The pandemic brought out the best in the European Union. The €807 billion ($850 billion) NextGeneration program was lauded as a Hamiltonian moment, delivering a swift and effective response to a sudden economic crisis. Unfortunately, it isn’t aging well. Funded by bond sales that currently total €450 billion and are set to double by 2026, the bloc faces hard decisions on either permanently making the program the main EU financing vehicle — or accepting that centralised borrowing was just a one-time emergency measure.

A near €1 trillion bond market sector with liabilities out to 35 years can’t be left to wither on the vine. The EU hasn’t created a structure fit to last, doing a disservice to the entire euro project. The asset class is intended to shrink just as it reaches critical mass, with net repayments from 2028. To increase the existing structure would require approval from the EU constitutional court and most likely ratification from the German Bundestag. Neither of these look remotely viable, with any plans for extending the program likely to be dismissed as federalist mission creep.

At the outset of the bond sales, the European Commission promised a comprehensive primary dealer network, a repurchase market to increase liquidity and even a futures contract. Sadly, these are either works in progress for delivery sometime next year or not really functioning properly.

Euro governments raise finance through either scheduled auctions open only to official primary dealers, who build inventory then distribute to fund managers, or via the increasingly popular syndicated method, where investment banks act as arrangers and build an advance book of client orders. The EU has 37 nominated primary dealers, but their underwriting obligations are minuscule at 0.05 percent each per auction. That’s less than 2 percent combined, perhaps explaining why auctions have only really gained traction for short-dated bill issuance.

In practice, the rationale for any bank signing up as a primary dealer is to get higher on the pecking order for the syndicated bond sales that dominate EU fundraising, and have successfully delivered order books often more than 10 times what’s available for sale. While that has allowed the EU to scale up quickly, incentivising active market makers who in turn increase liquidity has been ignored.

Size doesn’t equal liquidity for EU debt, as its secondary market turnover is significantly below the daily volume in the big four EU states of Germany, France, Italy and Spain. EU debt is largely handled in investment banks by supranational credit traders, rather than the government bond desks. It isn’t used as a hedging tool in the manner than German bunds are — or especially bund futures. Although futures contracts are available for the bonds of other euro members, they barely trade — suggesting the likely fate for any EU bond futures contract.

It’s hard to see any of the major exchanges jumping at the opportunity. It’s expensive and time-consuming to breathe liquidity into any new contract, let alone one which will be on a downward issuance trajectory in the near future. It’s possible that Eurex, the main European exchange, is pressed into action, but its owner Deutsche Boerse AG probably doesn’t want to encourage competition with its highly successful bund contract, which trades many times more in nominal daily value than the underlying German cash bond market.

EU bonds are mostly held by "long-only" static investors, which has inhibited secondary market activity. Issue sizes of several billion euros aren’t sufficient to deliver liquidity compared with much bigger deals from individual countries. There is an underlying repo market, where stock can be borrowed or lent for a specific period, but it’s sleepy and similar to corporate debt rather than more liquid government issuers.

There’s no interest in actually shorting EU bonds for complicated arbitrage trades, which would help to build volumes organically. A missed trick was not encouraging new euro-denominated corporate debt sales to reference EU debt rather than German securities. But with a bid-to-ask price spread several times wider than bunds, both in regular trading and in repo, the momentum isn’t there. This filters down into collateral usage — the London Clearing House charges double the haircut for EU securities that it does on German equivalents.

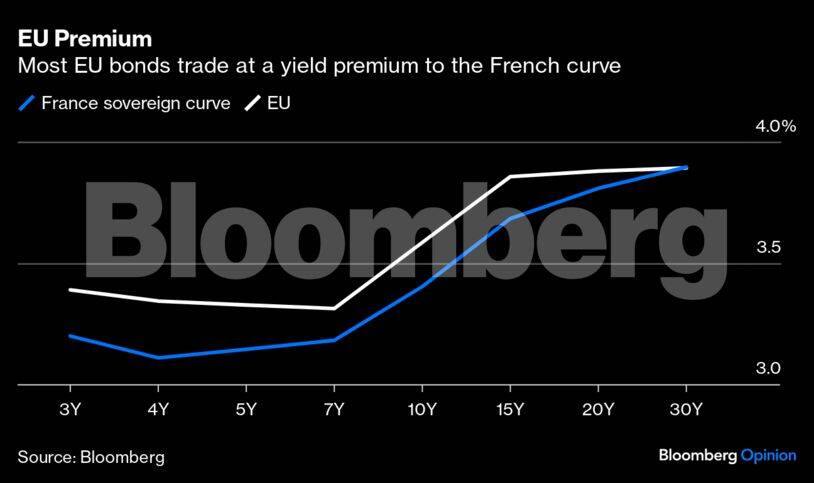

The EU is a AAA rated credit, but has settled into a yield premium of around 20 basis points in short to medium maturities over AA rated France. That stretches to 80 basis points over the 10-year German benchmark. EU debt isn’t treated as sovereign by bond investors, but as a supranational. It doesn’t have "joint and several liability" from all EU states — which in plain English means wealthy Germany is only on the hook for its own share of the EU's debt pile but not everyone else's. Presently, EU bonds aren't eligible for sovereign debt indexes, so investors aren’t compelled to own them even at those elevated yields.

Sharply rising interest rates have certainly taken the shine off the program. By next year, the EU’s annual financing costs will exceed €4 billion — nearly double that initially envisaged. But not ensuring the longer-term viability of the asset class is a missed opportunity — another example of the euro project’s failure to build an integrated capital market, and one that it’s probably too late to rectify.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. Views are personal and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.