With its high growth potential, India presents an exciting opportunity for investors amidst a global low-growth backdrop. India’s economic fundamentals remain robust. Its near-term economic momentum is impressive, with a remarkable 6.1 percent year-on-year GDP growth in the January to March quarter of 2023. Positive economic indicators, such as the Purchasing Managers' Index, showcase a strong recovery, while Goods and Services Tax collections reflect a robust consumer rebound. Signs of recovery are evident in India's high-skilled exports, mobile phone industry, and services exports. The revival of the manufacturing sector can be attributed to government reforms like the Production Linked Incentive (PLI) scheme and the diversification of the global supply chain. Digitalisation has accelerated spending in the informal economy, while India's banking sector has witnessed healthier balance sheets due to increased credit growth. The country boasts a large and resilient domestic consumer economy. As inflation falls, consumer spending is likely to receive a further boost.

The Reserve Bank of India (RBI) is expected to pause or even cut rates, thanks to declining inflation. This move will ease credit availability, stimulate investment, and drive infrastructure spending to reinvigorate overall economic growth. India's economic and earnings growth outperform many Asian countries, making it an attractive investment market. Furthermore, macro stability indicators like inflation, the current account deficit and fiscal deficit are in a better position than the previous year. In the next decade, we will witness India expand its share of global manufacturing, create new digital technologies, give rise to a new middle class and transit into a greener economy.

Large Opportunity SetIndia’s financial markets, including the stock exchanges and debt markets, have seen significant advancements in recent years. The regulatory framework has also improved, making it easier for foreign investors to participate in the Indian market. India’s two main stock exchanges, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) are among the top 10 largest stock exchanges in the world. With over 5,000 stocks listed on the BSE and more than 2,000 on the NSE, investors have a wide selection and ample market liquidity across all market capitalisation segments. There is a free float of around 50 percent, of which foreign institutional investors (FII) are the largest participants. Foreign ownership has been relatively stable and the high share of FIIs again highlights India’s openness to foreign investment.

Furthermore, unlike China’s onshore stocks, which only in recent years have been phased into global equity indices, Indian stocks have been included in major benchmarks for some time. The MSCI India Index is the fourth largest constituent of the MSCI Emerging Markets Index. This breadth of opportunities allows investors to tailor their portfolios based on risk appetite and investment goals.

An interesting recent phenomenon in India has been the rapid increase in retail trading activity. Recent data shows that retail investors are trading much more actively. A notable trend in India is the rapid increase in retail trading activity, mirroring global developed and emerging markets. As retail investors often have shorter time horizons and may overreact to near-term news, seasoned investors with rigorous investment processes and longer time horizons can find significant opportunities.

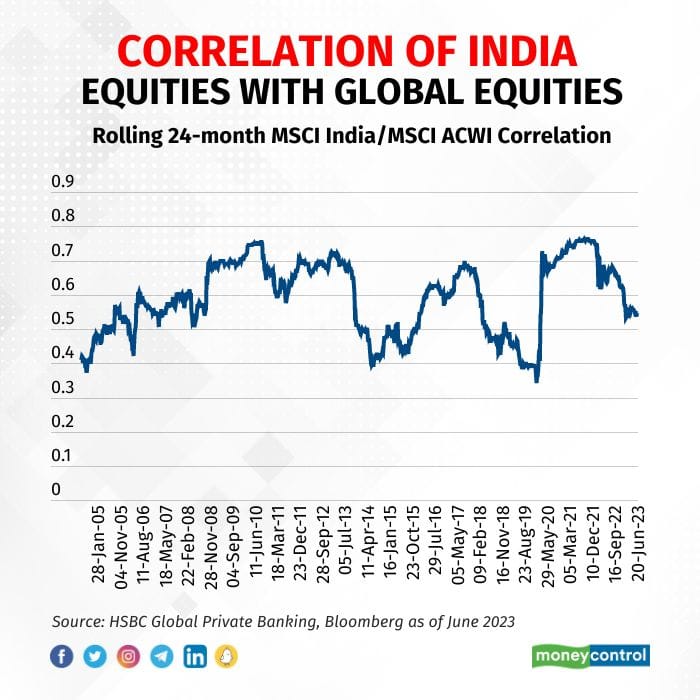

Diversification BenefitsIncluding India in a global portfolio can provide geographical diversification, reducing reliance on any single country or region. India’s economic performance is not necessarily correlated with other markets, which can help mitigate risk and enhance overall portfolio stability. Due to the unique characteristics of India’s economy, an allocation to India can increase diversification for global investors. Indian equities have a lower correlation than other EM markets because of India’s larger domestic economy.

The lower correlation presents opportunities for investors to consider diversification by adding India to their portfolio, as demonstrated by the stronger risk-adjusted returns over the past 20 years.

A key reason for the diversification benefit stems from the resilience of its domestic economy, where its domestic companies are closely linked to its strong structural growth opportunities. In an environment where this growth is set to continue, choosing India as a means for diversification becomes even more crucial to consider.

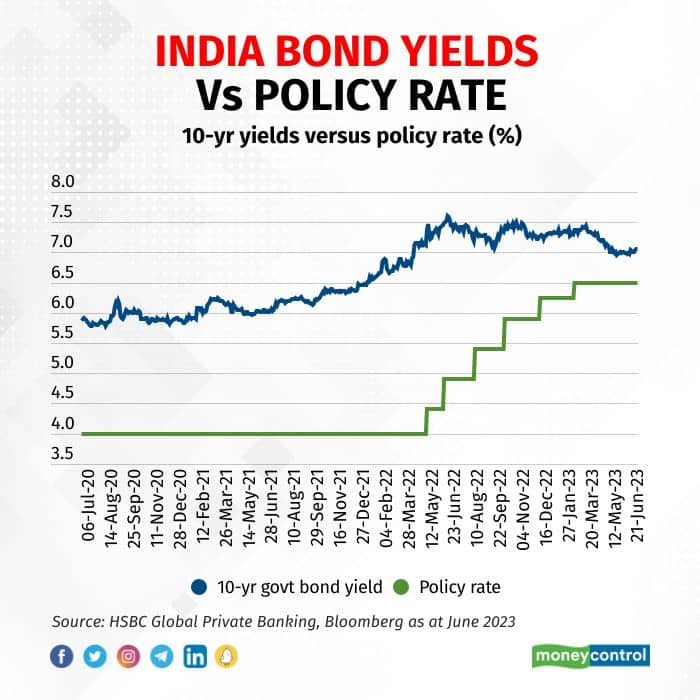

Beyond equities, it is also pertinent to consider the diversification benefits of Indian fixed-income and foreign exchange assets. The 10-year yields for Indian government bonds have stayed consistently above the RBI target policy rate, even since the central bank started hiking rates in 2022.

Furthermore, Indian bonds offer relatively attractive yields, providing opportunities for yield enhancement when included in a global bond portfolio. Currently, India’s government bonds yield an extra 3-5 percent over its counterparts in the US, UK and Germany.

The relative strength of the Indian Rupee (INR) is also worth taking into consideration, which appreciated about one percent against the US Dollar USD this year. The INR has also been less volatile than other major currencies as the USD strengthened in 2022. It is also supported by several macro factors, such as the return of foreign investments into the Indian equity market, the increase in net services exports, continued USD weakness and a narrowing trade deficit.

With India’s strong growth potential, the rise of the digital economy and smart manufacturing, investors should consider a satellite allocation to India, in addition to a broad emerging markets allocation. Such a strategy would allow investors to capitalise on India’s long-term growth potential for diversification and alpha opportunities in global portfolio context.

James Cheo is Chief Investment Officer, Southeast Asia, HSBC Global Private Banking and Wealth. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.