Indian markets created history yet again in July and the momentum carried forward in August as well when the S&P BSE Sensex inched closer towards 39,000, while Nifty50 climbed 11,700 for the first time.

The journey has been a roller coaster for investors because the index took a breather in March but the momentum picked up again in July. The index is now up 11 percent and the move is largely led by 5 stocks.

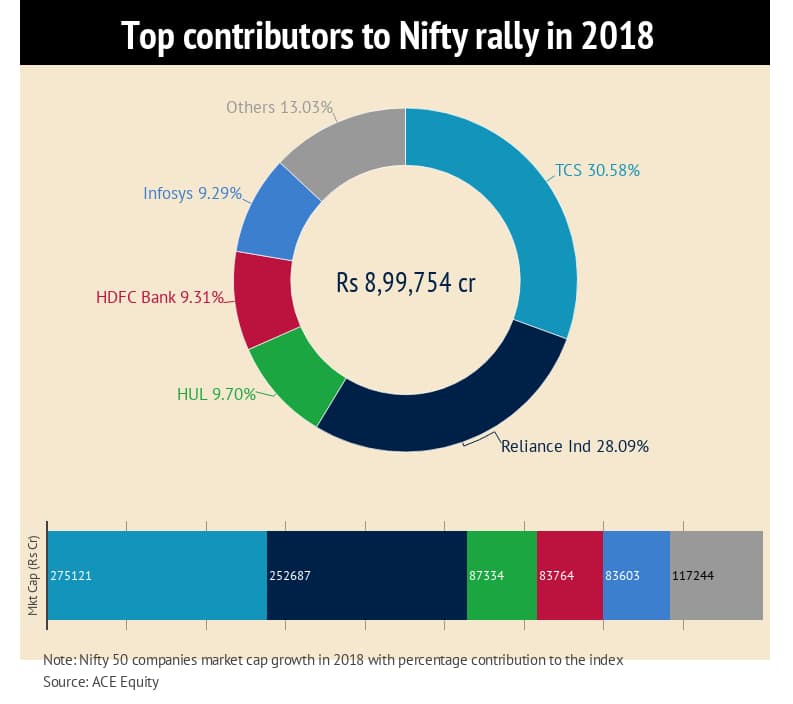

Did you just said 5! Yes, just five stocks in the Nifty5o added the most in market capitalisation to the index so far in 2018, data shows.

The total addition in Nifty market capitalisation so far in 2018 stands at 8.99 lakh crore and out of that 86.97 percent, or 7.82 lakh crore, was added by a handful of heavyweights such as TCS, Reliance Industries, HUL, HDFC Bank, and Infosys, according to AceEquity data.

As many as 28 out of Nifty50 stocks added to Nifty50 market capitalisation while the remaining 22 stocks witnessed selling pressure in 2018.

Among the 22 stocks, Bharti Airtel market-cap erosion was the highest at Rs 61,100 crore, followed by Tata Motors which saw the erosion of nearly Rs 50,000 crore in m-cap and IOC witnessed the steep erosion of Rs 37,608 crore in m-cap in the same period.

The Indian market has climbed all wall of worries to hit fresh record highs but sharp depreciation in rupee, higher crude oil prices as well as trade war woes could well cap gains for markets.

Investors are advising investors to stay with large-caps as mid-caps have still more downside left before they start outperforming again. But, high-quality mid-caps can be bought on declines.

Nifty on track to hit 12K:Most experts feel that the index is now on track to hit the crucial level of 12000 in 2018. The market saw a huge divergence in the Nifty Index and the AD line, in fact, the highest in the last 12 years.

Top-12 Nifty stocks (by weight) outperformed the broader market by 400bps and the remaining 38 by 1,300 bps (YTD). The biggest divergence observed in the Nifty vs. mid-caps was 20 percent, PhillipCapital said in a report.

“Risk aversion and rising volatility led to the market moving towards tried-and-tested defensive plays such as TCS, Infosys, HUL, HDFC, and Asian Paints,” it said.

In the backdrop of the current momentum and robust corporate earnings expectations, the brokerage firm has upgraded its base-case NIFTY December 2018 target to 12,000 from 11,500 earlier.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.