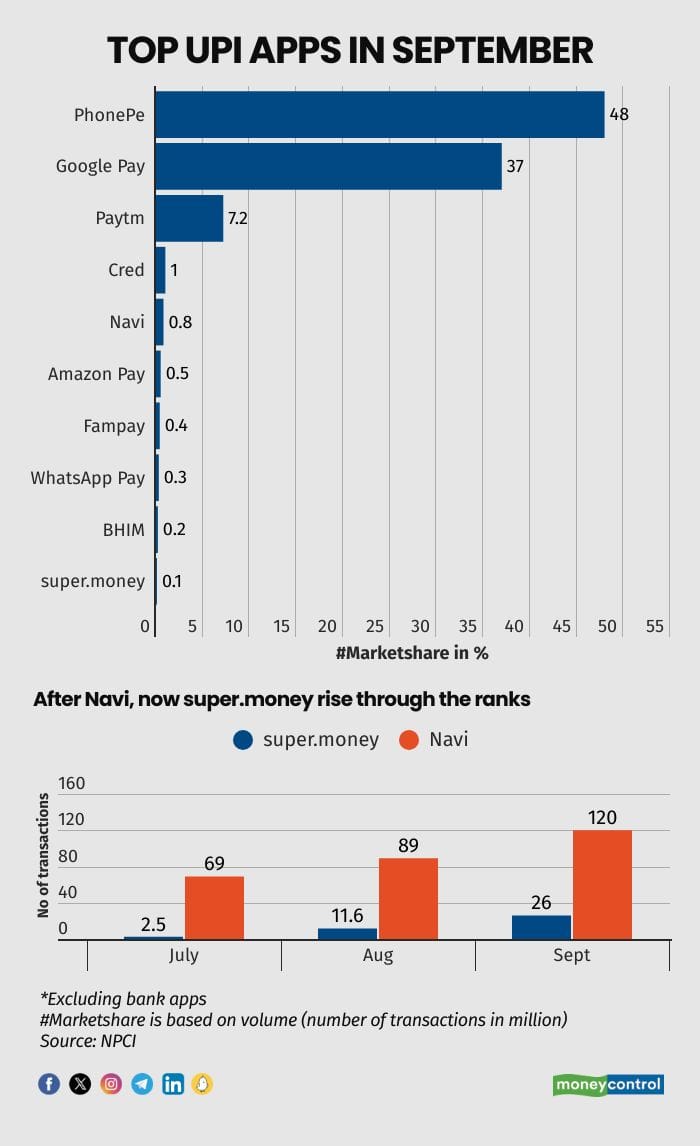

Flipkart Group’s Unified Payments Interface (UPI) app super.money has recorded a 10-fold growth in transactions in two months.

Super.money, run as a subsidiary, volume grew to 26 million in September from 2.5 million in July, the National Payments Corporation of India (NPCI) data shows.

With the rapid rise in transactions, super.money has become the tenth-largest UPI app, closely behind UPI subsidiary BHIM. The app reported 11.6 million transactions in August.

UPI apps in September

UPI apps in SeptemberThe app offers up to 5 percent cashback on food, travel and other merchant payments, helping the company make a mark.

Super.money is betting on selling credit products on UPI including a Rupay credit card, where the company has a wait list that has crossed a million, founder and CEO Prakash Sikaria said. The company is yet to start issuing cards but has asked interested customers to join a waiting list.

The app was launched in late June, it followed a staggered approach and the official launch happened in August.

Sikaria told Moneycontrol that it the company wasn't looking to build a 400-500 million customer base but would rather focus on 30-40 million consumers for deeper and more regular engagement. “Our objective is, we only want people to who we can cross-sell at least one financial product. The success metric will be measured by what percentage of people we can cross-sell to,” Sikaria said.

Walmart-backed Flipkart has its own UPI handle and did around 13 million transactions in September.

Flipkart’s erstwhile group company PhonePe, also majority-owned by Walmart, was hived off a year ago and is the biggest player with around 50 percent market share in the UPI ecosystem.

After two years of trying to corner market share from PhonePe and Google Pay, apps such as Cred, Navi and Fampay are seeing reasonable growth and scale.

Navi continues to grow at a brisk paceFlipkart founder Sachin Bansal’s fintech app Navi continued to grow at a rapid pace even at a higher base. The non-banking financial company’s app reported 120 million transactions in September, a growth of around 33 percent from the 89 million transactions it recorded in August.

In September, Navi overtook Amazon Pay to emerge as the fifth-largest UPI player and is now close to surpassing Cred, which reported 140 million transactions in September.

PhonePe and Google Pay continued to dominate the UPI payments with 48 percent and 37 percent market share respectively.

NPCI’s subsidiary BHIM, despite being spun off as a separate subsidiary and offering cashbacks, failed to grow reporting 26 million transactions during August as well as September.

UPI has reported 15 billion transactions worth Rs 20.6 lakh crore in September.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.