As a Futures and Options strategy, Amit Trivedi, Co-Founder, Investworks.in recommends a ratio trade. One can buy 6,000 strike Calls and sell two 6,100 Calls, so there is Rs 3 invested in this strategy, he said

first published: Sep 18, 2013 10:30 am

A collection of the most-viewed Moneycontrol videos.

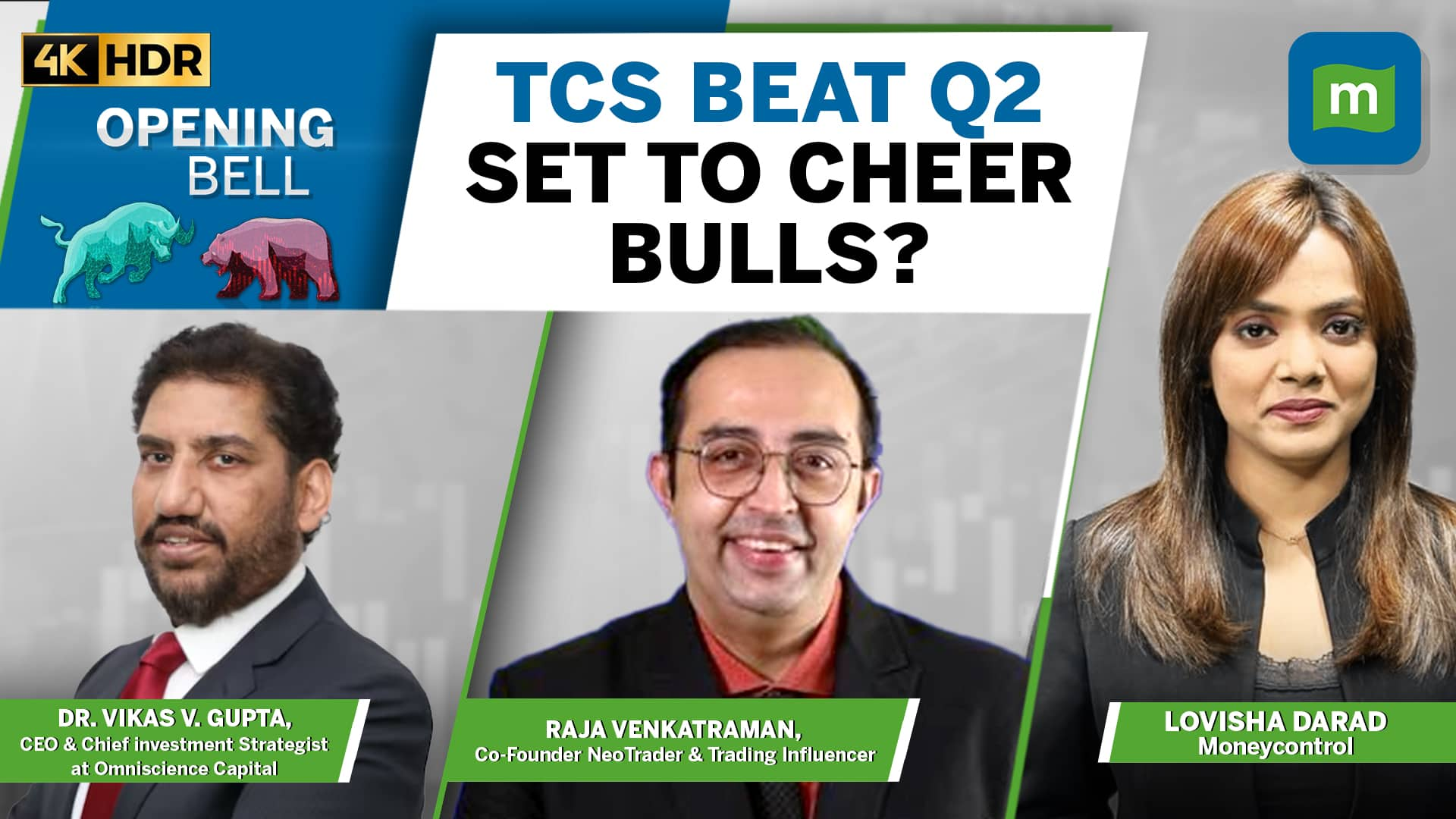

Live: Will Nifty bulls aim to break 25,250 after strong TCS Q2? | Opening Bell

TCS Q2 Earnings Live: Margin, Revenue Beat Street Estimates

Live: Nifty reclaims 25,100 ahead of TCS Q2 results; pharma, metals shine | Closing Bell

Canara Robeco AMC's Rs 1326 Cr IPO Kicks Off | Management Shares Growth Plans| IPO Watch Live

You are already a Moneycontrol Pro user.