Last week, the government issued consolidated norms for overseas investment by Indian entities. The new set of guidelines, called the Foreign Exchange Management (Overseas Investment) Rules, 2022, will subsume extant regulations pertaining to Overseas Investments and Acquisition and Transfer of Immovable Property Outside India Regulations, 2015.

The core idea of bringing the new regulations is to streamline overseas investment by Indian businesses and thereby ensure the ease of doing business in a highly integrated global economy.

But, at the same time, there are some critical changes in the rules that will help Indian banks address a long-standing problem — diversion of funds by loan defaulters to foreign lands. Under the notified rules, any person, a resident in India who has an account appearing as a non-performing asset (NPA), or is classified as a wilful defaulter by any bank or under investigation by a financial service regulator or by investigative agencies in the country shall, before making any financial commitment or undertaking disinvestment overseas, obtain an NOC from the lender bank, regulatory body or investigative agency. This is a key change.

As Moneycontrol reported, bankers have given thumbs up to the government's new investment rules saying it will stop siphoning off of assets and aid loan recovery by banks. With banks’ NOC now mandatory, the earlier window available to wilful defaulters to divert funds abroad, is now closed. Wilful defaulters have used this loophole in the past.

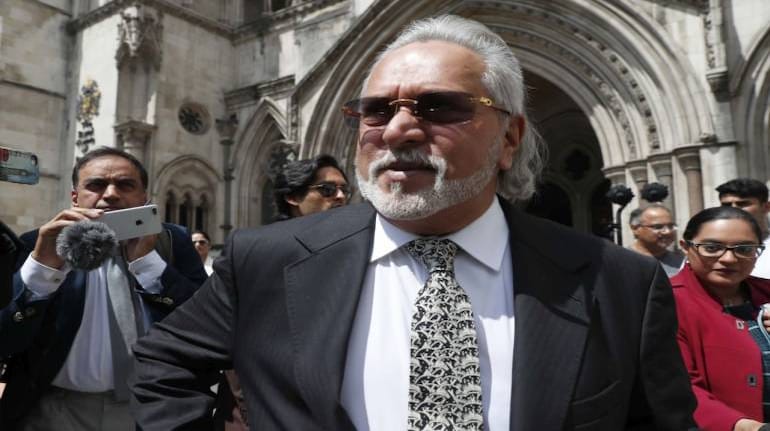

One key example is Vijay Mallya who along with his firms - Kingfisher Airlines and United Breweries – was charged for fraudulently diverting over Rs 3,700 crore bank loan funds to a UK-based Formula 1 motorsport firm, a T20 IPL team, and for enjoying private jet sorties. Mallya, declared a wilful defaulter, owed Rs 9,000 crore in principal and interest to a consortium of banks led by the State Bank of India. There are several other examples too.

In this backdrop, the new rules are a clear winner for banks provided they use it effectively. The catch here is timely action in such cases. That’s because if the lender bank or regulatory body or investigative agency concerned fails to furnish the certificate within 60 days from the date of receipt of such application, it may be presumed that there was no objection to the proposed transaction.

Banks’ loose approach in taking action against wilful defaulters have been blamed in the past for huge monetary losses. Armed with the new rules, banks now have a chance to act.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.