Zomato has become India’s first venture-backed startup to be a part of the BSE Sensex, which includes India’s 30 most liquid and valuable companies. Over the last two years, Zomato has delivered 70 percent growth, far outpacing the benchmark average of 19 percent and thus also trades at a premium valuation of 10.6x one-year forward revenue, compared to the Sensex average of 5.4x. In our opinion, it is the beginning of our lead market indices being more representative of the economy – especially tech companies, like those in the US and China.

In another development, Swiggy’s IPO added $13 billion in market cap to the RainGauge Index (RGI) bringing the other half of the food delivery duopoly to the public markets. While it listed at a 55 percent discount to Zomato, this gap narrowed to 50 percent within a month as Swiggy’s stock surged 31 percent after listing compared to Zomato’s 20 percent rise in the same period - showing the Street’s growing familiarity with the business and that the management did play a role in the convergence of market values.

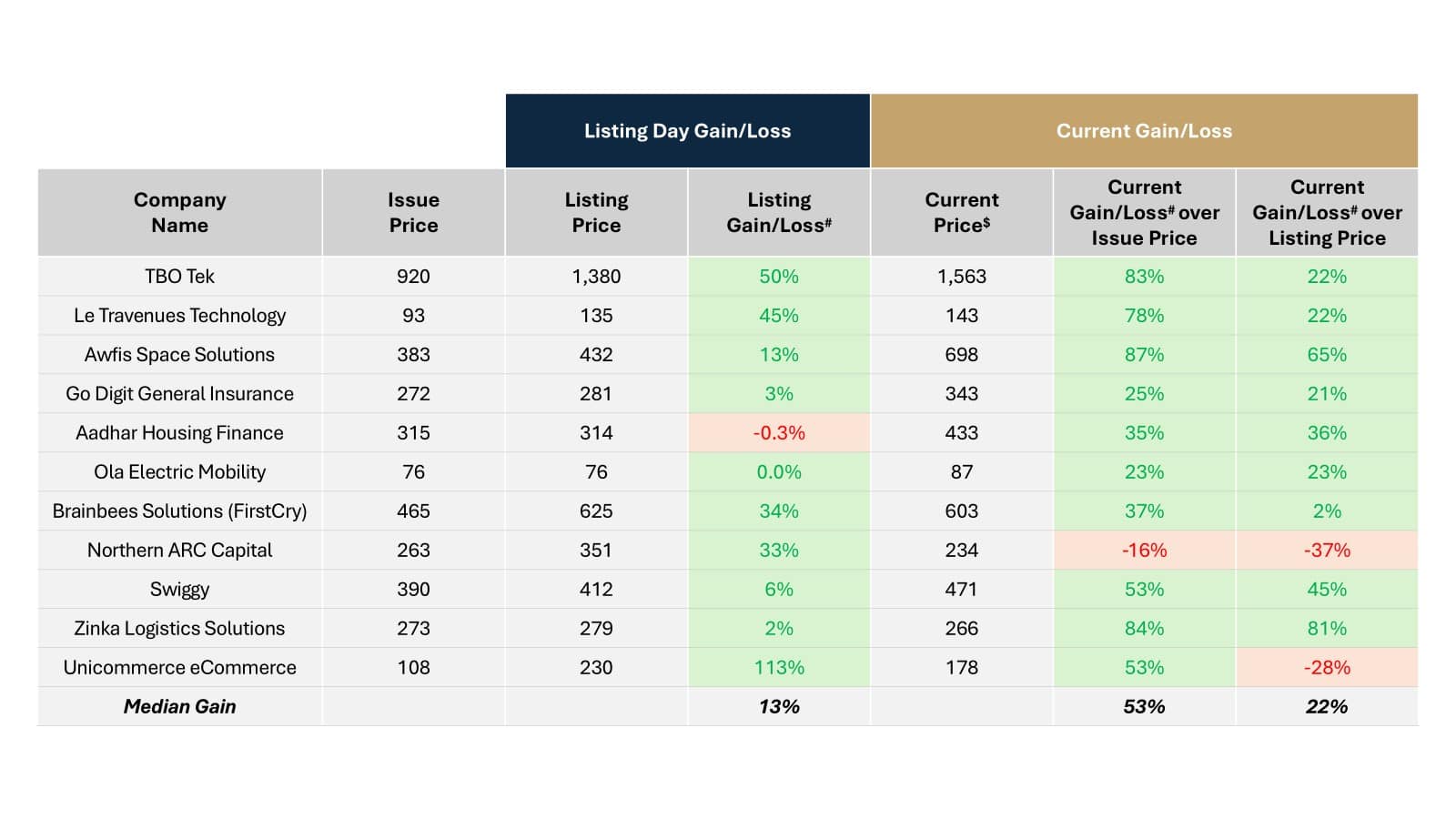

Out of the 11 venture-backed IPOs since the beginning of FY24, 10 are trading over their issue price. The median premium of 53 percent over the issue price is a function of buoyant markets and the fact that more startup managements are following the age-old adage of leaving value on their first brush with public markets.

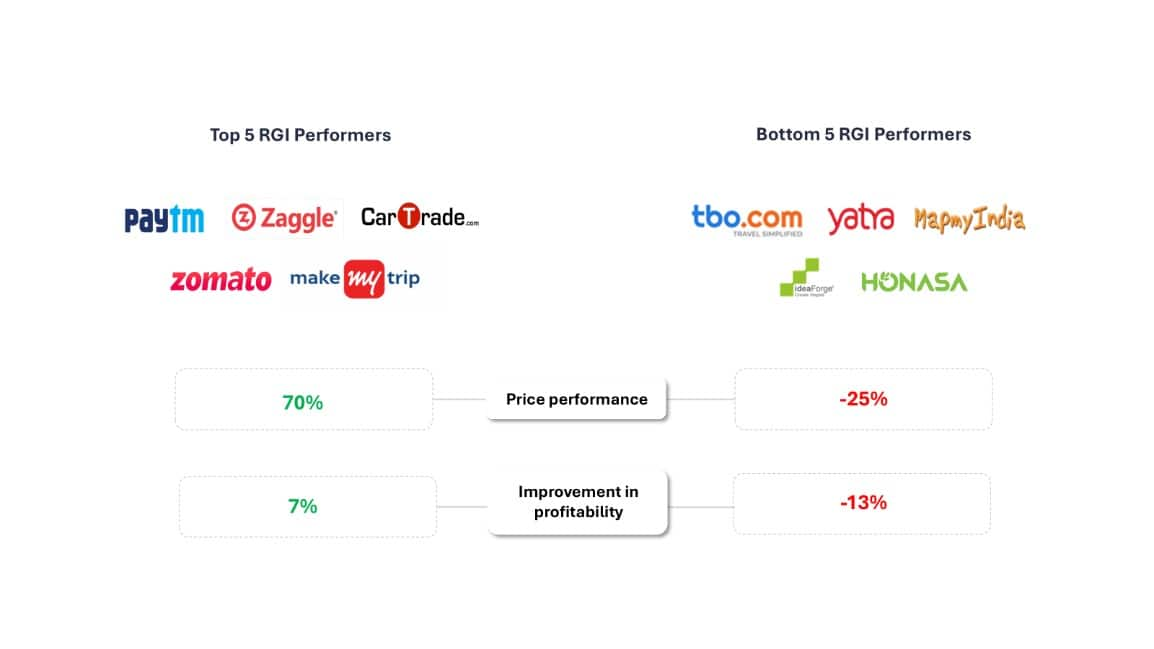

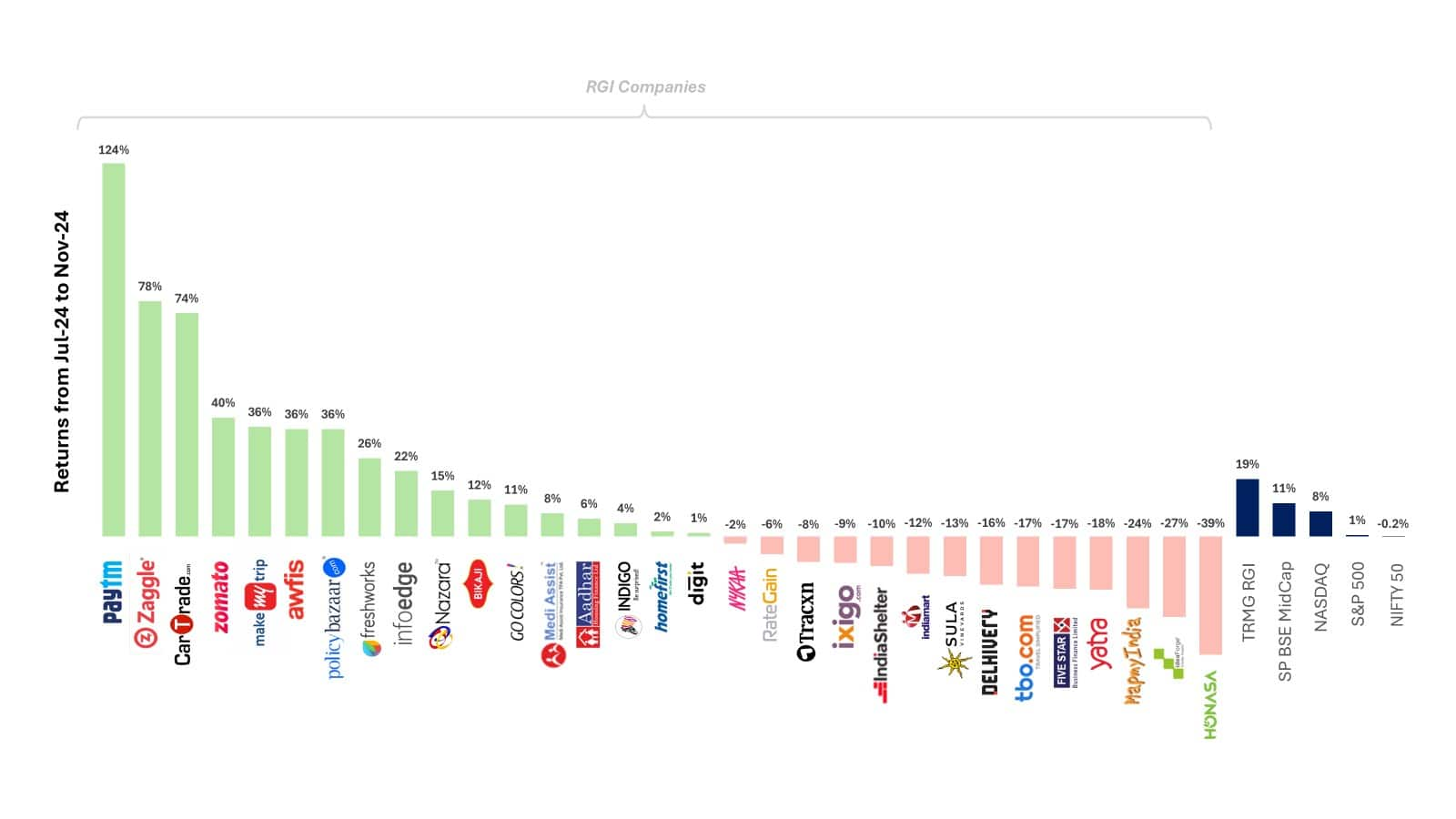

The RGI has delivered a 19 percent return over the past five months ended November 2024, compared to a 0.2 percent decline in the Nifty 50. However, the outperformance was not broad-based, with gains concentrated among just half of the index constituents, highlighting selective strength, rather than a widespread rally.

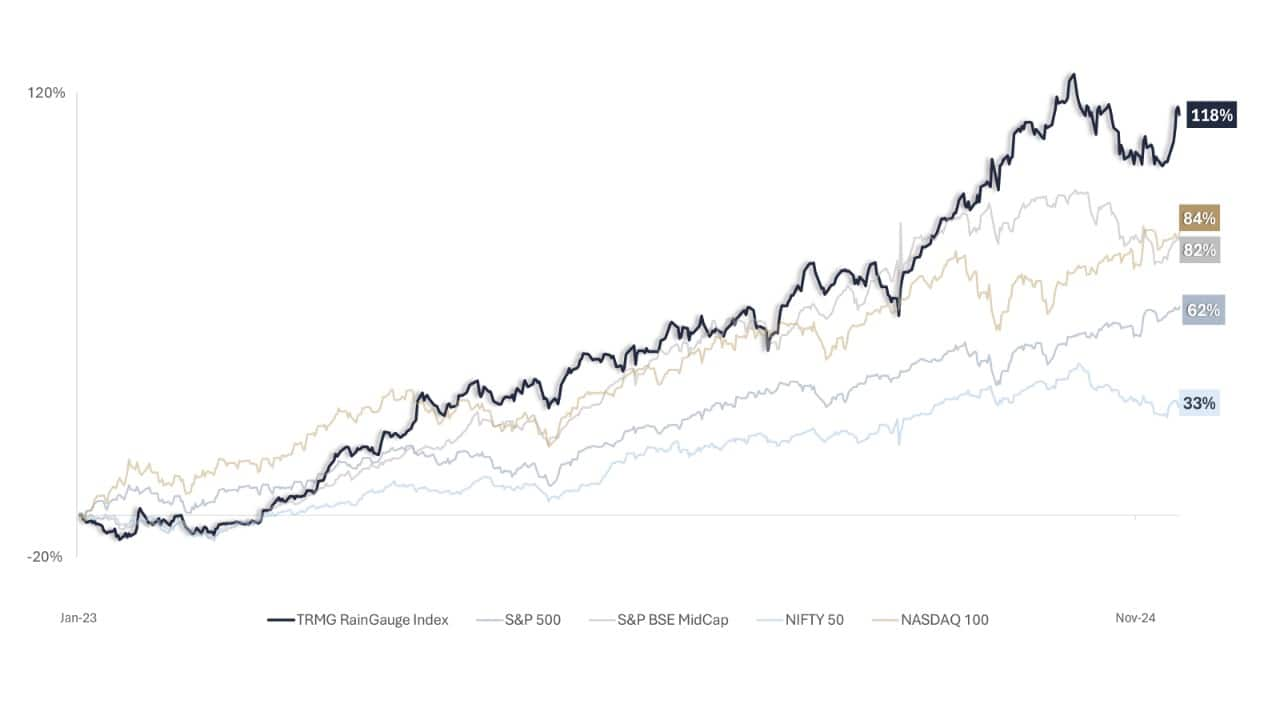

How did VC-backed startups perform in the last quarter?RGI tracking India’s start-up ecosystem, has delivered a 118 percent return since 2023, outpacing major indices like Nifty, Nasdaq, S&P, and the MidCap index.

Data as on November 29, 2024. Performance (in %) quoted is absolute return as on November 29, 2024. Data Source: FactSet, NSE, S&P. Any mention of stock/sector/index names does not constitute investment advice.

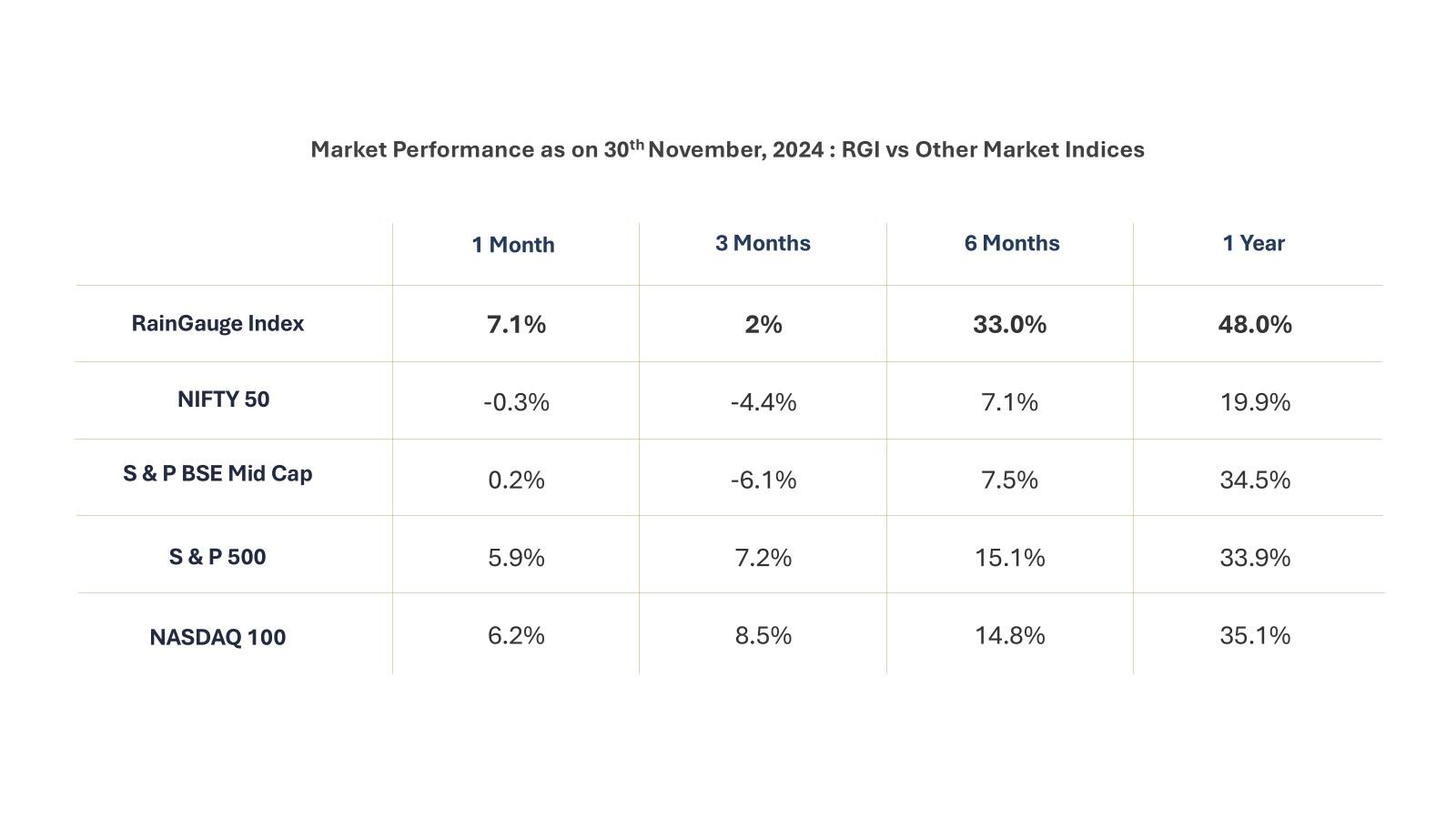

Data as on November 29, 2024. Performance (in %) quoted is absolute return as on November 29, 2024. Data Source: FactSet, NSE, S&P. Any mention of stock/sector/index names does not constitute investment advice.

RGI has outperformed the Indian benchmark indices, which traded in the red for the last three months ended November 2024.

Data Source: FactSet, NSE, S&P.

Data Source: FactSet, NSE, S&P.

An average Indian listed startup trades at 1.2x its mid-cap peers because it grows at 1.8x higher than them.

RGI rose 19 percent in five months ending November 2024, outperforming Nifty 50 (-0.2 percent). However, the performance was driven by only half of the index constituents.

Majority of the companies listed in 2024 are trading at a premium over their issue and listing price.

The complete report can be downloaded from: RainGauge — The Rainmaker Group

(Kashyap Chanchani is the Managing Partner at The Rainmaker Group and Dhwani Mehta is his colleague. The firm advises mid-late stage private, venture-backed companies on fundraising.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.