Microsoft Corp. reported 35% growth in cloud services. Alphabet Inc.’s own cloud unit beat estimates and narrowed its losses. Yet both stocks slumped.

Two tech titans post solid numbers in strategically important businesses in the middle of a stock market rout, rising US dollar and looming recession. Yet investors reacted like Grampa Simpson: angry at everything, and very cranky. Their frustration is understandable, but not particularly useful.

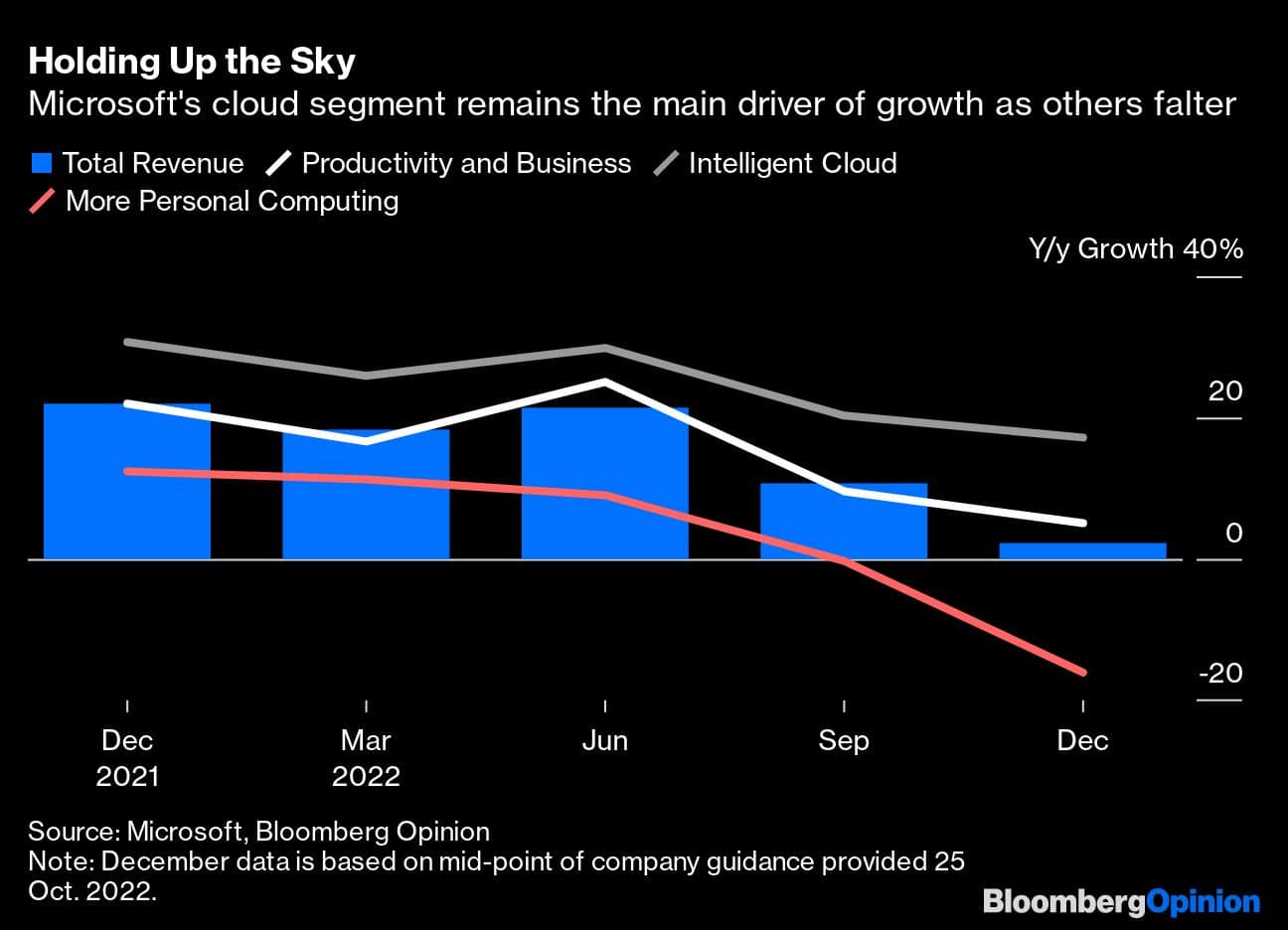

We knew that Microsoft’s consumer-facing divisions were in trouble. That its More Personal Computing unit posted revenue almost the same as a year prior, when analysts predicted a 2% drop, was a marvelous feat. The smallest of the company’s three business segments would have eked out 3% growth if not for the stronger greenback. Yet sales of its flagship Windows products dropped 6% for the simple reason that consumers and corporations are feeling the pinch and dialing back PC purchases which directly impacts software demand. Revenue for Xbox content and services fell, showing that consumers are in no mood for games.

Its productivity and business segment, the second largest, climbed 9% which was better than analysts had expected. Sales of Office products chugged along while LinkedIn social networking business continued to add momentum. But 20% growth in the largest segment, called Intelligent Cloud, wasn’t enough to keep shareholders happy.

Azure and its associated cloud products did phenomenally, but that was insufficient. Without the currency impact growth was 42%, just shy of the 42.6% consensus of estimates, analysts at Barclays Plc wrote. A quick roundup of sell-side analyst reactions shows a similar theme: the Azure business only missed a little, but the disappointment is huge.

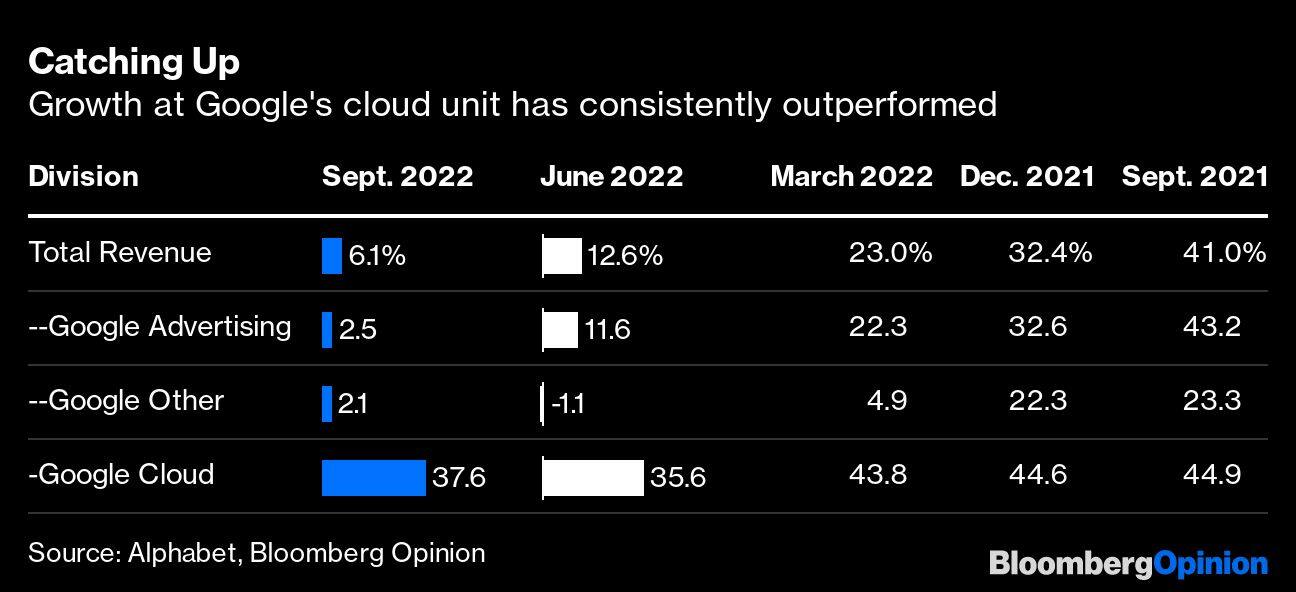

If you turn then to Alphabet, the company formerly known as Google, its cloud business remains a loser. Yet it’s also the one showing the most potential. While the entire firm posted 6% growth and all its other areas returned single-digit figures — both positive and negative — cloud climbed 38% for the quarter. And the operating loss margin for that division narrowed to 10% of revenue from 16% a year earlier.

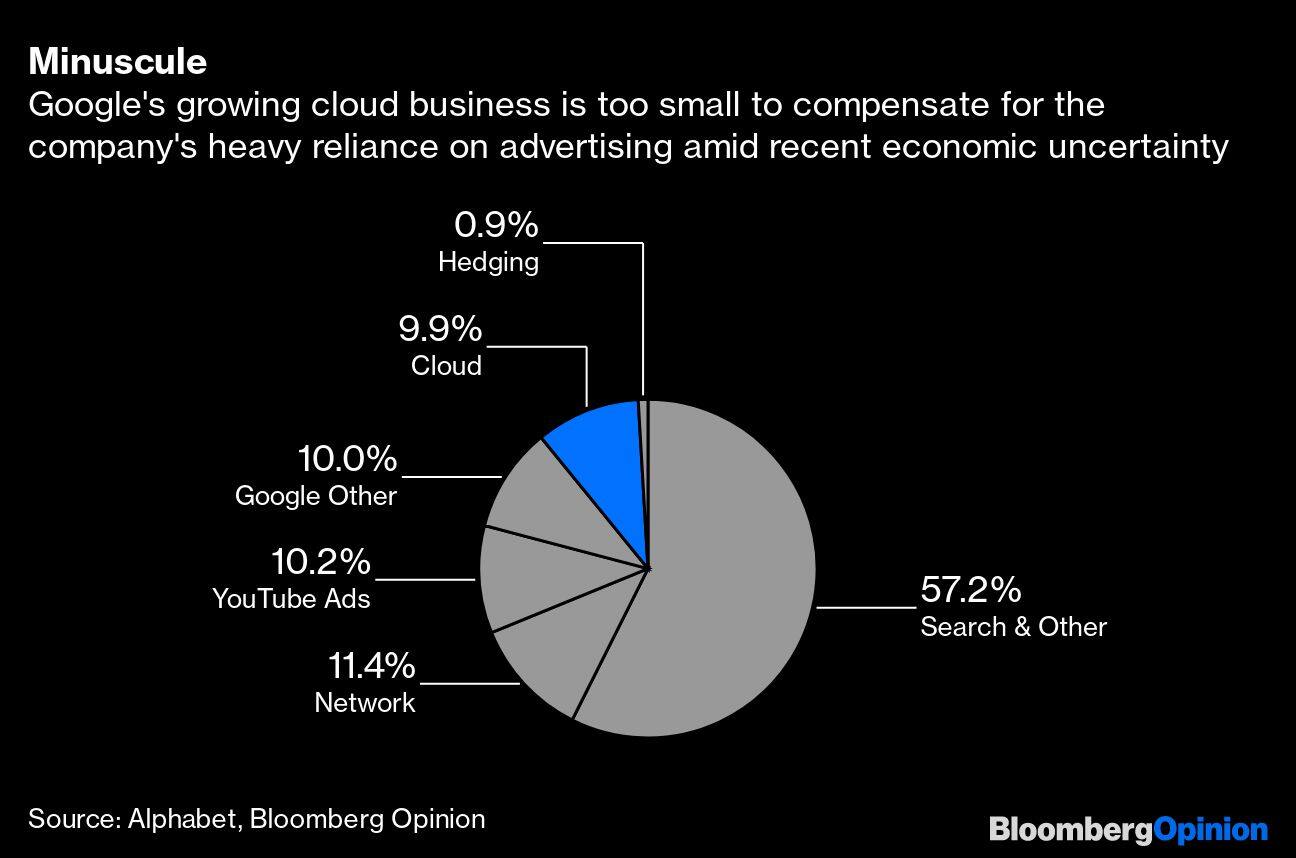

The problem for Alphabet, and its investors, is that the cloud division is just too small at just 10% of total revenue. Meanwhile, the rest of the company relies on the rather fickle business of selling ads, which is becoming an increasingly challenging task in the current macroeconomic environment.

Shareholders are overreacting to these two companies’ earnings reports for a deceptively simple reason: they need more.

Faced with one of the greatest economic downturns in recent history, it has become accepted wisdom that businesses that rely on consumer sentiment such as advertising are going to suffer. Yet cloud services, a relatively new product that hasn’t faced a global recession, ought to be more robust. Once individuals and companies migrate more of their information, computing power, and entertainment content to someone else’s server, they’re somewhat wedded to that provider and are likely to keep paying ongoing fees. It’s the digital version of the razor-and-blade model.

This bulwark against recession has made Microsoft shares more resilient than ad-dependent businesses like Alphabet and Meta Platforms Inc. But the sudden notion that cloud isn’t living up to its side of the bargain — protecting them from high inflation and low growth — has investors running for the exits.

The kneejerk reaction to Microsoft’s December-quarter outlook highlights how sensitive markets are just now. Soon after Chief Financial Officer Amy Hood told a conference call that revenue for the Azure cloud business would drop 5% from the prior quarter — implying 37% year-on-year growth — shares tumbled. The company’s personal-computing segment is set to fall 16%, its productivity business will climb around 5% and the broader intelligent cloud unit (which includes both Azure and other server software) will rise 17%. But investors feel that a 37% increase in Azure is a disappointment.

That classic meme of Homer Simpson’s dad yelling at a cloud, symbolizing the senility of getting angry at something which can’t be changed, is more relevant than ever. Investors may be unhappy with what the cloud is doing — floating high up there while all else remains grounded — but there’s really no better option, so they’d better learn to accept it.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.