IndiaMART InterMESH share price surged 12 percent in morning trade on July 22 after the company reported a more than two-fold jump in its Q1 FY21 consolidated profit at Rs 74.1 crore, backed by strong operating performance.

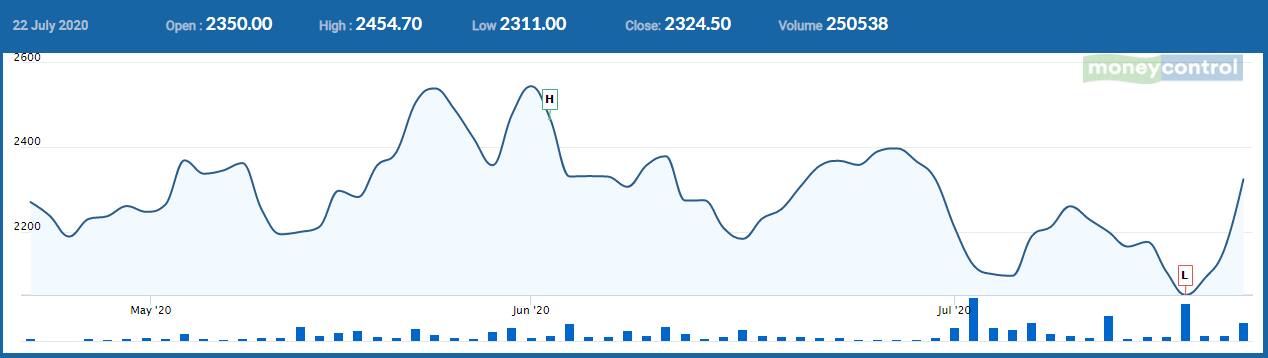

The stock price has seen a steady rise in prices with the scrip gaining 16 percent in the last 3 days. It was trading at Rs 2,401.60, up Rs 248.00, or 11.52 percent at 09:25 hours. It has touched an intraday high of Rs 2,456.60 and an intraday low of Rs 2,316.50. It was trading with volumes of 9,547 shares, compared to its five day average of 5,935 shares, an increase of 60.86 percent.

Revenue from operations of the company grew 3.9 percent to Rs 153.1 crore, primarily driven by marginal improvement in realisation of existing customers.

"Number of paying subscription suppliers were the same as last year due to the challenging economic and market conditions amid the COVID-19 pandemic. Consolidated deferred revenue grew 3 percent to Rs 628 crore in Q1 FY21 YoY," the company said in a BSE filing.

Commenting on the quarter gone by, its CEO Dinesh Agarwal said, "I am pleased to report a modest financial performance in Q1 as the ongoing adverse market conditions had an anticipated impact on our customers, revenue, deferred revenue and cash flow from operations."

Consolidated earnings before interest, tax, depreciation and amortisation (EBITDA) shot up 99.7 percent YoY to Rs 73.3 crore and margin expanded significantly by 2,300 bps to 47.9 percent in quarter-ended June. "EBITDA margin expansion was primarily driven by various cost optimisation measures leading to sustained and temporary rationalisation of expenses," the company said.

According to Moneycontrol SWOT Analysis powered by Trendlyne, IndiaMart InterMESH has zero promoter pledge with FII / FPI or Institutions increasing their shareholding.

However, Moneycontrol technical rating is very bearish with moving averages and technical indicators being bearish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.