BUSINESS

Why this large smallcap fund is not worried despite the frothy markets

Ownership of smallcap stocks by institutions such as mutual funds has risen drastically, which makes the current rally much more stable compared to earlier ones, says B Gopkumar, MD and CEO, Axis Mutual Fund

BUSINESS

Year Ender 2023: Some giveth, some taketh for mutual fund investors | Simply Save

2023 was an eventful year for the Indian mutual fund industry, as assets under management (AUM) neared Rs 50 lakh crore mark. Lovaii Navlakhi, Managing Director and CEO at International Money Matters, shares insights into key investment trends of 2023, top mistakes investors made during the year and what investors should look out for in 2024.

BUSINESS

Five sectors that Mahesh Patil of Aditya Birla Sun Life Mutual Fund likes

The CIO of India’s sixth-largest fund house says this is the time to rebalance investors’ portfolio towards large-cap stocks. And investors should not be too aggressive towards equities just because markets are on a high.

BUSINESS

Sovereign Gold Bond 2023-24 Series III opens today: Should you invest?

The launch of SGB Scheme 2023-2024 Series III has come on the back of gold prices increasing by more than 10 percent in 2023 and defying expectations amid a high interest rate environment.

BUSINESS

Where to invest Rs 10 lakh today, after Sensex crossed 70,000-mark?

Even as equities remain among the best long-term asset classes, prices at all-time highs warrant caution, experts say.

BUSINESS

Start looking at fixed-income funds a lot more actively now: Anthony Heredia, Mahindra Manulife MF

The MD and CEO of India’s 25th biggest AMC suggests that for 2024, investors should not obsess over thematic products or specific market caps but should remain invested in multi-cap or flexi-cap funds and do it systematically and gradually.

BUSINESS

Equity fund inflows hold steady; mutual fund industry AUM nears Rs 50 trillion landmark

The contributions via systematic investment plans (SIPs) topped the Rs 17,000 crore level for the first time in November. The SIP book came in at Rs 17,073 crore against Rs 16,928 crore in October.

BUSINESS

Time to invest in long-term debt funds, say experts as RBI keeps interest rates steady

With Reserve Bank of India expecting to maintain status quo on policy for the next five-six months, debt market experts suggest that investors can start taking some exposure in 10-15-year papers at this point.

BUSINESS

2024 General Elections: Does it make sense to pause your SIPs till the results?

Many investors have been known to keep their investment plans on hold when a general election is around the corner. But trying to time the market is a futile exercise

BUSINESS

Budget@10: Tax burden rises on mutual fund gains, but exemption limit increases

The mutual fund sector has grown almost five times over the past decade. During this period, debt and equity mutual fund investors have taken hits from budget announcements

BUSINESS

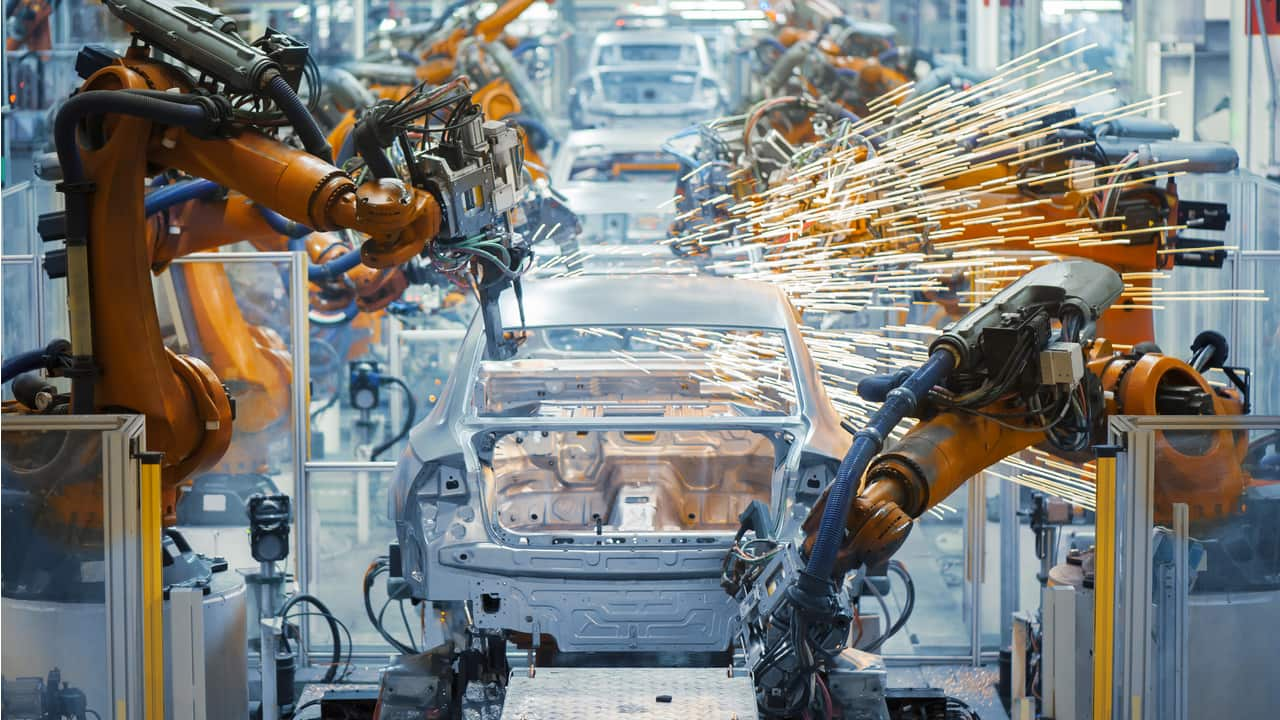

Axis India Manufacturing Fund new fund review: Should you invest?

The new fund aims to leverage India's manufacturing renaissance. While experts are bullish on this theme, there are concerns over the fund house’s recent performance.

BUSINESS

Why hybrid mutual funds are gaining currency? | Simply Save

Hybrid funds are back in the limelight after the debt taxation changes in the Budget. This category has seen net inflows of Rs 72,000 crore. What changed for this category and why are investors making a beeline for these funds? Chintan Haria of ICICI Prudential Mutual Fund has answers.

BUSINESS

Can SGBs continue to outperform gold funds?

Sovereign gold bonds 2015-Series-I has delivered 13 percent XIRR to its initial investors. Gold ETFs and physical gold have fallen short in comparison.

BUSINESS

Investors strike it rich as first sovereign gold bonds come up for maturity

The first tranche of Sovereign Gold Bonds, which are government securities denominated in grams of gold, are all set to see its first redemption on November 30. Investors holding SGB 2015-I till maturity will stand to gain a CAGR of 10.88%.

BUSINESS

Removal of debt tax benefit is fuelling equity market rally: Trust Mutual Fund’s Sandeep Bagla

The CEO of Trust Mutual Fund says interest rates will not rise dramatically or fall in the near term. However, a rate cut is likely somewhere at the start of FY25

BUSINESS

Why mutual funds made a beeline for Tata Technologies IPO

As many as 17 domestic mutual fund houses picked up shares worth Rs 355 crore in the anchor book of Tata Technologies’ IPO through a total of 39 schemes.

BUSINESS

Tata Technologies IPO anchor round: Mutual funds that invested and those skipped

India’s two biggest asset management companies, SBI Mutual Fund and ICICI Prudential Mutual Fund, invested the highest sum in the anchor round at Rs 42 crore each.

BUSINESS

In love with banks: DSP Mutual Fund launches banking and financial services fund

The banking and financial services sector has been underperforming the Nifty 50 since 2019. However, DSP MF believes that the reversal in underperformance, reasonable valuations, and strong balance sheets of these companies will attract investors.

BUSINESS

Unifi Capital receives in-principle approval to launch mutual fund business

Chennai-based Unifi Capital has assets under management (AUM) of Rs 20,400 crore with around 10,000 Portfolio Management Services (PMS) and Alternative Investment Funds (AIF) clients across 22 states in India.

BUSINESS

Kotak Mutual Fund launches healthcare fund. Should you invest?

Kotak Healthcare Fund is being launched in the background of healthcare funds returning an average of 25 percent in the last one year. While this sectoral fund category has delivered good returns over long-term periods, timing is key, as pharma funds can see cycles of underperformance.

BUSINESS

How this value fund came to top the returns chart

With its focus on public sector units, Motilal Oswal S&P BSE Enhanced Value ETF has been able to deliver nearly 50 percent returns in a year. Can this value-based focused fund continue to perform?

BUSINESS

Should mutual funds invest in new-age startups?

Unitholders have started questioning the rationale of mutual funds investing in loss-making new-age companies at lofty valuations. While a mutual fund’s exposure to a single stock is mostly minuscule, some experts believe that fund managers may be running out of ideas amid a steady rise in SIP contributions.

BUSINESS

Why do mutual funds invest in IPOs? Simply Save

In recent times, mutual funds have faced some criticism for investing in IPOs of new-age start-ups despite the lack of track record and poor financials. What are the factors for selecting an IPO and are mutual funds taking extra risk by investing in IPOs? Moneycontrol spoke to Bharat Lahoti, Co-Head-Hybrid and Solutions Funds at Edelweiss Mutual Fund for answers. Listen in

BUSINESS

Kenneth Andrade’s Old Bridge Mutual Fund applies for its first fund with SEBI

Old Bridge Focused Equity Fund would follow the multi-cap strategy, wherein the scheme would invest across market capitalization -- mid-cap, small-cap, large-cap.