Market chaos: Equity funds that have corrected the most since September peaks

Here is a list of equity schemes that saw the biggest decline since their last peak in September. Experts' advice is that investors should not be influenced by short-term fluctuations and instead concentrate on long-term objectives

1/9

Indian equity markets have been on a downtrend over the last two months. On November 13, the BSE Sensex fell more than 1,100 points to 77,533.3 at the day's low, before ending at 77,690.95. The frontline indices have registered more than a 10 percent slump since their last peak on September 26, 2024.

The Nifty 50 index has plummeted over 10 percent while Nifty Midcap 150 and Nifty Smallcap 250 indices have declined 10.6 percent and 9.5 percent, respectively. Factors that have triggered this volatility and dampened investors’ sentiment include tepid second-quarter (Q2) earnings, relentless foreign institutional investors’ (FIIs) sell-off, rising valuations of domestic mid and small-cap stocks and escalating geopolitical tensions. While experts advise investors not to be swayed by short-term gyrations and focus on long-term goals, here’s a list of equity schemes from major categories that declined the most from their last peak of September 26.

The Nifty 50 index has plummeted over 10 percent while Nifty Midcap 150 and Nifty Smallcap 250 indices have declined 10.6 percent and 9.5 percent, respectively. Factors that have triggered this volatility and dampened investors’ sentiment include tepid second-quarter (Q2) earnings, relentless foreign institutional investors’ (FIIs) sell-off, rising valuations of domestic mid and small-cap stocks and escalating geopolitical tensions. While experts advise investors not to be swayed by short-term gyrations and focus on long-term goals, here’s a list of equity schemes from major categories that declined the most from their last peak of September 26.

2/9

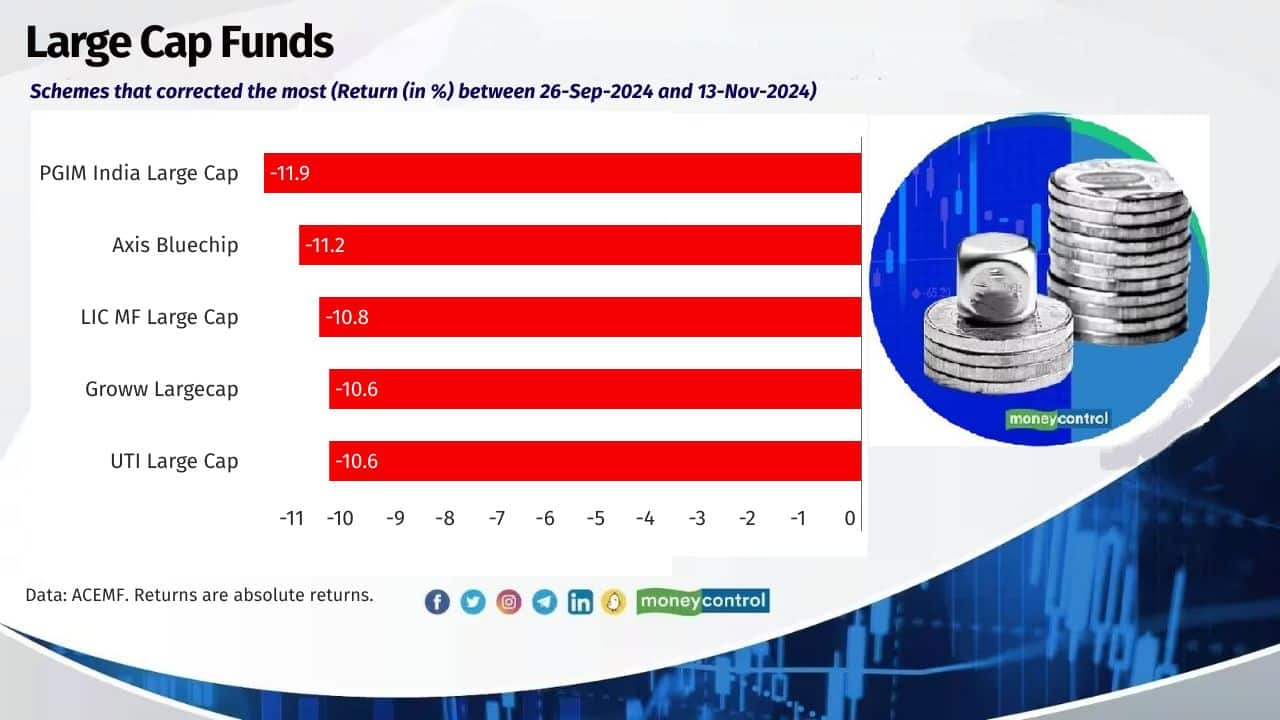

Large Cap Funds

Average return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.8%

Nifty 50 – TRI: -10%

Average return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.8%

Nifty 50 – TRI: -10%

3/9

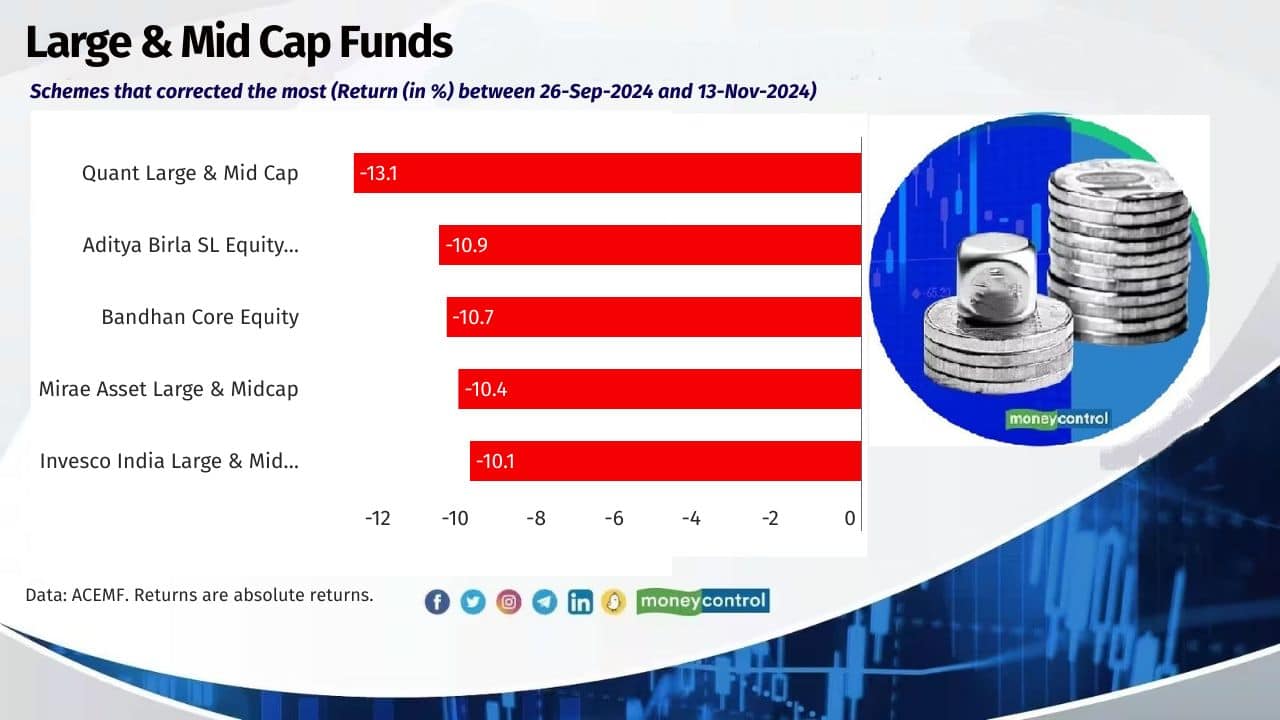

Large & Mid Cap Funds

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.3%

NIFTY LargeMidcap 250 – TRI: -10.5%

Also see: MF holdings in new-age tech stocks triple in the past year; here are their top picks

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.3%

NIFTY LargeMidcap 250 – TRI: -10.5%

Also see: MF holdings in new-age tech stocks triple in the past year; here are their top picks

4/9

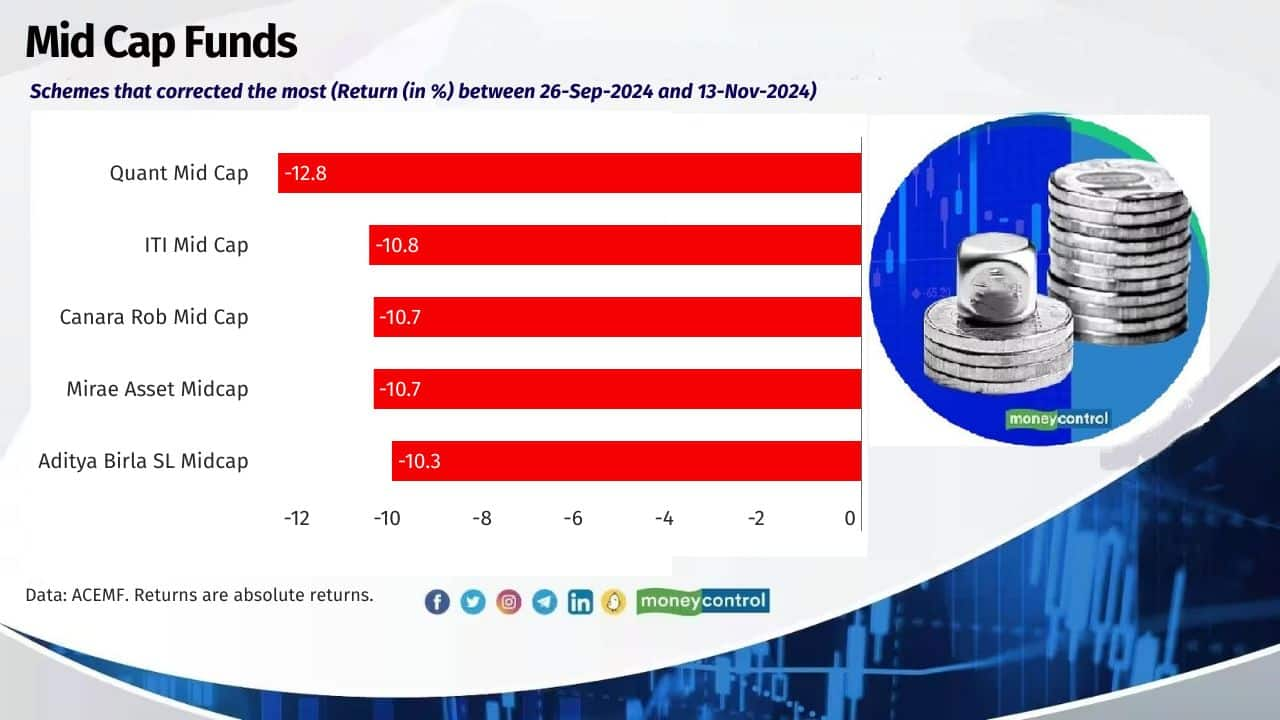

Mid Cap Funds

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9%

Nifty Midcap 150 – TRI: -10.5%

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9%

Nifty Midcap 150 – TRI: -10.5%

5/9

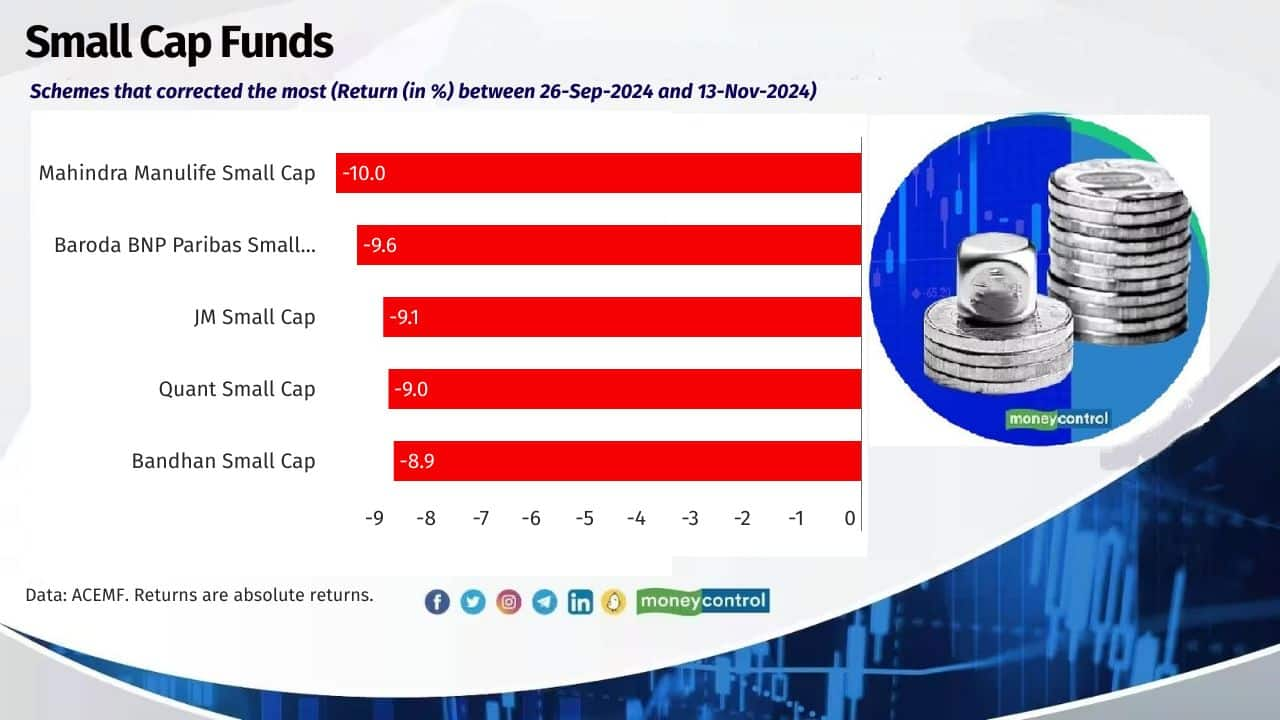

Small Cap Funds

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -8%

Nifty Smallcap 250 – TRI: -9.5%

Also see: Want to invest overseas? Here are the international mutual funds that are open for subscription

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -8%

Nifty Smallcap 250 – TRI: -9.5%

Also see: Want to invest overseas? Here are the international mutual funds that are open for subscription

6/9

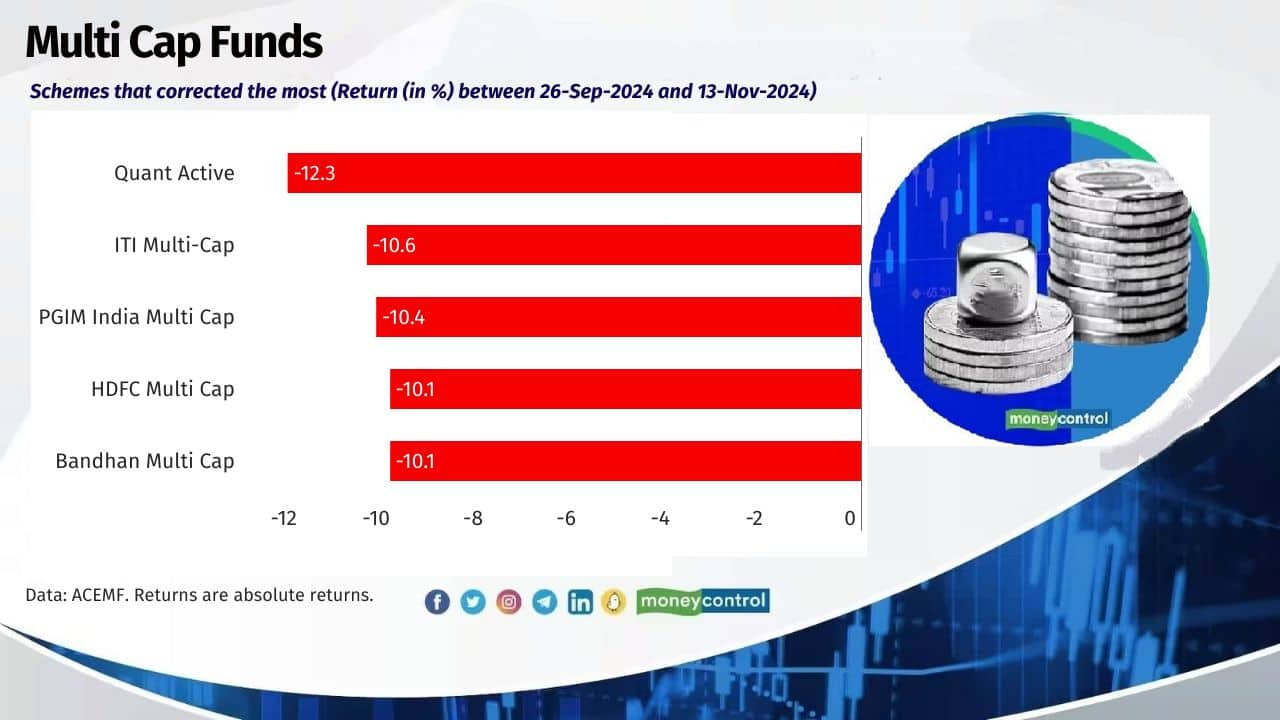

Multi Cap Funds

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9%

Nifty500 Multicap 50:25:25 – TRI: -10.3%

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9%

Nifty500 Multicap 50:25:25 – TRI: -10.3%

7/9

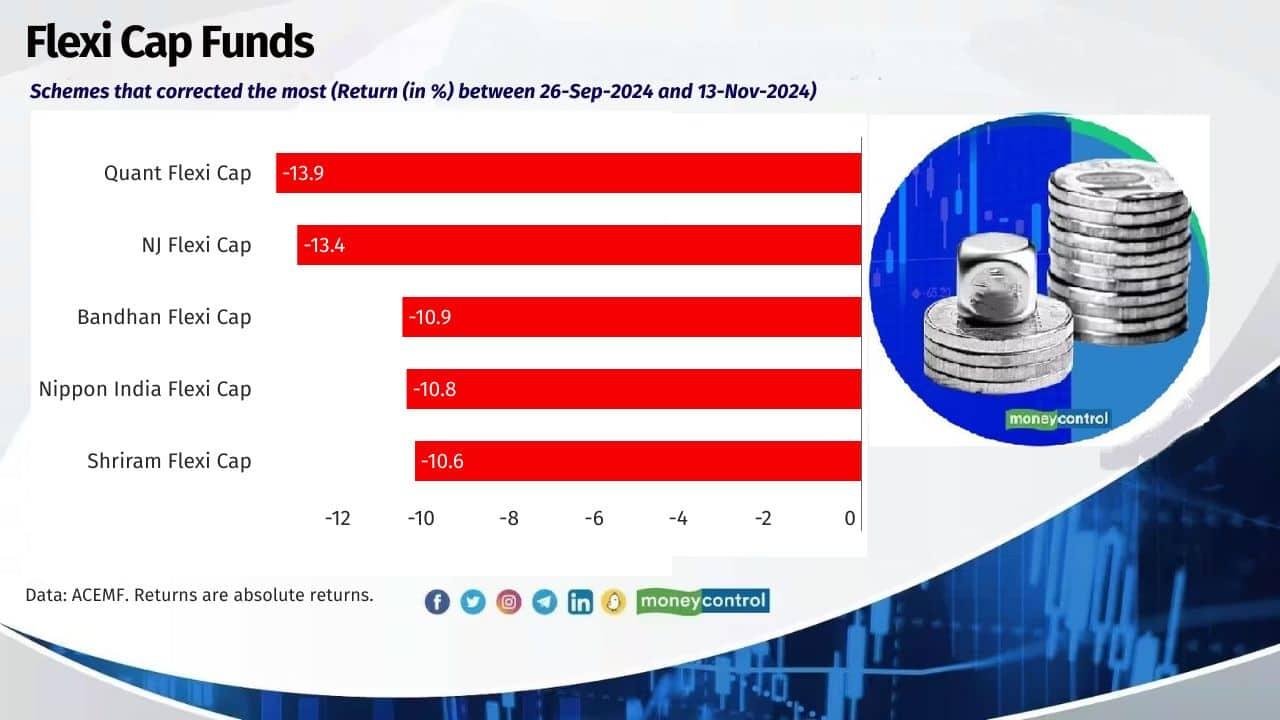

Flexi Cap Funds

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.2%

NIFTY 500 – TRI: -10.5%

Also see: How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.2%

NIFTY 500 – TRI: -10.5%

Also see: How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

8/9

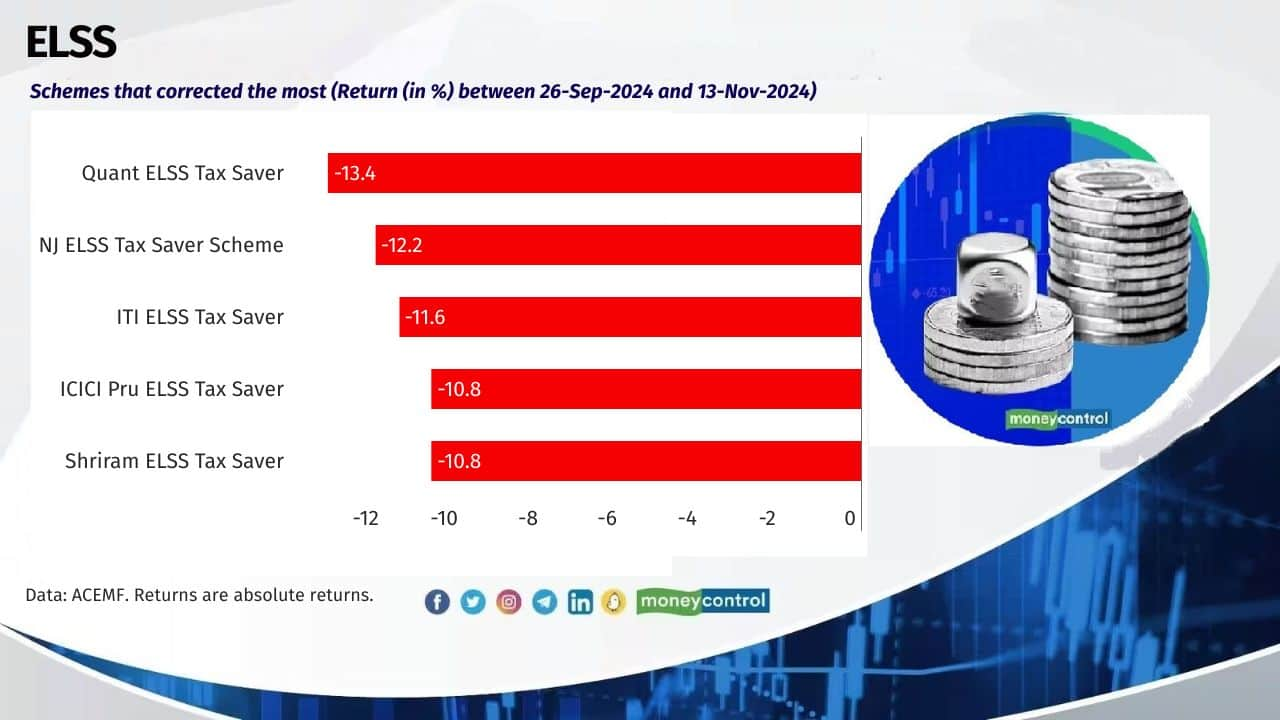

ELSS

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.3%

NIFTY 100 – TRI: -10.6%

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -9.3%

NIFTY 100 – TRI: -10.6%

9/9

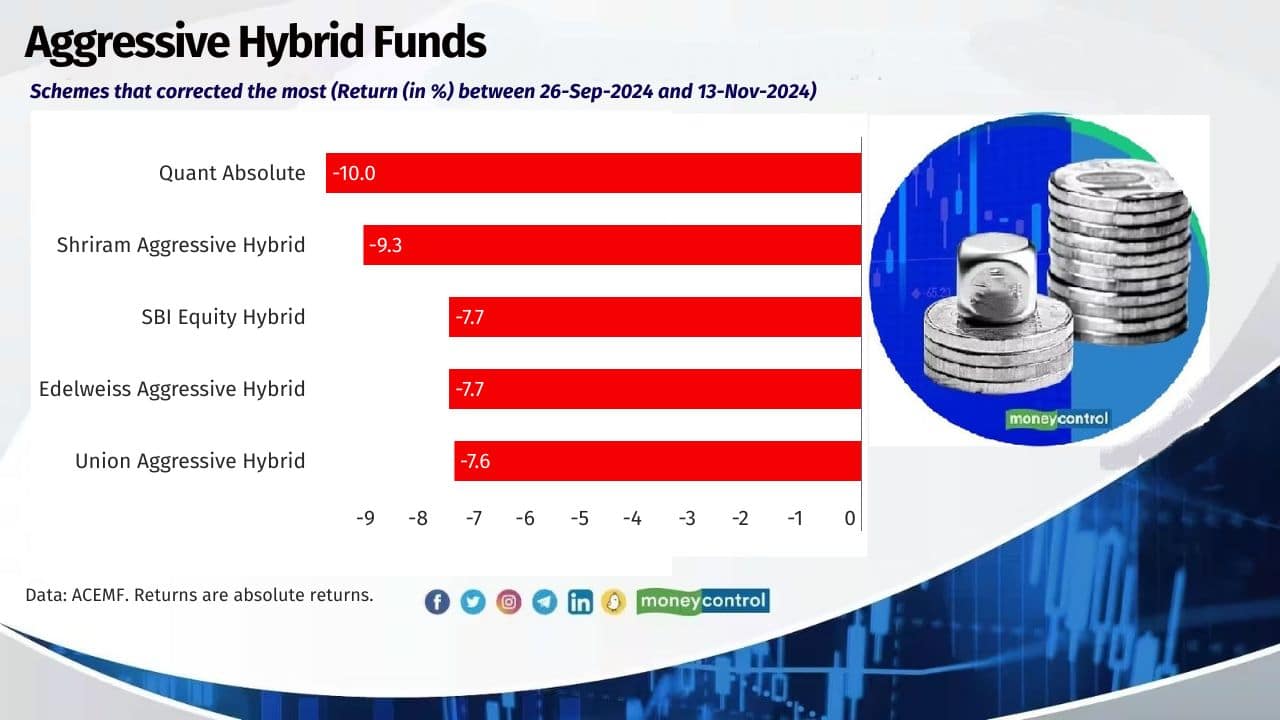

Aggressive Hybrid Funds

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -6.8%

NIFTY 100 – TRI: -10.6%

Also see: Worried about market turbulence? Here are top-performing aggressive hybrid funds to ride out the volatility

Average Return of the category (From 26-Sep-2024 To 13-Nov-2024): -6.8%

NIFTY 100 – TRI: -10.6%

Also see: Worried about market turbulence? Here are top-performing aggressive hybrid funds to ride out the volatility

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!