Nifty surpassed 16,000 for the first time as bulls become aggressive last week and closed the week around 16,270 with a gain of more than 3%.

The index touched its all-time highs of 16,350. It gyrated in the 15,850-16,350 range and 16,000 is now working as major support level for Nifty. The index witnessed Long Built up on OI (open interest) front in the week gone by.

The Bank Nifty, too, picked up momentum but was unable to close above 36,000. It formed a broader range of 36,000-34,600. Overall, Bank Nifty ended the week with a gain of approximately 4 percent with a rally of more than 1,200 points last week.

Further diving into the Nifty's upcoming Weekly expiry, Call writers showed aggression by building more positions compared to put writers. Nifty Vital resistance stands at the 16,300 levels where it got nearly 35 lakh shares - highest among all - followed by 16,400 levels with 31 lakh shares.

On the lower side, 16,000 stands at the immediate support level where there were nearly 30 lakh shares and 15,500 will work as vital support with addition of 31 lakh shares.

Looking at the Bank Nifty's upcoming weekly expiry data, on the upper side, immediate resistance stands at 36,000 (15 lakh share) followed by 36,500 (12 lakh shares). Whereas, on the downside, 35,500 (9 lakh shares) stands as the immediate support level followed by 35,000 (11 lakh shares) as the the vital support level.

India VIX, fear gauge, witnessed marginal decreases nearly 1.5 percent from 12.80 to 12.60 over the week. India VIX is trading near the lowest level of pre-covid crash.

Cool-off in the IV has given relaxation to the market. Further, any downtick in India VIX can push the upward momentum in Nifty.

Looking at the sentimental indicator, Nifty OI PCR for the week has increased from 1.089 to 1.397. Bank Nifty OIPCR over the week increased from 0.796 to 0.874 compared to the previous Friday. Overall, data indicates more of put writers over call writers in Nifty and Bank Nifty.

Moving further to the weekly contribution of sectors to Nifty. Most of the sectoral indices have contributed positively such as private banks, IT and NBFCs contributed nearly 170, 88 and 80 points, respectively, to the Nifty's 461.30 points gain.

Followed by FMCG, oil and pharma both adding approximately 42, 35 and 29 points, respectively. Whereas metals and fertilizers contributed nearly 6 points each on the negative side.

Looking towards the top gainer & loser stocks of the past week in the F&O segment. PEL topped by gaining over 15.5%, followed by Dr Lal Path Lab 10.60%, Cholamandalam Financial 9.70%. Whereas, IDEA has lost over 15%, RBL Bank -7.8%, Coromandel International-6.9% over the week.

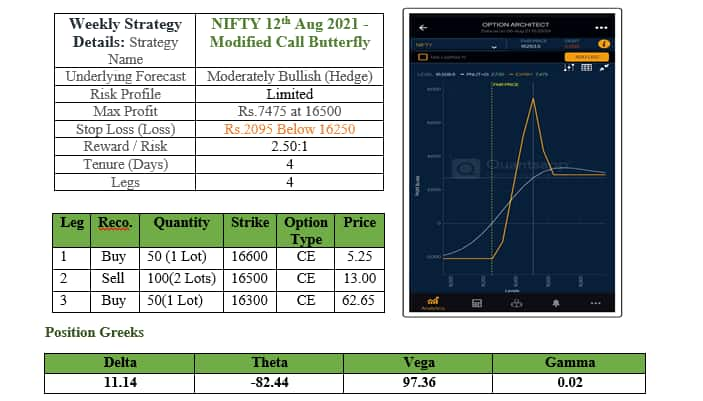

Considering the bullish momentum, the upcoming week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.