Innerwear and leisurewear companies (ILCs) have been on a roll in recent years on the back of operating leverage, product premiumisation, brand appeal, increasing advertisement spends, and gradual foray into the apparel space.

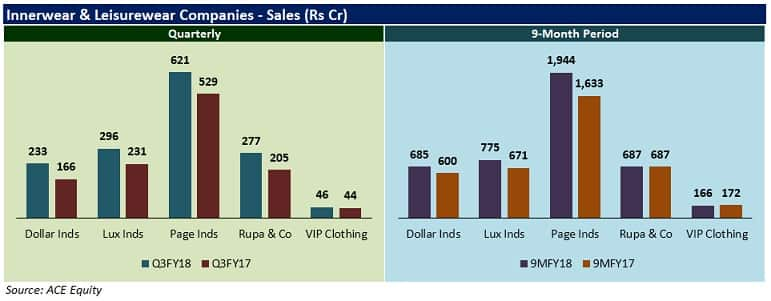

The Q3FY18 numbers of some of India’s leading ILCs (Dollar Industries, Lux Industries, Page Industries, Rupa & Company) seem to be underscoring this fact, whereas VIP Clothing continued to remain a laggard.

In all cases, the year-on-year sales growth for Q3 and 9MFY18 was primarily on account of a low base (demonetisation took place in Q3FY17) and a demand uptick due to seasonality (particularly in case of thermal/winter wear apparel manufacturers), among other factors.

Barring Rupa & Company, the improvement in EBITDA margins of all ILCs can prima facie be attributed to a volume-driven (higher manufacturing capacity) and/or realisation-driven (an increase in sales price per unit sold) growth, which in turn, led to healthy PAT margins.

Dollar is bullish on the growth prospects of its premium brands (Bigboss, Missy, Force NXT). Going forward, the company will actively promote them by introducing new schemes for distributors, mainly in the tier 2/3/4 regions of India. Ad spends as a percentage of sales will be around 8-10 percent.

New product offerings in the relatively under-tapped categories (womenswear, childrenswear, sportswear), no major capex outlay in the near-term, and cost control measures are some of the additional factors that could lead to an improvement in Dollar’s margin profile and return ratios.

Lux IndustriesTo capitalise on the GST transition from unorganised entities to organised players, Lux is focusing on the mass segment in innerwear. Furthermore, by virtue of enhanced capacity utilisation and manufacturing efficiencies, the company is targeting EBITDA margin expansion of 100-150 bps during the next 2-3 years.

Lux is gradually widening its footprint in the high-potential international markets. The company aims to increase its export revenues from 10 percent of total sales in FY17 to 12/15 percent in FY18/19, respectively, through addition of new geographies and a wider range of product offerings.

Page IndustriesPage is augmenting its network of margin-accretive Exclusive Brand Outlets (EBOs) pan-India by adding 80/500 outlets in Q4FY18/FY19, respectively. Post expansion, the contribution of 1000 EBOs (in total) to Page's annual revenue is expected to increase from 15 percent in FY17 to roughly 40 percent by FY20.

Most of Page’s proposed capex of Rs 200 crore (from FY17 to FY20) will be spent on store additions. The proportion of outsourced manufacturing will increase to 35 percent by FY19 end as against 17 percent in FY17. The company’s foray into kids innerwear is anticipated to add to top-line growth from FY19.

Rupa & CompanyBrand legacy, normalisation of trade channels post-GST, increased impetus towards high-value brands, a shift in product mix in favour of women’s innerwear, and a favourable demand scenario for its ‘Thermcot’ winterwear brand could bolster Rupa’s performance in years to come.

In addition to ‘FCUK’ (a brand already licensed in Rupa’s name), the company signed an exclusive license agreement with ‘Fruit of the Loom Inc’ to sell branded products pan-India. In case of the latter, initial emphasis will be initially laid on metros and western Indian cities, before considering other markets.

VIP ClothingTo earn higher margins, VIP, positioned as a mass brand until now, is moving into the mid-premium segment through its ‘Regal’ brand, particularly in South India, to begin with. Outsourcing of most of the company’s manufacturing functions to third-party vendors may ease working capital requirements, too.

Implementation of measures such as segregation of brands into separate strategic business units, expense control steps at the back-end, and limiting investments in low-margin products may pave the way for a revival in the company’s financials in due course.

Where should you invest?Inroads made by organised retailers across India, simplification of logistics (on account of GST and probable introduction of the e-way bill in FY19), and growing preference for branded innerwear (because of higher disposable incomes) are some of the principal tailwinds that could benefit ILCs in the long-run.

However, raw material cost escalations, increasing skilled labour costs, and a high degree of competitive intensity (in an oligopolistic Indian innerwear market, where fashion trends change rapidly) may impact the margins of ILCs. From a company-specific perspective, here’s what investors need to bear in mind:-

Dollar IndustriesProduct premiumisation, completion of backward integration to cut costs, regional expansion, and a strong balance sheet augur well for Dollar as it endeavours to capture a greater chunk of the fast-growing and dynamic innerwear market.

Lux IndustriesFor Lux, pace of diversification in markets other than western and central India, utilisation levels at its manufacturing facility, returns on ad spends, and free cash flow visibility (no capex plans for the next 3-4 years) remain the key monitorables.

Page IndustriesGiven a good track record, brand power (Jockey), and a highly capital-efficient business model, Page has all that it takes to succeed. To cash in on the potential for cross-selling in EBOs (which is better than multi-brand outlets), the company is increasing the number of distributors by 10 percent every year.

Rupa & CompanyWith no substantial capex lined up in the immediate future, Rupa’s debt-equity ratio is likely to remain stable at 0.1x. Success of the company’s owned and international top-end brands will be decisive in facilitating a margin uptick.

VIP ClothingA spike in selling expenses may curtail VIP’s profitability growth in FY19, post which EBITDA margins may go up. Debt reduction (Rs 10 crore) from the rights issue proceeds (Rs 43 crore) could offer some bottom-line respite, too.

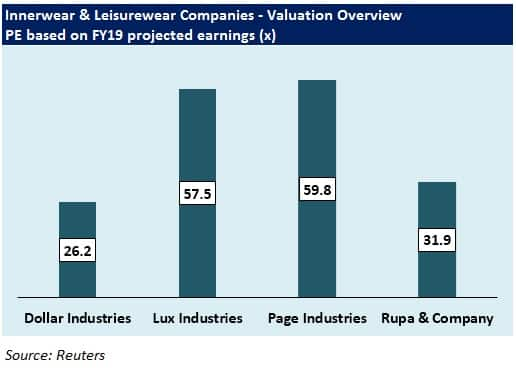

Unsurprisingly, barring VIP Clothing (that continues to grapple with some restructuring-related difficulties), a combination of robust fundamentals and consistent performance have caused ILCs to re-rate quite a bit over the years.

Since Indian ILCs appear to be well-positioned to make the most of the positives that the industry has to offer, it is worth keeping such stocks on the radar for accumulation on any weakness.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.