VIP Industries reported a steady Q2 FY19, a quarter that saw multiple headwinds like the depreciation of the rupee, rise in input prices and a hike in import duty.

The end-market demand looks robust, the shift from unorganised to organised luggage is a trend that is catching up well, and all the brands of the company are doing well in the market.

The stock has seen a significant price erosion in recent times (down 19 percent in the past two months), thereby rendering the valuation more reasonable at around 27 times its provisional earnings for FY20.

While near-term margin compression cannot be ruled out, we are enthused by the secular trends of growth in travel and tourism, strong end-market demand momentum and a steady but gradual shift towards organised players.

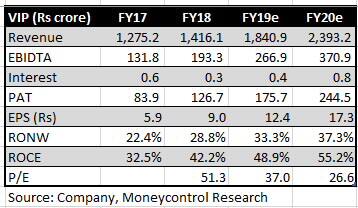

We expect earnings to grow at 39 percent CAGR over the next couple of years and the stock performance should mimic the same, even in the absence of multiple re-ratings.

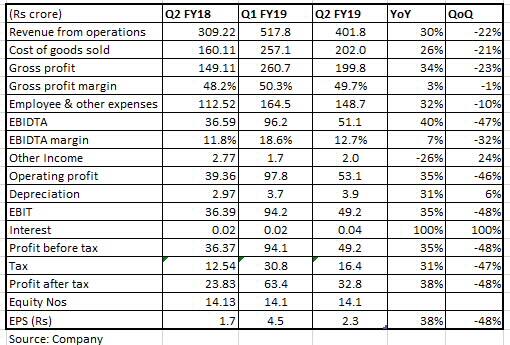

In the quarter under review, VIP reported a 30 percent on-year rise in revenue, making it the second consecutive quarter of robust revenue growth.

The company's management mentioned that volume growth was higher than value growth, as the company sold a larger share of smaller products.

Gross margin compression was only 60 basis points as the company still enjoyed benefits of old inventory.

In fact, VIP's EBIDTA (earnings before interest depreciation and tax) margin improved by 90 basis points year on year to 12.7 percent, aided partially by improved sales momentum.

Although the rupee has stabilised, the management mentioned that the during the quarter under review, it enjoyed the benefits of old inventory and in the absence of the same, its margin in Q3 could feel the full impact of the rupee's depreciation.

A modest price hike can partially negate this impact. However, since the growth is coming more from the lower end of the market, which is extremely price-sensitive and is experiencing heightened competition, it may not be able to pass on the input price pressure.

Consequently, the company's management is expecting the second half of the current fiscal year to be a tad softer.

All of the company's brands are doing well. The entry-segment Aristocrat appears to be benefitting from the shift to the organised sector, while Sky Bag is riding on the demand for back packs.

Also, the newly-refurbished range of products that VIP sells is being accepted well by the market, and the unlimited warranty offered on its brand Carlton Edge has worked for it.

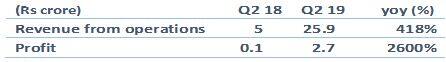

VIP's ladies handbag brand Caprese is doing well and the company is introducing a product in the budget category under this brand.

In terms of distribution channels, modern and general trade, institutions, and e-commerce did well.

Long –term trajectoryThe company is exploring opportunities to shift a part of the sourcing away from China, and the Bangladesh operation is a case in point.

Incidentally, there is no duty on imports from Bangladesh. However, the company doesn’t see significant opportunity for further capacity expansion in Bangladesh.

The trend that could be supportive for margin in the long term is the shift in buyers preference for hard luggage, especially polycarbonate. The sourcing of the hard luggage is from India and VIP is also expanding its capacity here.

Outlook – secular for the long-termVIP is the market leader in a market where unorganised players still dominate with an 80 percent share in volume terms, and over 66 percent in value terms.

The growth of travel infrastructure such as roads, airports and railway stations have contributed significantly to the development of the travel industry in India.

Over the years, both domestic and international air travel has seen consistent double-digit growth, which is likely to accelerate.

Aided by macro drivers like GDP growth, rising personal income levels, changing lifestyles, huge middle class as well as the availability of low-cost air fares and diverse travel packages, India is rapidly becoming one of the fastest growing outbound travel markets in the world.

These trends have a significant positive impact on the long-term fortunes of the luggage industry.

In addition to these above-mentioned drivers, luggage has also become an important part of the wedding trousseau, with even people in tier-II and tier-III cities buying branded suitcases and strollers during the wedding season.

The penetration of luggage as a category is much lower than that of other consumer products.

The optimism is resonating in the commentary of the management, who expects the company's earnings to grow at over 30 percent CAGR over the next five years.

While the stock has some near-term headwinds, the soft patch is just the right opportunity to accumulate it for the long-term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.