Madhuchanda Dey

Moneycontrol Research

The RBI’s refusal to extend Yes Bank promoter-CEO Rana Kapoor’s tenure beyond January 2019 despite the bank’s stellar financial performance, appears to confirm gloomy chatter about the numbers. Investors need to be cautious about the stock.

A stellar journey

Yes Bank was synonymous with Rana Kapoor. He founded Yes Bank in 2003 and in the last fifteen years created a bank of formidable size and influence. Since its listing in 2005 till date, the stock has risen by 4,378 percentage in absolute terms, generating a compounded annual return of 34 percent. This wealth creation has been accompanied by a similar performance in business.

Over the last decade (2006 to 2018) the profitability of the bank had grown 42 percent compounded annually. Business growth has been equally supportive with total assets, advances and deposits growing at a compounded rate of 43 percent, 77 percent and 42 percent, respectively.

Past – picture perfect

In recent times, Yes Bank outperformed most of its peers and the market has rewarded the stock for this. The 28 percent and 34 percent growth in deposits and loans, respectively, in the past four years has silenced critics. Consequently, its share in deposits and advances of the system has improved to 1.7 percent and 2.4 percent, respectively from 0.9 percent in FY14. The bank had succeeded in taking up the share of low-cost CASA to 37 percent by end of FY18 from 22 percent four years back and in the process managed to improve its net interest margin as well.

However, being a corporate-focused bank, what surprised the markets about Yes Bank is its pristine asset quality (gross NPA of 1.28 percent in FY18) amid the troubled landscape of Indian corporate sector. Nobody knew the secret sauce for this success and many industry watchers felt it too good to be true.

What spooked the RBI?

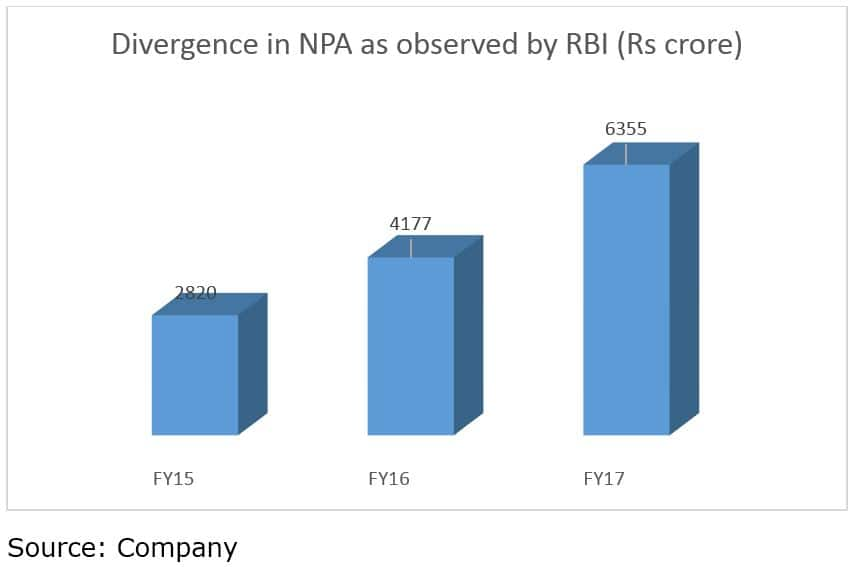

RBI must have sensed this concern too especially since the quantum of asset quality divergence (from what RBI felt what ought to be recognised as non-performing assets) was on the rise.

The divergence post the last round of audit was especially alarming as it was one of the highest as a percentage of advances in the system.

Yes Bank today is a decently large sized bank with a balance sheet in excess of Rs 3.3 lakh crore and hence, assumes importance in the system. If Axis Bank’s ex-CEO lost her job because of an unexpected divergence in asset quality, it was only logical that RBI would act tough with Yes Bank as well.

What’s worrying Yes Bank’s shareholders in the near term?

Axis Bank shareholders had reasons to cheer as in the quarters following the asset quality divergence, Axis Bank steadily recognised the problems in its balance sheet. And on the back of a fast clean up, it raised capital and is now set to accelerate under the new CEO.

As for Yes Bank, the pristine asset quality will remain a question mark until RBI conducts its next audit on FY18 numbers. Last year, the findings were known with the Q2 result.

Rana Kapoor was a hands-on CEO and so the bank could go through some tumult before an able successor steps in.

However, of greater concern is the bank’s ability to raise capital to maintain the blistering pace of growth until all the concerns are allayed. The bank had last raised equity in March 2017. Given the emerging opportunities due to the comatose state of many state-owned banks, Yes Bank would have liked to take advantage of the environment by bolstering its equity base.

Investors will have many more questions till the dust settles. In the interim, the stock is expected to remain volatile with a downward bias. Investors should exercise caution and shouldn’t bottom fish in a haste till clarity emerges on the quality of its books.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.