WORLD

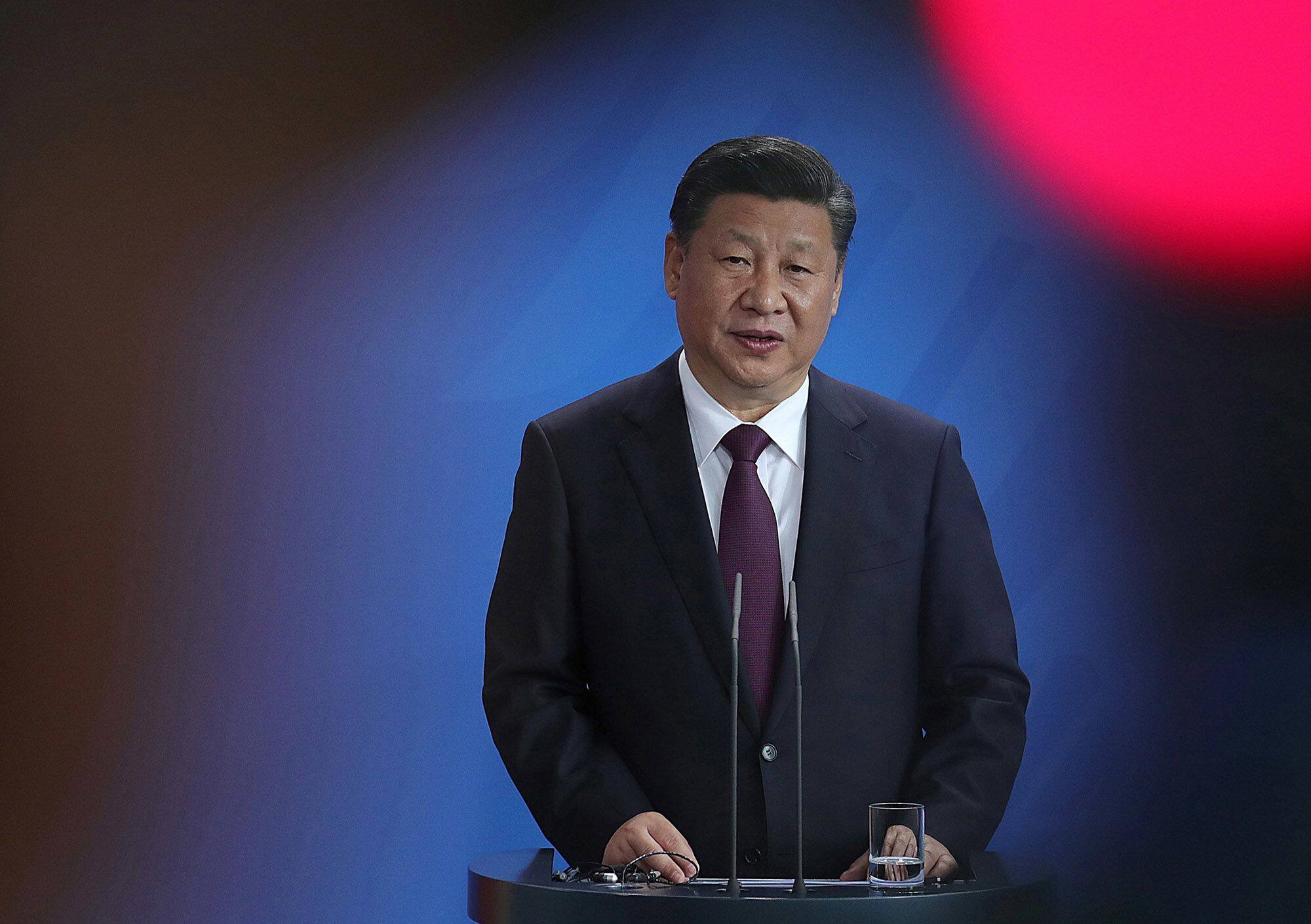

Xi says China’s power has increased, warns of ‘dangerous storms’

The Chinese leader’s speech kicking off the congress is one of the party’s most important political declarations. It ran for almost two hours, considerably shorter than the last one in 2017, which lasted for more than three hours

POLICY

China’s Xi defends Covid Zero, Hong Kong policies at Congress

The Chinese leader spoke without a mask at a distance from the more than 2,340 delegates, including provincial leaders, top military figures, farmers and minority representatives, who wore facial coverings, aside from a handful top leaders

WORLD

Inside the bicycle’s conquest of Amsterdam

Dutch cycling is very social: Communication with fellow travelers, via eye contract and gestures and speech, is what allows riders to negotiate often-packed paths without incident. There’s no barking “on your left!” when passing; riders just flow silently past

ECONOMY

Biden brushes off risks of strong dollar on global economy

But with the Fed on track to continue lifting borrowing costs through the end of the year, Biden sought to deflect blame for the slowing global economy. On Saturday, he criticized UK Prime Minister Liz Truss’s tax-cutting plans for causing turmoil in markets, calling it a “mistake”

ECONOMY-ECONOMY

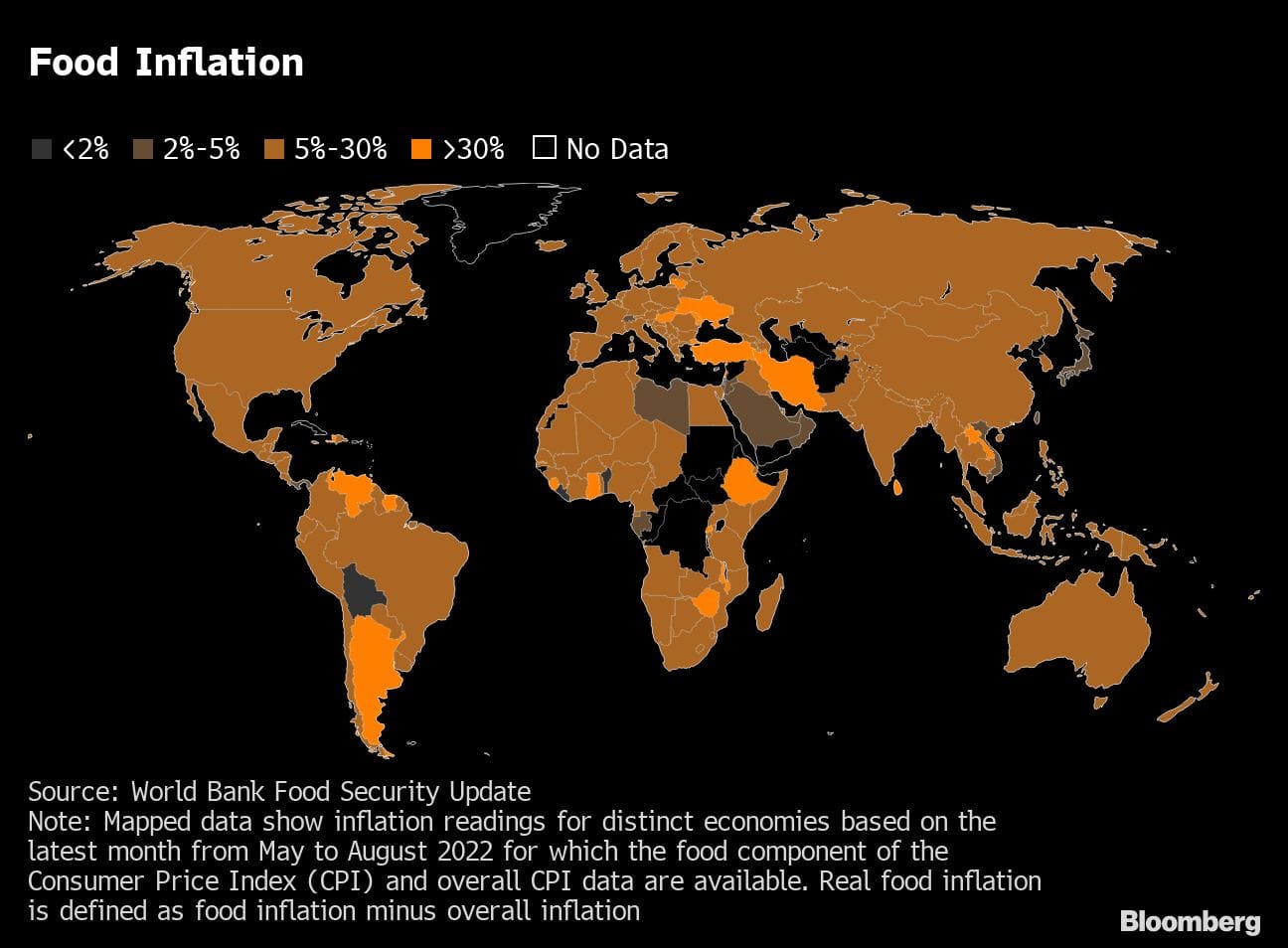

Soaring dollar leaves food piled up in ports as world hunger grows

Around the world, countries that rely on food imports are grappling with a destructive combination of high interest rates, a soaring dollar and elevated commodity prices, eroding their power to pay for goods that are typically priced in the greenback

BUSINESS

Rupert Murdoch wants to put his media empire back together again

Both Fox Corp and News Corp have set up special committees of independent directors to study a potential deal and evaluate possible terms

INDIA

India sells sugar in ‘golden opportunity’ on tight global market

Mills in the South Asian country, which vies with Brazil as the world’s top sugar producer, have so far contracted to export about 1.2 million tons and aim to ship as much as 8 million tons in the 2022-23 year, according to Rahil Shaikh, managing director of trading company Meir Commodities India Pvt.

BUSINESS

BofA strategists see more pain in store before stocks reach low

Thursday’s rally in US stocks after a hot inflation print resembled a “bear hug” amid oversold conditions, high cash levels and the lack of a credit event, strategists led by Michael Harnett wrote in a note.

BUSINESS

UAE royal’s firm plans to invest $10 billion in US, Europe

The group, chaired by United Arab Emirates National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan, sees this as an opportunity to offload some of its existing equity holdings, reduce its exposure to riskier assets and broaden its global portfolio, according to people familiar with the matter.

BUSINESS

Kanye West made Adidas billions, but he can also destroy it

Kanye West, now known as Ye, commands an almost fanatical following. Up until now, that has been part of the appeal for companies that have collaborated with him. If Ye puts his name on something, it will sell.

BUSINESS

Reliance said to be sole bidder for metro’s India business

Charoen Pokphand Group Co. is no longer actively in talks with Metro, leaving only Ambani’s Reliance to pursue the so-called cash-and-carry business, the people said, asking not to be identified as the information is private. A final decision could emerge as early as next month, one of the people said.

BUSINESS

Private bets shield world’s largest investors from market mayhem

The big question now looming over giants from China’s $1.2 trillion sovereign wealth fund to California’s public pension, the largest in the US, is how long those private bets will remain insulated as the economic outlook darkens.

BUSINESS

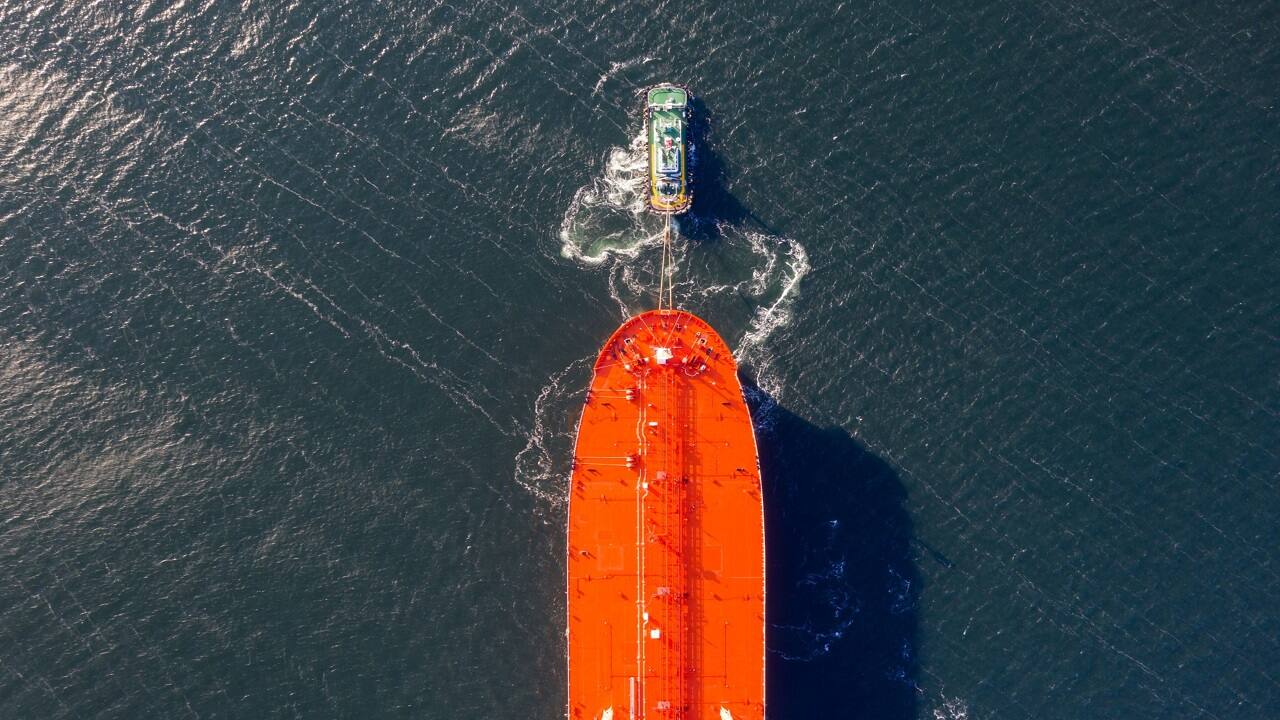

Russia sanctions spur buying frenzy for ice-breaking tankers

Some ice-class Aframax vessels have recently been sold at between $31 million and $34 million, double the price compared with a year earlier, said shipbrokers. The bids for tankers have been aggressive and most buyers are preferring to keep their identities secret, they added.

BUSINESS

Contamination report sparks Shanghai rush for bottled water

Shanghai took emergency measures to secure its water supply because contamination from the sea forced authorities to cut delivery from two key reservoirs temporarily, the Beijing-based Caixin Global reported Tuesday night, citing city officials.

WORLD

Hong Kong eyes property tax cut, visa moves to reverse covid brain drain

Chief Executive John Lee could include the measures in his maiden policy address later this month, according to people familiar with the matter, who asked not to be identified because the deliberations are private.

BUSINESS

Car-sharing platform Zoomcar to go public via SPAC deal

Zoomcar operates a marketplace for private vehicles, with owners making their cars available on the platform and users able to rent them by the hour, day, week or month. The company, whose headquarters are in Bangalore, operates in more than 50 cities in India, Indonesia, Vietnam and Egypt.

BUSINESS

Crypto hackers set for record year after looting over $3 billion

At least $718 million has been stolen so far in October alone, taking the gross tally for the year past $3 billion and putting 2022 on course to be a record for the total value hacked, according to blockchain specialist Chainalysis Inc.

BUSINESS

Joe Biden’s ‘slight’ recession would mean economic pain for millions

Economic contractions -- even modest ones -- traditionally lead to markedly higher unemployment as companies slash their payrolls by millions of workers in response to lower demand. That would undercut Biden, who has touted job growth to argue the economy is on strong footing despite decades-high inflation.

BUSINESS

Aluminum, producer stocks surge as US weighs Russia ban

Metal products from Russia have so far been shielded from sanctions due to their importance in everything from automobiles and skyscrapers to iPhones.

BUSINESS

Jefferies’s southeast Asia, India dealmaker Probir Rao to leave, sources say

Probir Rao will depart from the US investment bank next week, one of the people said, asking not to be identified as the information isn’t public. The Singapore-based managing director has been with Jefferies for more than 13 years, according to his LinkedIn profile.

BUSINESS

Elon Musk launches new ‘Burnt Hair’ perfume with fragrance of ‘repugnant desire’

Elon Musk announced the scent — called “Burnt Hair” and described as “the essence of repugnant desire” — in a tweet Tuesday, before changing his Twitter biography to “Perfume Salesman.”

BUSINESS

Deutsche Bank taps Credit Suisse rxecutive as Asia wealth head

Yee Young, the number two wealth executive for Credit Suisse in the region, will start at Deutsche Bank next year and continue to be based in Singapore, according to people familiar with the matter.

COMMODITIES

Oil skids for third day as recession concerns rattle global markets

Crude hit the lowest level since January last month, only to rebound after the Organization of Petroleum Exporting Countries and its allies agreed to cut oil supply

BUSINESS

Survival tips for tech startups as funding dries up

Venture capitalists and technology chieftains converged in Singapore in recent weeks to hobnob over a number of high-profile annual conferences, marking the city-state’s grand coming-out-of-Covid party.