Former BharatPe CEO Suhail Sameer-backed OTP Ventures is looking to mark the first close of its debut fund at Rs 400 crore by June, sources have told Moneycontrol.

The early-stage fund (pre-seed, seed, series A), co-founded with Kunal Suri, former managing director (MD) of FoodPanda and co-founder of Google-backed Simsim, a video commerce app (now closed), and Saurabh Vashishtha, co-founder SimSim, will invest in consumer brands, consumer tech and fintech sector.

“They would be anchoring the fund and be the largest investors in the same, while the rest will come from a mix of founders, institutions (Indian and global), and established professionals,” one of the sources said. "They are still in talks to onboard some Limited Partners (LPs), and will make the first close by June."

In an email response, Sameer confirmed the development to moneycontrol, saying, "We (OTP Ventures fund) applied for the fund licenses to SEBI and IFSC (Gift city) in late 2023. We just received our approvals and would do the first close likely in June. Kunal, Saurabh and I are co-founders and GPs of the fund."

Without disclosing names, he mentioned said the fund has already committed four early stage investments.

Till now, the trio have been signing seed cheques for startups through their Limited Liability Partnership (LLP) firm, OTP Venture Partners LLP, and have done over 80 investments together, of which 65 were based in India.

However, with the new fund launch, the partners would not be making new investment from the firm owing to "potential conflict of interest".

"The 3 of us are friends for 15 years, were colleagues at McKinsey, and have been investing together (though OTP Venture Partners LLP) for 8 years. We won’t invest from OTP venture Partners LLP going forward - we see it as a potential conflict of interest. All our investments now will be from the OTP Ventures Fund," Sameer told moneycontrol.

As an angel investor, Sameer has backed more than 32 startups, including Mamaearth, Dezerv, GenWise, OTO, Rupeek, Gourmet Garden, Lorien Finance, White.Inc, Glip and Zesty and has had two portfolio exits—SimSim and Fego (acquired by Perfios), data sourced from Traxcn showed.

Operators' driven-fundDelhi-based OTP Venture Fund was floated in April 2023 soon after Sameer stepped down as BharatPe CEO.

Citing example of global funds like a16z which leverage the operator-investors model, Sameer shared his plans to follow the similar path and have "skin in the game" with founders being the largest investors in the fund.

"We (founders) will be the largest investors in the fund to demonstrate high skin in the game (and hence don’t intend to have anchor investors)," he added.

An "operator" here refer to founders and early employees of startups, executives at large tech companies, and experts in specific domains who go on to raise their own funds, leveraging their full-time job and sector knowledge to source, invest in, and support great startups.

These could be solo or multi-operator funds or a mix of operator -investor partnership fund.

"Operator driven-funds have done incredibly well globally (e.g., a16z) through better ability to both evaluate businesses and add value to the portfolio companies post investment. They are still nascent in India (barring a couple of exceptions). As a result we have a lot of interest from both founders looking to raise capital and investors (LPs), looking to participate in early stage companies through experienced operator investors," he said.

"This would hopefully become more prevalent as more successfully exited founders set up funds over the next decade," he added.

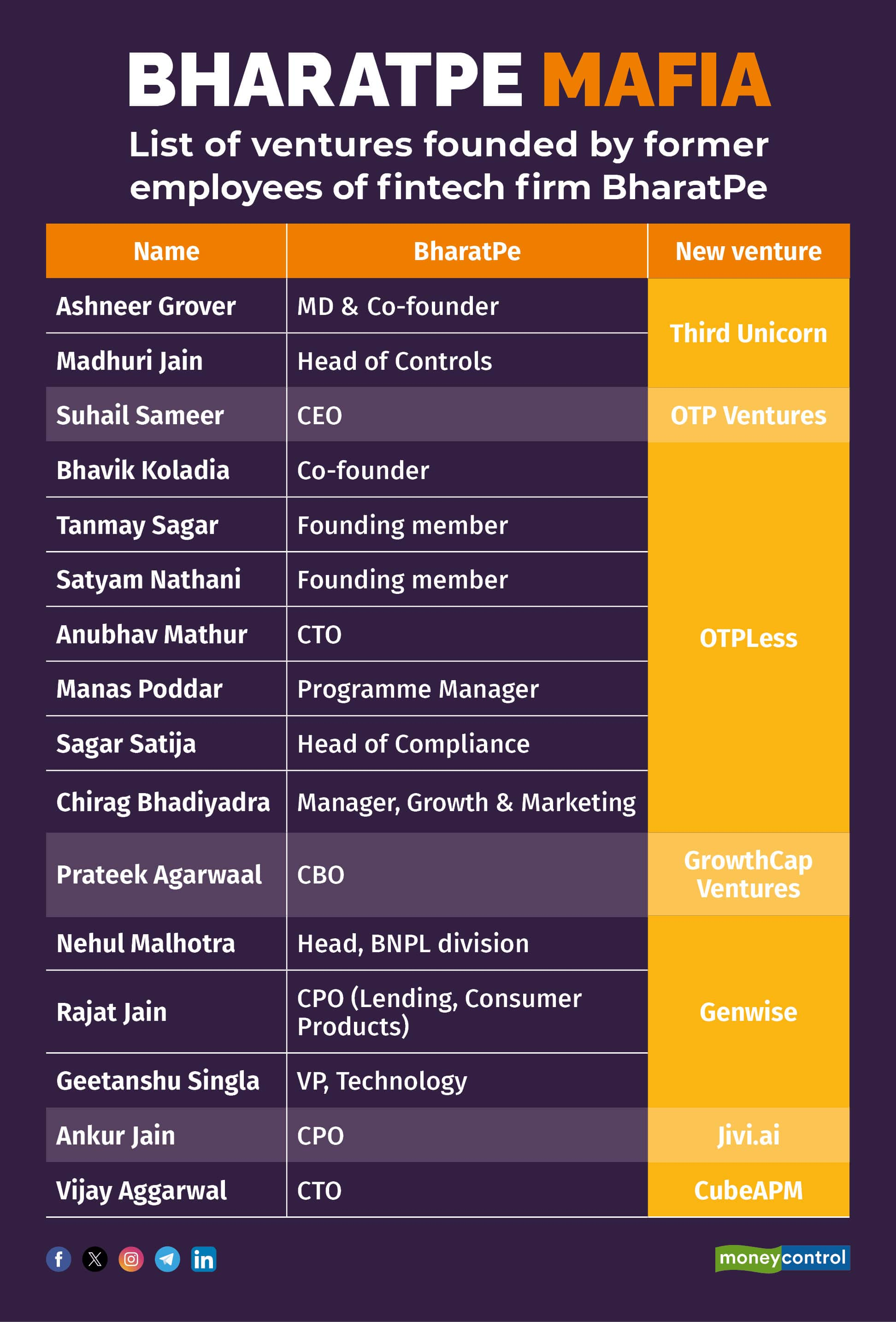

BharatPe MafiaIn a wider trend, a series of former executives of BharatPe have moved on since the start of 2022 to launch their own ventures, joining the growing list of the so-called BharatPe mafia.

Starting with its controversial co-founder and former CEO Ashneer Grover, who started Third Unicorn post his exit. The venture has launched a sports fantasy app, CrikPe, with another fintech app--ZeroPe--in the offing.

Source: Moneycontrol research

Source: Moneycontrol researchMuch before leaving BharatPe, founding members Tanmay Sagar and Satyam Nathani, along with co-founder Bhavik Koladiya, had started to work on a new SaaS venture, OTPless. Their BharatPe peers Manas Poddar, Sagar Satija and Chirag Bhadiyadra soon joined them.

Last year, Anubhav Mathur, formerly the director of engineering at BharatPe, joined OTPLess as a CTO.

Former BharatPe chief business officer Pratekk Agarwaal is running his recently-closed early-stage VC fund GrowthCap Ventures to invest in fintech, deeptech and software-as-a-service (SaaS) sectors.

Former senior executives — Nehul Malhotra, Rajat Jain, Geetanshu Singla— founded an elderly-focused application — GenWise. Former CTO Vijay Aggarwal is building CubeAPM, an application performance monitoring tool.

Former CPO Ankur Jain, who quit in October, is set to launch AI healthcare startup Jivi.ai.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.