We have moved up from the lows in Nifty by almost thousand points. By this time, we all must have participated in the up-move. However, it becomes a bit risky to trade further up because we need to ensure that past rally must sustain and there is a further rally.

While our momentum indicators may take care of the further rally detection part. The sustainability part is still pending. This is where one can rely on Open Interest data of Futures. Just like volume, Open Interest (OI) is also a tally of activity in a Futures or Options contract.

Volume is the number of shares or contracts that are traded over a given period of time, usually a day. But Open Interest (OI) is the number of unsettled or outstanding contracts since the start of trading of the financial instrument; volume being a daily number, Open Interest is running total of positions which are open since the life of the financial instrument, till date.

In simple words, any new Buyer and Seller when come together and create a trade, it increases an Open Interest by 1 contract. On the other hand, if an existing Buyer Sells and an existing Seller buys back then it reduces open interest by 1 contract.

It comes in handy when analysing trade data of futures contracts. How the Open Interest data helps is by suggesting the entry or exit of trading bets. Simple rule of market is that the activity participated by a lot of new traders has more likelihood of sustaining than an activity that is led by exiting participation.

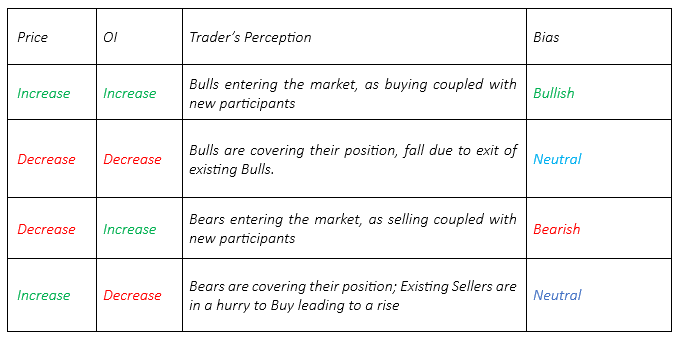

In other words, rise OI means that there is fresh trading interest entering the market, while falling OI is indicative of reducing trading interest. As far as direction goes there is not much complication Rising price is seen with a bullish perspective and Falling price is seen with a bearish perspective.

Let us put 2 + 2 together.

As we can see the increase and decrease in prices now has a solid filter of Open Interest. Futures Open Interest will help with sustainability because the rise in price with rise in OI will always have a more likelihood of sustaining and extending the rise than the rise in in price with fall in OI (due to sellers’ exit).

Where do we see this data?

We add up all Open Interest changes in all the Futures contracts of available expiries, which is a publicly available information on exchange website. Price is also known. All that is left is to make is confident decision with the help of a small but crucial filter.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.