Last week, the Reserve Bank of India (RBI) issued a press release and an advisory to banks and regulated entities. The two notifications informed that banks/FIs were expected to have developed the systems and processes to manage the complete transition away from Libor from July 1, 2023. In fact, not just RBI but other central banks and regulators will also be sending similar message to their regulated entities. This marks the end of the London Interbank Offer Rate (Libor), the most widely used benchmark interest rate in global financial markets.

Libor is an interest rate which is averaged from a poll of top banks in London. Before the opening of financial markets in London, these select banks are asked what will be the interest rate they will pay for borrowing from other banks. The banks give their own rates, which are then averaged and made Libor for that particular day. Given London’s prestige and prominence as an international financial centre, Libor soon became the benchmark for global interest rates. Libor was calculated across tenors (one day, one month, one year, etc) and across currencies (US dollar, euro, British pound, etc.). Libor became a trillion-dollar highly trusted market, with most foreign currency and interest rate derivatives dependent on it.

The Libor ScamDuring the 2008 global financial crisis, it was reported that banks were colluding and reporting a Libor lower than actual interest rates. Investigations revealed that these allegations were indeed true. The banks were rigging and reporting a lower Libor to reduce their borrowing costs and thereby showing themselves as more creditworthy than was the case. Lower Libor also meant that borrowers underestimated the risks leading to higher debt.

The scam led to banks being fined billions of dollars and pounds. And, it broke the most important aspect of financial markets: trust. The 2008 crisis exposed many banks and bankers for mismanagement and fraud. How does one deal with elite banks colluding to rig one of the foundations of financial markets?

The Libor crisis led to changes in the way benchmark interest rates are computed. The first major change involved shifting the administration of Libor from the British Bankers’ Association to the Financial Conduct Authority. The FCA was a new regulatory body created in 2013 with the objective of ensuring that financial markets provide honest, fair and effective solutions to consumers. It provided a roadmap for Libor transition in 2021 in two stages. In the first stage was the ending of contracts in pound sterling, euro, Swiss franc and Japanese yen settings, and the one-week and two-month US dollar, immediately after December 31, 2021. In the second stage, all remaining US dollar positions were to be ended after June 30, 2023.

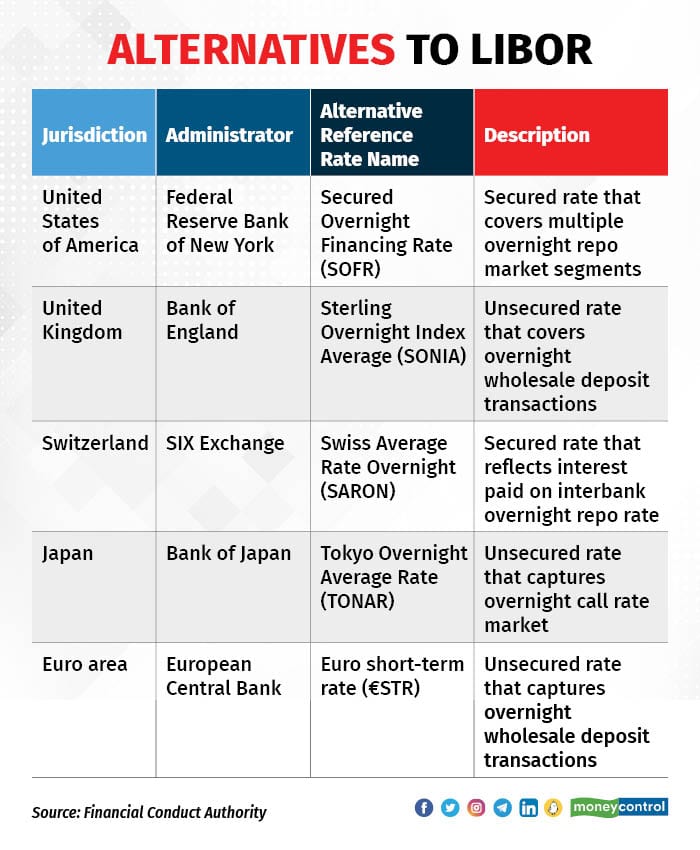

New Benchmark RatesThe second major change involved designing new alternative reference/benchmark rates (ARR). The responsibility of fixing new rates shifted to the central banks. So for instance, the Federal Reserve Bank of New York computed the Secured Overnight Financing Rate (SOFR), the Bank of England Sterling Overnight Index Average (SONIA) and so on. One lesson from the Libor crisis was to shift from the polling-based method to interest rates based on actual trading. Hence, these new ARRs are computed from the actual trading of interest rates.

In 2013, the RBI had established a committee under chairperson P Vijaya Bhaskar. The Committee reviewed benchmarks in India. There were four agencies that computed benchmarks in India — the Fixed Income Money Market and Derivatives Association of India (FIMMDA), the Foreign Exchange Dealers' Association of India (FEDAI), the National Stock Exchange (NSE) and Thomson Reuters. The FIMMDA produced interest rate benchmarks in collaboration with the NSE, Thomson Reuters and the Primary Dealers Association of India. The FEDAI was behind benchmarks dealing with foreign exchange markets.

Given this myriad structure, the committee suggested that FIMMDA and FEDAI form a new organisation to produce all these benchmarks under one roof. Accordingly, Financial Benchmarks of India Limited (FBIL) was instituted in 2014 ‘to develop and administer benchmarks relating to money market, government securities and foreign exchange in India’.

FBIL has been streamlining processes and changing methodologies and even the names of benchmarks. For instance, the NSE-Mibor, which was stylised on Libor for acting as a benchmark for India’s interbank market, was changed to FBIL-Mibor. The FBIL-Mibor began to be computed from interest rates based on markets, in line with the global lesson learnt from the Libor crisis.

For international transactions, the transition has moved from Libor to NY Fed’s SOFR. Libor was a major factor in the supremacy of London as an International Financial Centre. The Libor crisis followed by Brexit led to a serious dent in London’s reputation. In the competition between New York and London, Libor was one major factor on which London gained over its competitor. With the shifting of contracts from London-based Libor to New York-based SOFR, New York has gained significantly from the crisis. If other countries also follow SOFR, it will further strengthen the hegemony of the US dollar.

To sum up, the RBI and other market organisations have managed the transition from the Libor-based system in a fairly seamless manner. Internationally too, things have been managed well. RBI Deputy Governor T Rabi Shankar in a 2022 speech discussed the transition, growth and challenges going forward in this exercise of designing benchmarks. He rightly said that “a benchmark is as good as the underlying market”. The underlying markets driven by top global banks not just broke the processes but also broke the trust which is vital to the functioning of financial markets. One hopes that the financial market community has learnt lessons from the crisis. But then with financial markets and their players, one can never say “This time will be different”.

Amol Agrawal is faculty at Ahmedabad University. Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.