The S&P BSE Midcap index, which has nearly doubled in the last three years of Modi government in office, produced 35 stocks which turned multibaggers. Meanwhile, 15 stocks gave negative returns during the same period.

Midcap stocks came on investors’ radar after the Modi-led NDA government came to power back in 2014 on renewed focus on reforms, proposal to implement goods and services tax (GST), measures by the government to boost agricultural income as well as productivity.

“Whatever seeds PM Modi sowed in the past 3 years like promoting Make in India, demonetisation, RERA etc. investors will be reaping the benefits in the next 2 years in the form of GDP growth, fiscal discipline, curbing black money and maintaining inflation,” Achin Goel, Head, Wealth Management and financial planning, Bonanza Portfolio told Moneycontrol.

The huge gush of liquidity from mutual funds (MFs) also poured into mid and smallcap stocks, which pushed valuations of many above their respective long-term averages.

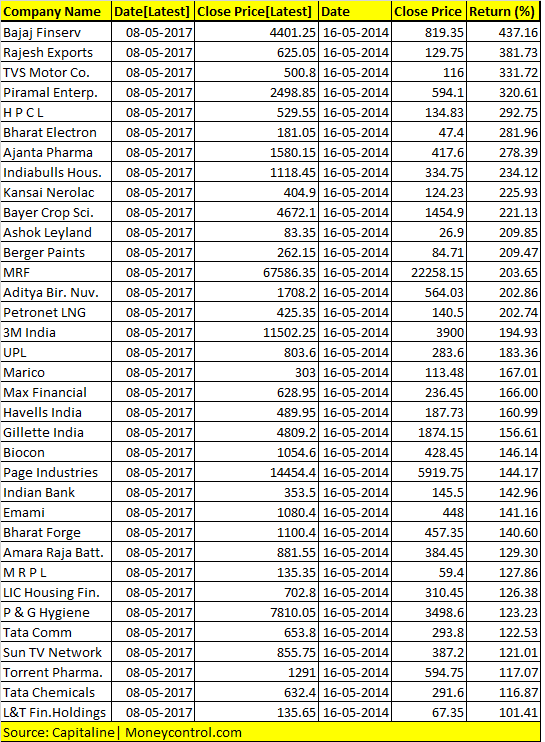

Stocks which more than doubled investors wealth in the last three years include names like Bajaj Finserv, Rajesh Exports, TVS Motor Company, Piramal Enterprises, HPCL, Bharat Electronics, Ajanta Pharma, MRF, UPL, Biocon, Emami, Bharat Forge etc. among others.

Stocks which gave negative returns include names like Adani Enterprises which slipped 78 percent, followed by Reliance Communications which was down 74 percent, and Jindal Steel fell 58 percent in the same period.

The Indian stock market surged to record highs despite geopolitical concerns, hawkish US Federal Reserve, and back home valuations look stretched. The only positive takeaway is that the rally was broad based.

If you are a risk averse investor and invested in the market by taking exposure in mid and smallcap funds, chances are that you were able to beat benchmark returns by a wide margin in last three years.

Small and midcap funds have also not disappointed investors. Almost 95% of small and midcap fund have beaten S&P BSE Mid & Smallcap index on a 1 year, 3 year and 5-year rolling return basis, according to Morningstar data.

The midcap stocks have been able to deliver returns in the last three years since the Modi government came to power and the reforms initiated will keep the momentum going, but investors should remain cautious and book partial profits and then buy stocks on dips.

Valuations now look stretched!The liquidity driven rally which drove many midcap stocks higher in the last one year might be staring at stretched valuations now which have raised a cause of concern among many analysts on D-Street.

“The diversions between a midcap valuation and largecap valuation are pretty high and that is also reflected in the way midcaps have performed in the last five years,” Swati Kulkarni, Fund Manager, UTI AMC told Moneycontrol.

“In last three years also, the differential in returns is pretty much high and that has led to this kind of valuation differential with midcaps being at an all-time high premium to largecaps,” said Kulkarni.

She further added that investors should avoid blindly following the momentum in midcaps. Investors need to be very stock specific and avoid any kind of concept stocks at this point in time.

Following the relatively much strong rally of 25-28 percent in the midcap/smallcap indices during January-April 2017 (compared to 11-13 percent in Nifty/Sensex), the midcaps are now trading at relatively richer valuations.

“Midcaps are now trading at much rich valuation, and the risk-reward has turned unfavourable. It might be a good idea to increase the exposure to the largecap stocks in your portfolio,” said a Sharekhan report.

“It is only a tactical call and we remain constructive on Indian equity markets and believe that a sustainable multi-year rally is ahead of us,” it said. Retail inflows are driven by lack of decent returns in other asset classes, reflected in the ever increasing Equity AUMs of Mutual Funds and other investment vehicles.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!