Rajesh Palviya

The global slowdown concerns would definitely be driving volatility in Indian equity markets in the near-term but long-term growth story of Indian markets remain intact even amid this volatility.

Earning growth would be the major driver for the market in FY20 given the fact that since last 2-3 years earning uptick has not been converted as compare to the estimates.

If the voters vote for a stable government then we expect reform momentum to continue which would further support earnings growth.

In terms of technicals, on the monthly and quarterly chart, the Nifty50 index is trending upwards forming a series of higher Top and higher Bottom formation which signals sustained Up-Trend across all the time frames.

Since March 2016, the index has observed firm support from its three years Up-sloping trendline support zone which reconfirms the bullish sentiments on the long term charts.

It is well placed and is sustaining above its important averages i.e. 50, 100 and 200-day SMA which signifies sustaining up trend on medium to long term basis.

For FY20, we continue to maintain our bullish stance with an upside range of 11,850-12,200 levels. On the downside, a major support zone is towards 11,230-11,000 levels; hence, any significant correction towards the support zone will remain as an investment opportunity

The monthly strength indicator RSI and the momentum indicator Stochastic both are in positive terrain which supports further strength.

Here is a list of stocks which could give 10-20% return in FY20:RBL Bank Ltd: Buy | LTP: Rs 671 | Target: Rs 740 | Stop Loss: Rs 620 | Upside 10%

On the quarterly chart, the stock price has decisively broken out its consolidation range of Rs 600-475 levels on a closing basis and is sustaining above the same.

This breakout is accompanied with rising volumes which supports the bullish sentiments ahead. The monthly strength indicator RSI and the momentum indicator Stochastic both are in positive territory which supports upside momentum to continue in the near term.

The stock price is sustaining well above its 20, 50 and 100-day SMA which supports the bullish sentiments ahead.

Pidilite Industries Ltd: Buy | LTP: Rs 1,285 | Target: Rs 1,500 | Stop Loss: Rs 1,070 | Upside 16%

On the weekly charts, the stock price has formed an “Inverse Head & Shoulder” pattern and has given a breakout on a closing basis.

This breakout is accompanied with an increase in volumes which supports the bullish sentiments ahead.

The weekly, as well as monthly strength indicator RSI and the momentum indicator Stochastic both, are in positive territory which supports upside momentum to continue in near term.

The stock price is sustaining well above its 20, 50 and 100-day SMA which supports bullish sentiments ahead.

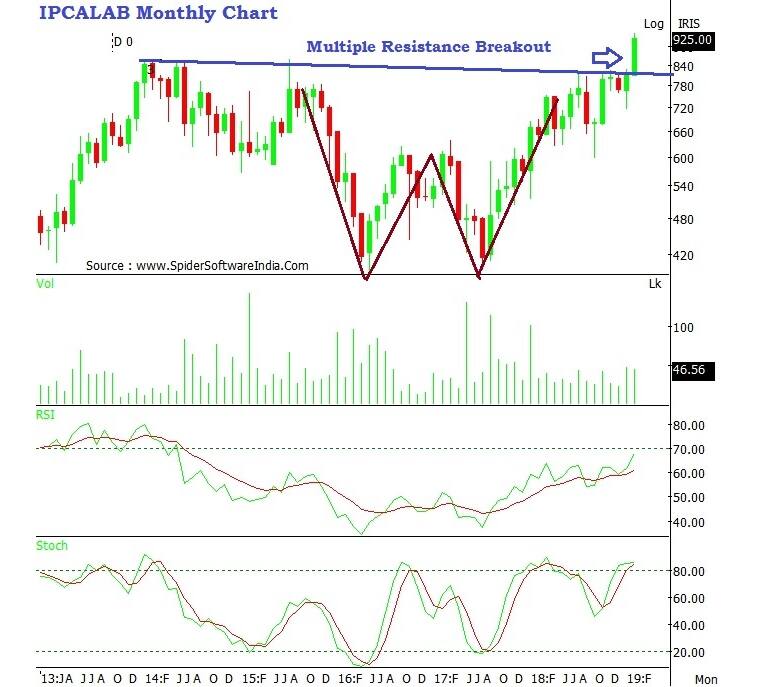

Ipca Laboratories Ltd: Buy | LTP: Rs 956| Target: Rs 1,100 | Stop Loss: Rs 850 | Upside 15%

On the monthly chart, the stock price has formed a “Double Bottom” pattern and has given a breakout on a closing basis. Also, on the monthly chart, the stock price has given a “Horizontal Trendline” breakout at Rs 830 levels.

This breakout is accompanied with rising volumes which supports bullish sentiments ahead. The monthly strength indicator RSI and the momentum indicator Stochastic both are in positive territory which supports upside momentum to continue in the near term.

The stock price is sustaining well above its 20, 50 and 100-day SMA which supports bullish sentiments ahead.

Muthoot Finance: Buy | LTP: Rs 617 | Target: Rs 750 | Stop Loss: Rs 545 | Upside 21%

On the quarterly chart, the stock price has decisively broken out its consolidation range of 520-360 levels on a closing basis and sustaining above the same.

The monthly strength indicator RSI and the momentum indicator Stochastic both are in positive territory which supports upside momentum to continue in the near term.

The stock price is sustaining well above its 20, 50 and 100 day SMA which supports bullish sentiments ahead.

Godfrey Phillips India Ltd: Buy | LTP: Rs 1,121 | Target: Rs 1,400 | Stop Loss: Rs 1,020 | Upside 24%

On the monthly chart, the stock price has given “Down Sloping Channel” breakout at Rs 955 levels. This breakout is accompanied with an increase in volumes which supports bullish sentiments ahead.

The weekly, as well as monthly strength indicator RSI and the momentum indicator Stochastic both, are in positive territory which supports upside momentum to continue in the near term.

The stock price is sustaining well above its 20, 50 and 100-day SMA which supports bullish sentiments ahead.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.