The month of October started on a bullish note and so was the December quarter. The 3-month period which started from October 1 to December 31 will be keenly eyed by investors as it will also be the last quarter of the calendar year 2017.

The September quarter closed on a muted note, down a little over 1 percent. But, if history is anything to go by then there are as many as 27 stocks which rose up to 250 percent in the December quarter of the calendar year 2016 when Nifty fell nearly 5 percent.

The anecdotal evidence suggests that many small and midcap stocks grabbed headlines in the December quarter of 2016 while in the S&P BSE 500 index only 145 stocks gave positive returns and 349 stocks slipped in red.

Stocks which gave multibaggers returns in the December quarter of 2016 include names like SE Power, Kushal Tradelink, India Metals, Vama Industries, HM Sugar Mills, Indokem, Atlas Jewellery, Niraj Cement etc. among others.

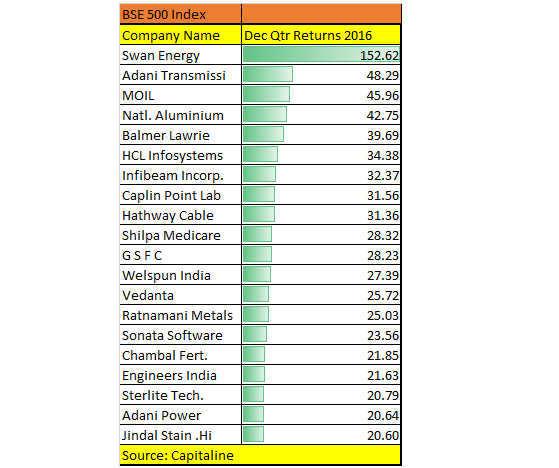

In the S&P BSE 500 index, Swan Energy rose 152 percent while Sterlite Technologies, EIL, Chambal Fertilisers, Sonata Software, Vedanta, Welspun India, GSFC, Shilpa Medicare, Caplin Point, Infibeam, Balmer Lawrie, NALCO, MOIL, Adani Transmission rose in the range of 20-50 percent.

December quarter will be crucial for markets amid expectations of a stimulus by the government to support growth, a possible rate hike by the US Federal Reserve as well as RBI policy meet scheduled in the month of December.

A pickup in domestic growth and global cues are probably the two crucial factors for equity markets to track in Q4CY17, Morgan Stanley said.

Key news flow to watch for this quarter include GST collections and the impact on growth; earnings season; issuances; domestic mutual fund flows; global cues; and monetary policy said the note.

India has underperformed emerging markets in recent months given the weakness in growth, but the global investment bank expects growth to turn stronger in the months ahead.

All eyes are on earnings which may remain muted in the September quarter but are expected to rebound in the December quarter.

The market is treading with caution after the Reserve Bank of India (RBI) governor warned that the government needs to be cautious on fiscal stimulus even as the economic growth slows.

The Reserve Bank of India (RBI) kept policy rates on hold in its fourth bi-monthly policy meet on Wednesday but has lowered growth projections and turned cautious towards monsoon.

However, experts feel that the structural story for markets remains intact and investors who are in for long term should not pay heed to short-term gyrations.

“We are approaching markets with a positive view over medium-long term. Structural reforms, focused efforts on infrastructure creation, increasing disposable income along with favourable macro environment can be a highly potent combination for market performance,” Saravana Kumar, CIO, LIC Mutual Fund told Moneycontrol.

“Currently, implied multiples embedded in equity valuations is a short-term concern however as earnings delivery would commence, markets may get a much-needed comfort on valuations. In short, our view on the immediate term is cautious however we are quite optimistic in medium to long-term timeframe,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.