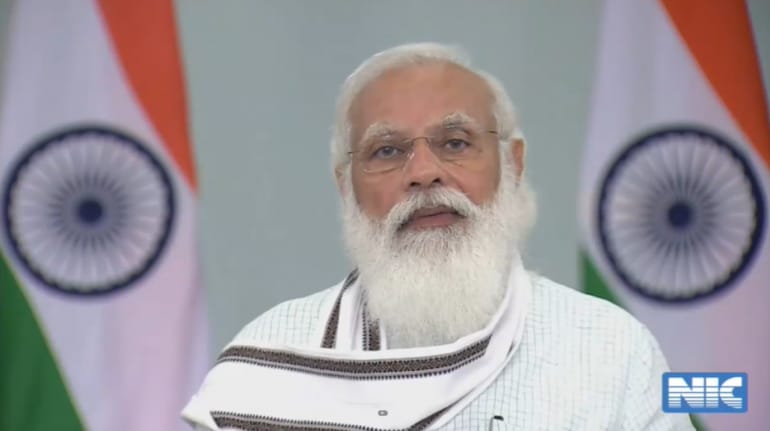

Further to the cause of enhancing and solidifying the structure of the digital payments in India, Prime Minister Narendra Modi announced the launch of e-RUPI, a cashless, contactless, voucher-like digital payment system that is aimed to further “ease of living”. Per Modi’s tweet, the system will be launched today at 4:30 pm. Notably, the platform has been collaboratively developed by the National Payments Corporation of India (NPCI), the Department of Financial Services, the Ministry of Health and Family Welfare, and the National Health Authority.

What is e-RUPI?The person and purpose-specific payment system will function in the form of an SMS string or QR based code, which will be sent straight to the beneficiary’s phone and will be redeemable at designated centers without the need for any credit/debit card, mobile banking applications, or more, thus eliminating any physical interface. Essentially, it will work like a pre-loaded, prepaid voucher that can be encashed without the intermediate need for debit cards, internet banking, and more, thereby seamlessly connecting beneficiaries and sponsors. Also, taking payment security a step ahead, the system ensures that the service provider payment is only made after completing the transaction.

“Being pre-paid in nature, it assures timely payment to the service provider without the involvement of any intermediary,” said the official PMO statement.

Why e-RUPI?Given the close involvement of various ministries in its development, the immediate use case of the new system could be well-placed in delivering timely and leak-proof transfers under schemes that cover mother and child welfare, fertilizer subsidies, drugs and diagnostics, tuberculosis eradication, nutritional support and more. Moreover, even the private sector can leverage this system for their employee benefit and corporate-social welfare programs.

How does it work?Under the umbrella entity of NPCI’s UPI platform, both private and public sector banks will be onboarded as issuing entities. Once that is done, these entities will be approached by various government agencies with specific beneficiary details, the payment purpose, and other information. Once the beneficiary has been identified using their mobile number, a voucher will be specifically generated and delivered to the said person for redemption.

Is it different from digital currency?Yes. Fundamentally, e-RUPI is formally backed by the Indian currency as an underlying asset, thus distinguishing it from virtual currencies. The apex bank is also currently working on implementing central bank digital currency or CBDC across the country in a phased manner. Recently, RBI deputy governor T Rabi Sankar stressed the needs of such CBDCs. According to him, those are “desirable not just for the benefits they create in payments systems, but also might be necessary to protect the general public in an environment of volatile private VCs”.

Add to that India’s increasing appetite for digital payments and cryptocurrencies like Bitcoin, Ethereum, and more, along with immense potential areas in a high currency to GDP ratio, currently at 14.6 percent, and safeguarding retail investors volatile cryptocurrency markets.

Digital currencies simply involve the nation’s current fiat currency, the rupee, taking on a digital avatar. However, it would require a major legal overhaul since our current system is built to deal only with physical currency.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.