Motilal Oswal Securities

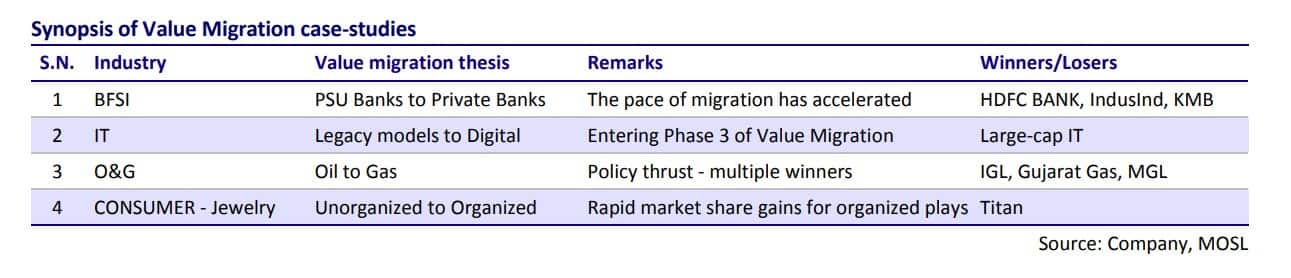

Equity investors are always in search of sectors that are seeing smart money inflows or seeking value by migrating from one sector to another, according to a report by Motilal Oswal.

Adrian Slywotzky, author of 'Value Migration' defines the term as a flow of economic and shareholder value away from obsolete business models to new, more effective designs that are better able to satisfy customers’ most important priorities.

The framework tries to identify industries where value migration is underway and can help pick potential winners early in the cycle.

“India is indeed witnessing a phase of heightened disruption over the last three years, with transformational and game-changing reforms like the Goods & Services Tax, Real Estate Regulatory Authority, Insolvency & Bankruptcy Code, and demonetisation driving underlying changes in the way businesses operate and create value for stakeholders,” the report stated.

Value migration happens in three stages:

Value inflow: In this phase, a company or an industry captures value from other industries or companies due to their superior value proposition. The market share and profit margins of the company or industry expand.

Stability: In this phase, competitive equilibrium is established. Growth rates moderate.

Value outflow: Value starts to move towards companies or industries meeting evolving customer needs. In this phase, market share declines, margins contract and growth stops.

BFSI: Pace of value migration accelerating

The report said value migration from the state-run to private sector banks is one of the most prominent themes underway today. "While the thesis has been playing out right and has many more legs to go, it is the pace of migration that has surprised us positively."

The domestic brokerage firm said the corporate banking sector in India has been under tremendous pressure over the past few years. It sees private sector banks emerging even stronger, while state-run banks will continue to face challenges on capitalisation and growth.

“Private sector banks have done a phenomenal job in building their liability franchise (strong traction in CASA mix) using both digital capabilities and rapidly expanding branch network. The market share loss of state-run banks has accelerated and we expect this trend to continue.”

Motilal Oswal feels there is still a long way to go for value migration from public sector to private sector banks and digitisation will drive the trend further.

Information technology: Staring at Phase III of value migration?

For the best part of last decade, the Indian IT services industry offered low-cost talent at rates 40-60 percent cheaper to their global clients. It was the answer that large developed market clients’ needed to optimise their IT spending.

Championed by local and MNC peers alike, the model stabilised, and then, growth rates began to wane. Fast forward to today. Client spending patterns has moved to: 1) Optimising IT spends on existing programmes further by use of cloud, automation, artificial intelligence, robotic process automation and software as a service (SaaS) technologies; and 2) Investing these savings towards digital transformation.

As a result of the above, the pie of bread-and-butter services for the industry has been directly hit and new services that provide growth opportunities are not moving the needle much, thanks to a low base.

Besides, the new models are significantly deviant from status quo, requiring companies to embrace bold moves such as cannibalising existing streams of cash generation, resetting to a lower profitability (at least in the interim) and actively chasing acquisitions.

In this context, we witness the three phases of value migration, starting from value inflow benefiting the regime of low-cost sourcing route to IT spending optimisation to value outflow towards models built on the combination of automation, cloud and digital technologies.

Value migration from oil to gas

In the last few years, rising pollution has been at the forefront of the policy-making and judicial activism in India. The focus on increasing penetration of gas becomes all the more important considering that in the latest study of the World Health Organisation (WHO), half of the 20 most polluted cities globally are Indian.

Policy initiatives in exploration and production (E&P) like Hydrocarbon Exploration Licensing Policy (HELP), Open Acreage Licensing Policy (OALP), premium pricing for gas production from difficult fields, and National Data Repository among others are expected to boost domestic gas production by ~10% YoY for the next 3-4 years.

With enabling policies, increase in gas supply and improvement in pipeline infrastructure, broadly, the whole gas sector is expected to benefit – producers, importers, transmission companies and city gas distribution companies (CGDs).

Jewellery: massive value migration unfolding

Opportunity for branded jewellers in an era of demonetisation/formalisation of the economy and Titan being the key beneficiary was one of the high-conviction themes we had focused upon as a part of long-term value migration opportunities.

Since then, additional growth drivers have emerged – GST implementation, which has further tilted the balance in favour of organised trade, rigorous provisions under PMLA, and credit squeeze for unorganised trade as a fallout of the Nirav Modi scam.

This is over and above the initiatives undertaken by company – aggressive expansion plans, focus on wedding jewellry portfolio.

This is over and above the initiatives undertaken by company – aggressive expansion plans, focus on wedding jewellery portfolio.

Titan has already been witnessing healthy market share expansion away from the unorganised trade and has delivered strong performance over the last 18 months on revenue as well as profitability front.

From a longer-term perspective, the management has guided for strong 20 percent five-year revenue CAGR in its jewellery division.

“The value migration opportunity in the jewellery industry remains immense, given the size of the industry and Titan, as the only pan-national branded jewellery player, is at the forefront to capture this long-term opportunity,” said the report.

Disclaimer: The views and investment tips expressed by Motilal Oswal report on Moneycontrol are its own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.