Quant Mutual Fund and Sageone Investment Managers LLP have picked shares worth Rs 37.09 crore in auto ancillary company Divgi Torqtransfer Systems on its debut on March 14.

The stock recouped losses in late morning deals and closed the first trading day at Rs 605.20 on the NSE, up 2.6 percent over the issue price of Rs 590 per share.

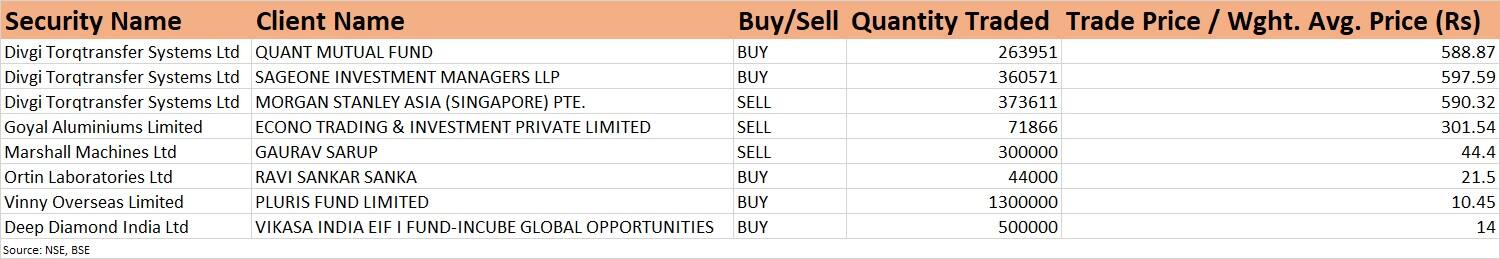

Quant Mutual Fund has acquired 2.63 lakh shares in Divgi Torqtransfer Systems and Sageone Investment Managers LLP bought 3.6 lakh shares in the company via open market transactions, as per bulk deals data available with the exchange.

The average cost of acquisition of shares for Quant Mutual Fund was Rs 588.87 per share, and it was Rs 597.59 per share for Sageone Investment Managers.

However, Morgan Stanley Asia (Singapore) Pte exited Divgi by selling the entire 3.73 lakh shares at an average price of Rs 590.32 per share, amounting to Rs 22.05 crore.

Click Here To Read All IPO Related News

The Rs 412-crore public issue of Divgi Torqtransfer Systems was launched earlier this month during March 1-3 and was subscribed 5.44 times. The price band for the offer was Rs 560-590 per share.

Most experts advised holding the auto ancillary company stock given the strong business growth outlook, consistent financial performance, healthy long-term relationship with clients, and a reasonable valuation.

For FY22, the firm reported revenue of Rs 233.78 crore against Rs 186.58 crore a year ago. Net profit for the year stood at Rs 46.15 crore versus Rs 38.04 crore last year.

Divgi is one of the few suppliers in India having the capability to develop and provide system-level transfer cases, torque couplers, DCT solutions and transmission systems for electric vehicles (EVs) across a wide array of automotive vehicles and geographies, with leadership across select product categories.

The company operates three manufacturing and assembly plants in Karnataka and Maharashtra. A new facility is coming up at Shirwal in Maharashtra and is expected to be fully operational by fiscal 2024.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.