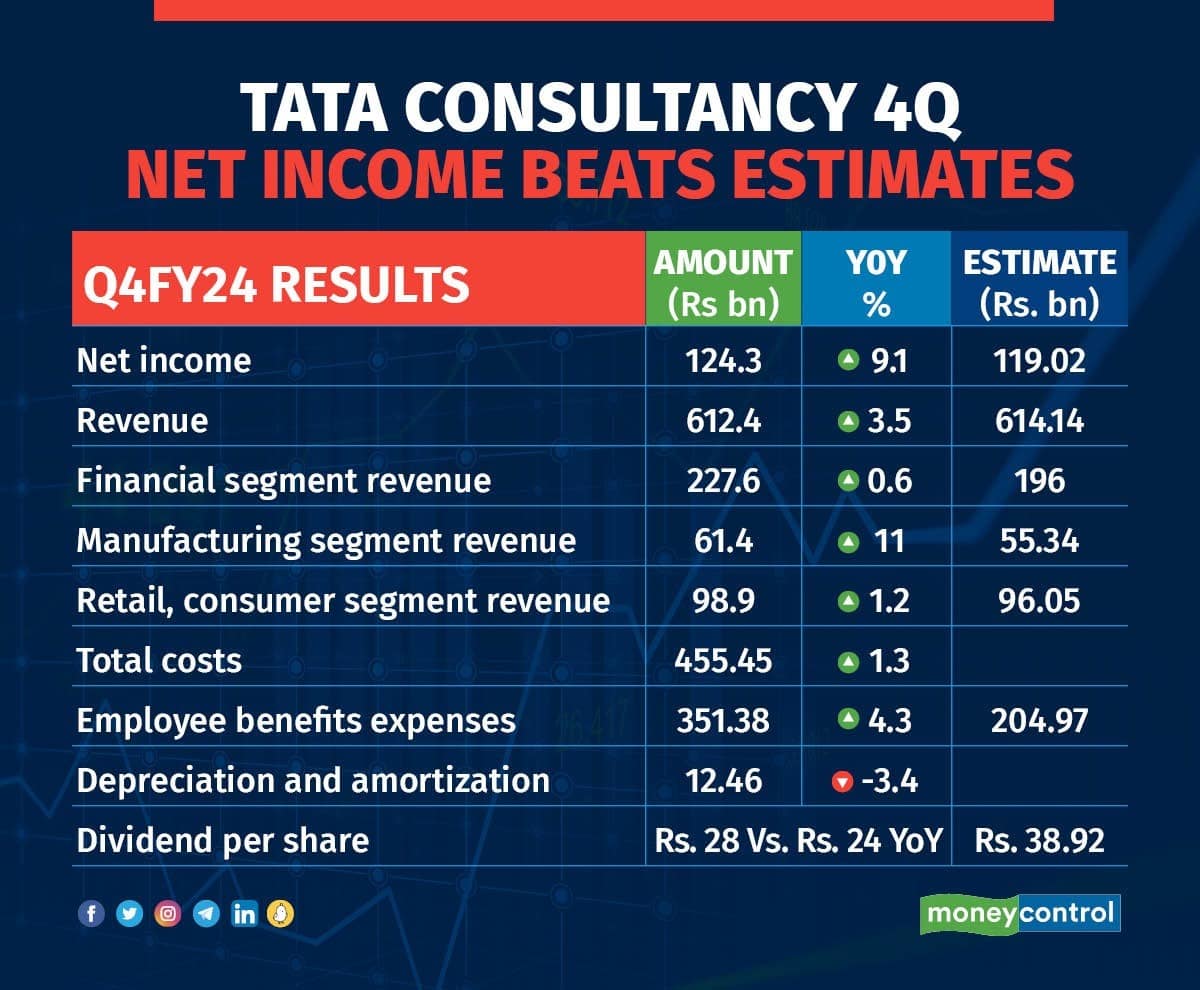

Tata Consultancy Services (TCS) reported 9 percent rise in consolidated net profit at Rs 12,434 crore (attributable to shareholders) for the fourth quarter of FY24 as against Rs 11,392 crore in the year-ago period.

Revenue rose 3.5 percent to Rs 61,237 crore in the three months ended March 31, 2024, the IT major said in an exchange filing on April 12.

Moneycontrol had projected a profit of Rs 11,902 crore on revenue of Rs 61,414 crore, based on an average of 10 brokerage estimates, which means while the company has managed to beat estimates for net profit, while it has been miss in terms of revenue estimates.

The EBIT margin or the operating margin was up at 26 percent for Q4, a 100 bps increased from 25 percent in the previous quarter; beating Moneycontrol’s estimates.

For the full year of FY24, revenue grew by by 6.8 percent YoY to Rs 240,893 crore. Net profit for the year was at Rs 46,585 crore. Operating margin for the year was 24.6%.

Revenue in North America, which accounts for half of total revenue, slipped 2.3% year-on-year. Revenue from banking, financial services and insurance clients, its biggest vertical, fell 3.2%.

Still, TCS raked in a record $13.2 billion worth of orders in the quarter, including a 15-year mega deal with UK insurer Aviva, an existing client.

TCS board also approved a final dividend of Rs 28 per share.

TCS said consolidated revenue rose 3.5% to Rs 61,237 crore in the January-March quarter

TCS said consolidated revenue rose 3.5% to Rs 61,237 crore in the January-March quarterK Krithivasan, Chief Executive Officer and Managing Director, said: “We are very pleased to close Q4 and FY24 on a strong note with the highest ever order book and a 26% operating margin, validating the robustness of our business model and execution excellence."

"In an environment of global macro uncertainty, we are staying close to our customers and helping them execute on their core priorities with TCS’ portfolio of offerings, innovation capabilities and thought leadership,” he added.

N Ganapathy Subramaniam, Chief Operating Officer and Executive Director, said: “Our Q4 performance is robust, with broad based deal wins across industries and geographies. Our products and platforms business sparkled with the mega deal win at Aviva and emerging markets had another stellar growth quarter demonstrating the power of TCS’ diversified portfolio.”

Milind Lakkad, Chief HR Officer, said: “We are pleased to announce the annual increments for our workforce, as we have done consistently every year, with top performers receiving double digit hikes. The reduced attrition at 12.5%, enthusiastic response to our campus hiring, increased customer visits and employees eturning to the office have resulted in great vibrancy in our delivery centres and elevated morale of our associates."

Meanwhile, TCS headcount declined sequentially by 1,759 employees in January-March. For the full year, headcount fell for the first time in 19 years by 13,249 employees.

TCS share price closed at Rs. 4003.80 per share on BSE, a 0.48 percent increase from the previous day's closing.

FY25 outlookSpeaking to the media at the company's earnings conference, Krithivasan said, "It will be difficult to call on when the growth would return. I don't want to hazard a guess, we've been actually now saying for second quarter FY25, we expect this to be a better year than FY24. But to say that growth would be returning in Q1 or Q2, will be calling in too soon."

He added that the reason that he said FY25 will be better than FY24 is also based on the fact that the major markets will start turning around (in) some time, though Krithivasan didn't specify which quarter. But it's coming from both aspects (US/Europe and India/Latin America), and it is not purely based on regional markets, he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.