BUSINESS

Active fund managers hiked exposure to these sub-sectors. Are you invested in any of these?

Active fund managers have either increased their exposure to or taken fresh positions in equities in these sub-sectors.

BUSINESS

Nifty IT hits record high: Here are the top smallcap stocks tech mutual funds are holding

While near-term pressures such as wage hikes and geopolitical risks may impact margins, the sector's long-term prospects remain strong due to rising global IT spends.

BUSINESS

This MC30 equity fund can limit your portfolio risk in the current market volatility

Canara Robeco Bluechip Equity Fund, a part of Moneycontrol’s MC30, a curated basket of 30 investment-worthy mutual fund schemes, invests in well-established bluechip companies with a proven track record and stable earnings

BUSINESS

Here are the top small-cap stock picks of PMS firms amid market correction

The volatility in the capital markets gives fund managers a golden opportunity to identify and buy undervalued, high-quality stocks.

BUSINESS

Market volatility: Stocks where top mid-cap and small-cap MFs redeployed cash

Market corrections provide opportunities for fund managers to accumulate quality stocks that are available at cheaper valuations. Moneycontrol has identified mid-cap and small-cap schemes that redeployed their cash notably in October. Here are their stock picks

BUSINESS

Stock market volatility: MF, PMS and AIFs are betting on these mid-cap stocks. Check if you own any

Mid-cap stocks with quality businesses and healthy prospects have always found a place in the long-term portfolios of investment managers, irrespective of market movements. They withstand the corrections relatively well and deliver better returns in the long run.

BUSINESS

Market chaos: Equity funds that have corrected the most since September peaks

Here is a list of equity schemes that saw the biggest decline since their last peak in September. Experts' advice is that investors should not be influenced by short-term fluctuations and instead concentrate on long-term objectives

BUSINESS

New-age tech stocks turn favorite among mutual funds. Check out their top picks

Swiggy shares, which had seen good demand especially from mutual funds during the anchor allocation round, made a decent debut on Dalal Street today. Mutual funds invest a small portion in these companies to avoid missing out on potential business model success despite the risks, experts say.

BUSINESS

Treasures of Indian Gold ETFs double in 4 years to 54.5 tonnes: World Gold Council data

Gold exchange-traded funds (ETFs) have become more appealing due to increased geopolitical risks, central bank policy changes, and volatility in the equity market

BUSINESS

Trump's re-election: Want to invest overseas? Here are the international mutual funds that are open for subscription

At present, 41 of the 76 international schemes are now open for fresh investments. Out of these, almost all funds allow SIP subscriptions, but many have stopped accepting lump-sum investments.

BUSINESS

10 US stocks that have found favour with domestic equity-oriented mutual funds

US equity markets have been a preferred destination for Indian fund managers looking to diversify their holdings across borders. Currently, there are 44 such schemes that have allocated up to 30 percent of their assets to overseas equities. They have invested either directly in US stocks or indirectly through the FoF route.

BUSINESS

US elections: With 38% returns this year, US-focused Indian mutual funds offer better geographical diversification

US Elections 2024: Indian investors should view US stocks as a long-term play, especially in areas like AI and cloud infrastructure, which are still in the early stages of a potentially decade-long growth cycle, say financial advisors.

BUSINESS

Worried about market turbulence? Here are top-performing aggressive hybrid funds to ride out the volatility

Top Hybrid Mutual Funds: Aggressive hybrid funds invest between 65 and 80 per cent in equity and the rest in debt. Higher allocation to equity can boost returns during stock market rallies, while the debt component can cap losses during market turbulence.

BUSINESS

How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

'Step-up SIP’ helps you to invest more money incrementally, like say when you get an annual salary hike. It converts your SIP from a marathon to a sprint. Under most circumstances, the 'step-up SIP' generates higher returns than the ‘normal SIP’, data shows.

BUSINESS

Wealth managers are recommending multi-asset funds amid volatility in equities

Multi-asset allocation mutual funds invest across the asset allocation spectrum of equity, debt, gold, silver, REITs, InvITs, derivatives, and international equities.

BUSINESS

Why buying Sovereign Gold Bonds in secondary markets may not be a good idea

While experts are optimistic about gold’s outlook, buying Sovereign Gold Bonds at a premium to the reference rate could result in a capital loss if prices do not appreciate enough to offset the premium being quoted currently.

BUSINESS

Gold ETFs see record volume on the exchanges YTD, almost double 2023 volumes

An absence of Sovereign Gold Bond issuances, the premium trading of SGBs in the exchanges, more investment from multi asset funds and attractive tax benefits are making gold ETFs more attractive.

BUSINESS

Exit plan: Mid-cap stocks that fund houses sold ahead of volatility

Fund managers exited as these stocks either reached their target prices or turned unattractive due to weak prospects

BUSINESS

With rate cuts on the horizon, is it too late to invest in debt mutual funds?

Experts believe there has been a significant rally in long bond yields, and incremental gains are expected with rate cuts. Given the outlook for a shallow rate-cut cycle, investors can consider focusing on funds with durations of 3 to 5 years.

BUSINESS

Gold ETFs shine all over the world, says World Gold Council report

US Fed rate cut, rising tensions in the Middle East and momentum in gold prices have contributed to the rise

BUSINESS

Top microcap multibagger stocks added by mutual funds, amidst volatility

Carefully chosen microcap stocks with disruptive business models have the potential to demonstrate rapid growth and provide multibagger returns

BUSINESS

Chasing Chinese dragons: What's in store for Indian mutual fund investors?

Four domestic mutual fund schemes provide access to Indian investors to participate in the bull run of Chinese equity markets. Though it presents an intriguing value opportunity, experts advise investors to proceed with caution because the recovery is likely to be gradual, despite the recent stimulus measures announced by the Chinese government.

BUSINESS

Israel-Iran war: Should you invest in gold funds to hedge your portfolio?

Experts say that while gold prices have gone up significantly, a lumpsum investment might be risky at this point, especially for short durations. But SIPs in gold funds can help you ride out the volatility.

BUSINESS

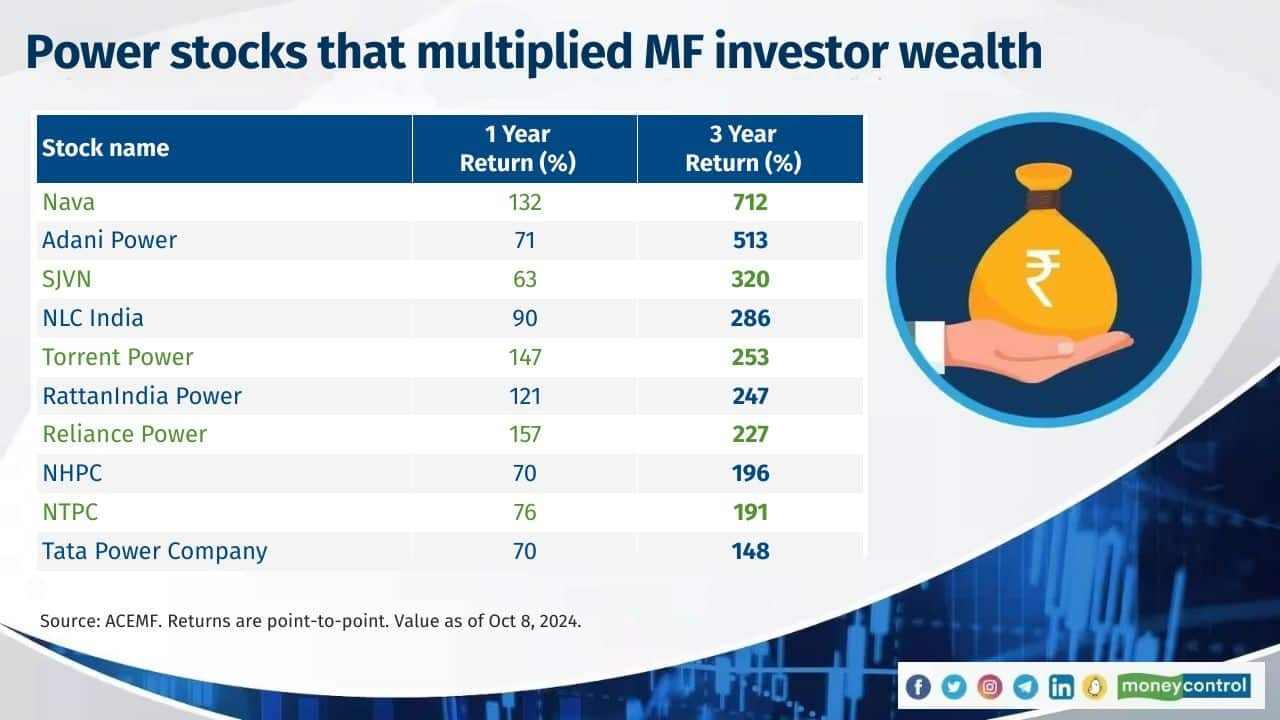

A powerhouse performer: The BSE Power Index rose 86% in a year. Here are the top stocks that MFs picked

The momentum in power stocks is likely to continue, supported by favourable policies, investments in green energy, and the global shift towards sustainability