Education-content provider S Chand’s initial public offer is set to hit the market on April 26. The book building issue, initiated with a price band of Rs 660-670, aims to raise Rs 717-728 crore.

While a strong brand equity and robust presence in the CBSE/ICSE curriculum augurs well for the company, business seasonality risks, lack of content diversification, inadequate digitization, and regulatory barriers could be tough nuts to crack, at least in the short term. These factors may also not support fancy valuations.

Here is a detailed analysis of the IPO aimed at trimming the company's debt and funding general corporate expenses.

S Chand and Company has been a major beneficiary of India’s rapidly booming education sector. The Delhi-based company, founded in 1939 and incorporated in 1970, is engaged in the business of publishing books for pre-primary/primary schooling, secondary/higher secondary academics, competitive exams, technical subjects, and professional courses.

The book-building issue includes an offer for sale of Rs 403 crore by the promoters and some major private equity investors.

Post-issue, the promoters’ shareholding will reduce from 58 percent to 47 percent.

What gives SCCL an edge?Strong brand equity: SCCL’s multi-brand portfolio includes 55 renowned names such as S Chand, Vikas, Madhuban, Saraswati, Destination Success, Ignitor, Chhaya, IPP, among others. The brands cover educational requirements of students across all age groups and classes.

Tie-ups with reputed authors: SCCL’s contractual relationships cover at least 1,958 authors (including co-authors) for over five years as on March 31, 2016. In FY16, the company sold 35.47 million copies of a total of 11,144 titles.

High K-12 market share: SCCL’s K-12 segment, which caters to requirements of students preparing for secondary/higher secondary CBSE and ICSE examinations (through textbooks, reference materials, and hybrid content products), contributes nearly 75 percent to the company’s consolidated annual revenues every year and continues to grow steadily. The segment also serves as a crucial platform for cross selling digital classroom solutions, apart from learning management and assessment tools.

Extensive distribution network covering all regions: As on December 31, 2016, SCCL’s network covers 4,932 distributors and dealers, apart from an in-house sales team of 838 professionals, based out of 52 offices to sell content to K-12 and higher educational institutions across the country.

Integrated in-house printing and logistical capabilities: In FY16, over 85 percent of SCCL’s printing requirements were met by its facilities located in Sahibabad and Rudrapur, thereby reducing its dependence on third-party vendors. As on December 31, 2016, 42 warehouses in 19 states facilitated effective inventory management.

Downsides/threatsOverdependence on Q4: Due to the seasonal nature of the business, most of the SCCL’s sales accrue in Q4 of every financial year. The first three quarters are generally not profit or margin accretive at all. Any volatility during the peak quarter can consequently affect the company’s financial results substantially.

Lack of revenue diversification: SCCL’s business model focuses on publishing alone, unlike Navneet Education Ltd, its closest competitor amongst listed players, which derives 40-45 percent of its revenues from stationery products and digitization. Therefore, the company is exposed to significant risks stemming from demand from one segment.

Not enough headway in the State Board publishing space: State Board curriculum is subject to frequent change (usually once every six years, in addition to revisions every now and then) in comparison to the CBSE/ICSE content. Since SCCL is not too active in this space as of now, it misses out on some tailwinds to generate higher revenues through publishing of revised content.

Regulatory risks: SCCL’s revenues are primarily driven by the K-12 division, the performance of which remains extremely vulnerable to any unexpected announcements by educational regulators that may threaten to reduce the company’s market share. For example, in recent times, the CBSE Board issued a notification whereby recommendation and use of books published by the National Council of Educational and Training (NCERT) and State Council of Educational Research and Training (SCERT) should be made mandatory by all schools.

Competition: Regional and local content providers, who are better positioned to price their products competitively due to lower operating costs and a better understanding of the students’ requirements in a particular region, are key competitors for SCCL in smaller towns and villages. Furthermore, talks of a proposal to adopt a common curriculum for subjects such as Mathematics and Science for all education boards, if effected, could cause SCCL to lose its market share in the K-12 segment, which happens to be its forte.

Slow progress on the digital education front: Digitization in India’s learning sphere has been gaining steam pretty quickly of late, given the extensive reach and potential of digital channels. SCCL has not been able to beef up its presence as much as it had envisaged.

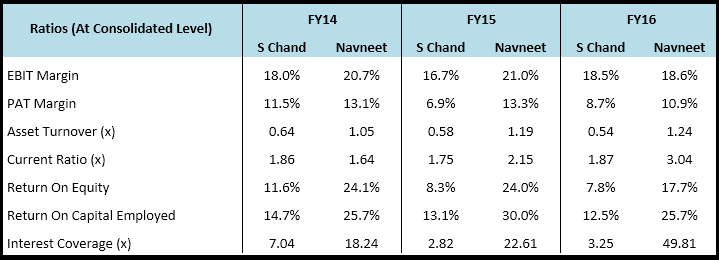

Valuation & conclusionGiven the headwinds stated above, at the upper price band of Rs 670, SCCL seems to be valued at approximately 45x FY17 (projected) earnings, which, in our opinion, is costlier than Navneet Education (trading at 25x FY17 expected earnings), which has a more diversified business model and comparatively better operational/return ratios, as shown below:-

We suggest the investors to avoid the issue for the time being and wait for a better re-entry opportunity in the secondary market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.