We all believe in the power of market forces. These are created by the consensus of either buyers or sellers, leading to an imbalance in the market sentiment, which results in excessive pressure. Such a price action can result in a windfall for those on the correct side or huge losses for those caught on the wrong side.

We look at how to detect this consensus in a market that is volatile and take appropriate action to prevent losses even if windfall gains are not possible.

Gross consensus is created by extreme sentiment, which can be detected by closely analysing the market data. As participants, we often gauge our consensus expectations by looking at aggregate positions, particularly in the futures and options market. For example, if we observe consecutive days of price increase accompanied by a rise in open interest, we can conclude that the consensus is bullish.

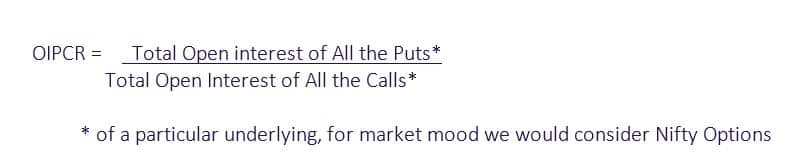

The Open Interest Put-Call Ratio (OIPCR) is a sentiment indicator that helps in determining consensus. The calculation of OIPCR is straightforward.

Before we go deeper, let's first understand the reason for buying or selling options.

1. Buy a call option when the sentiment is bullish.

2. Buy a put option when the sentiment is bearish.

3. Sell (or write) a call option when the sentiment is neutral to bearish.

4. Sell (or write) a put option when the sentiment is neutral to bullish.

Reading the behaviourGetting back to OIPCR, it is, like other indicators, based on the premise of intentions behind actions. There is a school of thought that views options as similar to insurance, with the option writers (similar to insurance providers) having more insight into the underlying asset (like a person's life expectancy).

This is because the option writer must pay a margin for the trade, which always has an unfavourable reward-to-risk profile.

A higher number of writers indicates a stronger intention. In this context, if there are more call writers than put writers, it means that most writers (who are assumed to be wise) expect the underlying to be neutral to bearish. Conversely, if there are more put writers, it suggests a different expectation.

The OIPCR can be used to determine market sentiment. If the OIPCR is greater than 1, it is considered bullish, and if it is lower than 1, it is considered bearish. However, its utility goes beyond this simple interpretation. The indicator can detect the dangerous consensus we discussed earlier, which can lead to drastic price movements.

To provide context, when the OIPCR goes significantly above 1, it indicates a shift from a bullish sentiment to an extremely bullish sentiment. Similarly, if the OIPCR is close to 0, it suggests an extremely bearish mood.

The key point is that extremes are rarely sustainable and therefore, generally mark a major turning point in the underlying asset (such as a major top or bottom).

How much is ‘too much’?Determining what constitutes "too much" is a difficult question but it can be answered by examining empirical evidence.

A general guideline is to be cautious when the OIPCR reaches a historical low or high compared to the preceding 52 weeks.

It's also important to monitor the overall trend of the OIPCR and how it changes.

If you see the OIPCR moving in the opposite direction of a rising market (with lower highs and lower lows), it may be time to reevaluate your strategy and consider implementing drawdown protection measures.

While the use of the OIPCR as a sentiment indicator is not an exact science, it has been a valuable tool over the past decade. Keeping this analytic in mind will likely pay off in the long run.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.