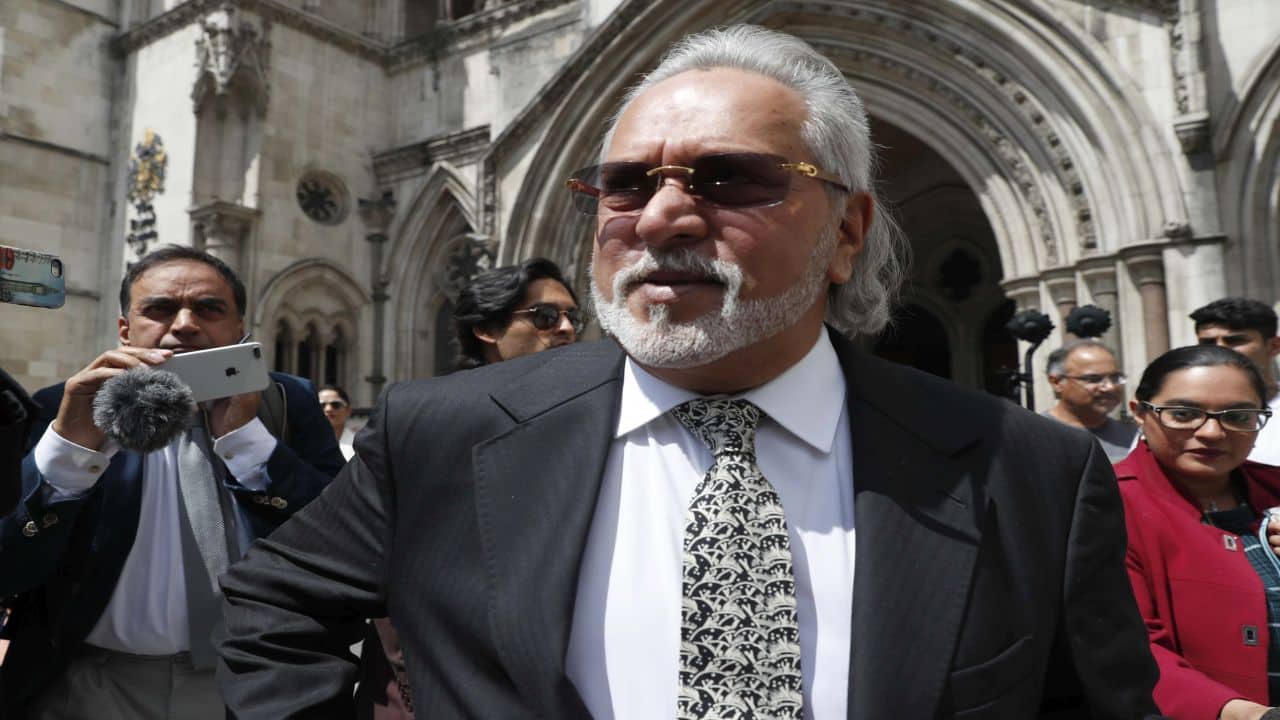

MC View | SC order bolsters India’s case for Vijay Mallya extradition

Though there isn’t anything Indian authorities could do to Mallya immediately, the ruling indeed makes India’s case stronger.

BUSINESS

Banking Central | India fighting a losing battle on the rupee front

After the Government raised import duty on gold and oil last week, the RBI has followed up with measures to attract more foreign funds. The idea is to stem the rupee’s fall. But, probably, India is fighting a losing battle, as risks to currency are mainly emerging from global events.

BUSINESS

After 6-year legal battle, Dhanlaxmi Bank officer’s sacking ruled unsustainable

The court ordered the bank to pay Rs 30 lakh in compensation to the banker, PV Mohanan, with 6 percent interest from the date of termination, aside from his legal expenses

BUSINESS

Banking Central | India's PSB privatisation bid needs political resolve

For long, both the UPA and the NDA governments have promised privatisation but what lacked was political will

BUSINESS

Banking Central| Where will the repo rate settle ultimately?

The MPC is caught in a twin battle. Its rate hike plans will be influenced by global factors going ahead where it has limited control.

BUSINESS

Banking Central | The case for a higher DICGC cover

The rising instances of cooperative bank failures highlight the need for a higher safety net for depositors.

BUSINESS

RBI cancels Millath Co-operative Bank's licence

As per the data submitted by the bank, all the depositors will receive full amount of their deposits from DICGC, the RBI said.

BUSINESS

Explained | RBI lifts business restriction on Mastercard: 10 key questions answered

On July 14, the Reserve Bank of India had imposed restrictions on payment system operator Mastercard, barring it from onboarding new domestic customers.