BUSINESS

TVS Motor Co launches $300-350 million fund raise process for EV arm; Citi tapped as advisor

Moneycontrol was the first to report that the firm was looking to tap private equity investors for its electric mobility business on November 9, 2021. Later, in December, TVS Electric Mobility was incorporated as a subsidiary with an investment plan of Rs 1,000 crore

BUSINESS

ADIA lead suitor for 20% stake buy in IIFL Finance's housing finance arm

Canadian billionaire Prem Watsa-backed Fairfax Group and the UK government’s development finance institution CDC Group are key investors in IIFL Finance, a retail-oriented NBFC, holding 22.3% stake and 7.7% stake, respectively

BUSINESS

Corporate Crossings | Paytm sees another exit as enterprise functions president jumps to Grant Thornton

Deepankar Sanwalka, a Big Four veteran of 27 years, has previously worked with PwC where he was the India advisory leader and leader of risk advisory services, and at KPMG he led the risk consulting vertical.

BUSINESS

Corporate Crossings | EY e-commerce & consumer internet spearhead Ankur Pahwa quits to start VC fund

Pahwa, also a partner in EY’s Transactions Diligence Practice has spent more than 16 years at the firm in two stints. He has worked earlier at BMR Advisors and Arthur Anderson (which merged its operations with EY India in 2002)

BUSINESS

Clermont Group & Arpwood Partners-backed SBFC Finance kickstarts IPO prep, appoints 3 I-bankers

Mumbai-based SBFC Finance kick-started operations in 2017 and acquired the retail lending business of Karvy Financial Services Private Limited with 65 branches and 700+ people.

BUSINESS

Blackstone-Aurobindo Pharma talks over injectable business stake sale hit hurdle

On March 16, Moneycontrol had reported that the race for the injectable business, which was being run by investment bank Kotak Mahindra Capital, had entered the final leg with three shortlisted suitors. “Blackstone is aggressively pursuing this deal and is being viewed currently as a strong contender,” the report had added.

BUSINESS

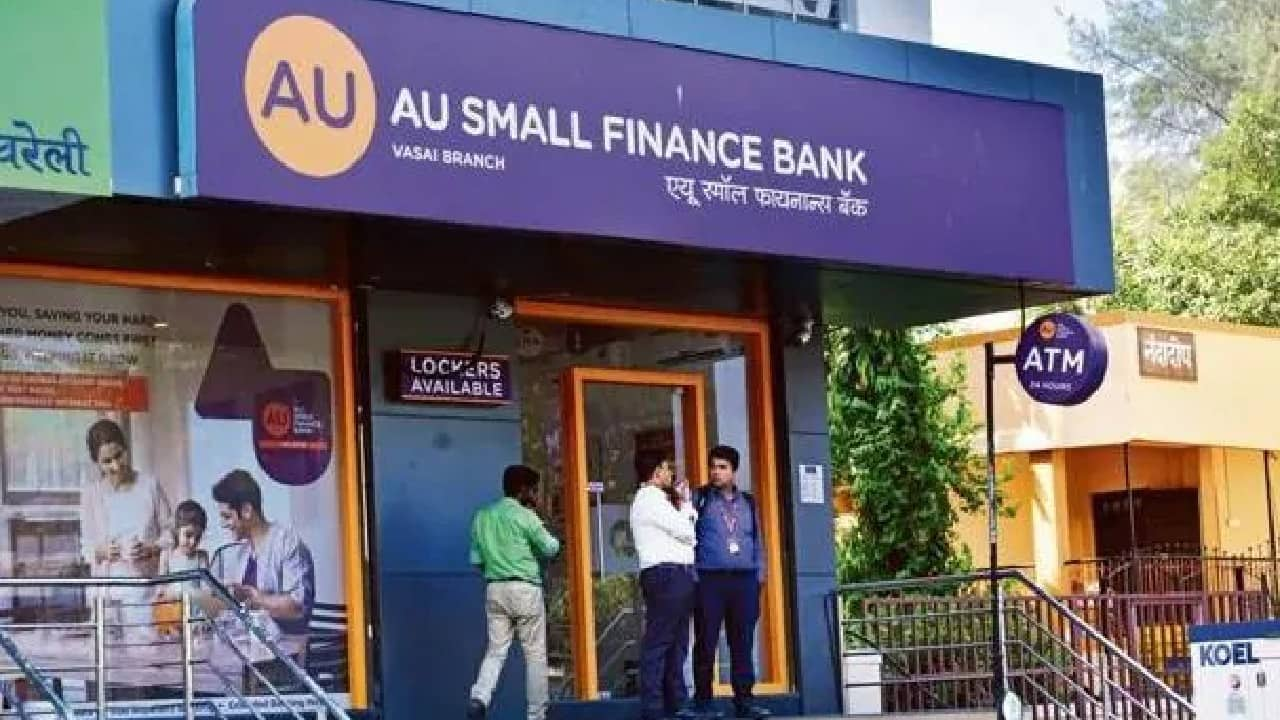

AU Small Finance Bank weighs Rs 2,000-3,000-crore QIP in FY23; four I-Banks on board

In December 2019, Singapore state investment arm Temasek announced that it had completed the acquisition of a 4.8 percent stake in AU Bank after investing Rs 525 crore. This quantum was part of a total commitment of Rs 1,000 crore made earlier. Later, in March 2021, the firm raised Rs 625 crore through the QIP route and the markets cheered the move which saw a strong reception from sovereign wealth funds, large foreign portfolio investors, life insurance companies and domestic mutual funds

BUSINESS

Pepperfry picks I-Sec, Axis Cap, JPM for around $250 mn IPO; Filing likely next month

Some of Pepperfry’s key investors include Norwest Ventures, Broadstreet Investments, General Electric Pension Trust and Bertelsmann. In February 2020, the company had raised $40 million in a growth round led by Pidilite Industries, the maker of popular adhesive brand Fevicol.

BUSINESS

Race for Mytrah Energy assets: JSW Group signs exclusivity pact; deal valued between $1.6 billion and $1.7 billion

JSW Energy, the likely acquiring entity, is keen to bolster its green energy footprint. Mytrah Energy has 1.7 GW of operational wind and solar assets

BUSINESS

Delhivery IPO today: GIC, Tiger Global, Steadview Capital among 64 anchor investors

Delhivery cut the size of the IPO to Rs 5,235 crore from Rs 7,460 crore planned earlier. It will raise Rs 4,000 crore via a fresh issue of shares.

BUSINESS

FirstCry to raise $1 billion via IPO; Kotak Mahindra Capital, Morgan Stanley on board

Multiple sources confirmed to Moneycontrol that preliminary discussions with investment banks over the IPO had already started.

BUSINESS

Canada pension fund ready to explore bets in pharma, healthcare in India at 'right prices'

The global investment behemoth continues to have more appetite for sectors such as renewable energy, said Graham while adding that going ahead it will explore investments in the pharma and healthcare segments in the country.

BUSINESS

Biba Apparels files papers for IPO to raise around Rs 1,500 crore

In the past few months, a spate of domestic fashion labels backed by private equity firms has made a beeline for Dalal Street. Sequoia Capital-backed women's bottom-wear brand Go Colours raised Rs 1,014 crore via its IPO and made a stellar debut on the bourses in November, listing at a 90 percent premium to its issue price.

BUSINESS

Temasek India’s Promeet Ghosh steps down to pursue entrepreneurial ambitions

The Temasek India portfolio has grown under Ghosh’s watch with the firm striking big-ticket deals including the acquisition of L&T's electrical and automation business for around $2.1 billion (as part of a consortium with France's Schneider Electric) and the buyout of Crompton Greaves consumer arm along with private equity peer Advent International

BUSINESS

Race for IDFC MF: Bandhan consortium holds edge ahead of IDFC board meet

On September 17, 2021, the boards of IDFC and IDFC Financial Holding Company gave the nod to kickstart the divestment process for the mutual fund business subject to requisite regulatory approvals. Interestingly, investors had earlier expressed concerns over a delay in the value unlocking exercise.

BUSINESS

HDFC Twins To Join Hands In The Mother Of All Mergers: India Inc Reacts

The merger could take up to 18 months to be completed, and according to analysts, it will be equally beneficial for both customers and the bank.

BUSINESS

Top healthcare investors Orbimed, CDC Group look to exit Asian Institute of Medical Sciences

Both Orbimed and CDC Group have an extensive healthcare portfolio in India. They invested in AIMS in 2014 and 2018, respectively.

BUSINESS

Mankind working on upto $1 billion IPO, one of the largest ever in pharma space

Mankind Pharma is being valued at close to $8-10 billion, according to sources. The size of the proposed IPO could range between $800 million and $1 billion, making it one of the biggest ever IPOs in the pharma segment.

BUSINESS

Nasdaq-listed Yatra Online’s Indian subsidiary files papers for an IPO

Yatra Online listed on the US bourses in December 2016. On August 13, 2021, Moneycontrol had reported that Sequoia Capital and Elevation Capital-backed AI-based travel app ixigo had filed papers for a Rs 1600 crore IPO.

BUSINESS

IDFC MF sale: Bandhan Group, Invesco MF consortiums picked for final leg

On September 17, 2021, the board of directors of IDFC Limited and IDFC Financial Holding Company Limited gave the nod to kick-start the divestment process for the mutual fund business subject to requisite regulatory approvals, as applicable

BUSINESS

KKR-backed Ramky Enviro launches sale process, firm’s valuation may exceed $1.5 billion

KKR announced the acquisition of a 60 percent stake in Ramky Enviro (recently re-branded as Re Sustainability) in August 2018 for $530 million. Back then, it was the largest buyout by a PE fund in India’s environmental services sector.

BUSINESS

Exclusive | IDFC MF Sale: 3 binding bids likely; Sundaram-Carlyle Combine may drop out

On September 17, 2021, the Board of Directors of IDFC Limited and IDFC Financial Holding Company Limited gave the nod to kick-start the divestment process for the mutual fund business subject to requisite regulatory approvals, as applicable.

BUSINESS

Brookfield to pick up minority stake in packaging films biz of Jindal Poly Films

The Indian packaging industry has seen a lot of M&A action since private equity fund Advent International offered an exit to Kedaara Capital and purchased a controlling stake in Manjushree Technopak in 2018

BUSINESS

Race For Auro Pharma Injectable Biz: Blackstone, Barings PE Asia & KKR In Final Round

In May 2021, in a move to improve operational efficiency, the drugmaker had approved the transfer of its injectable assets into a subsidiary called Eugia Pharma Specialities Limited for “greater focus, attention, and specialization” and also to “ augment fundraise and strategic tie-ups in future through joint ventures etc” according to exchange disclosures.