With global market signals confusing and Indian markets perched at slightly uncomfortable highs, investors are seeking the safe haven of quality. With markets at 21.1X expected FY17 earnings, does the combination of quality and value exist?

In trying to answer this question, our research picked up five companies – Apollo Tyres, Bharat Petroleum Corporation, Larsen & Toubro Infotech, MRF and Petronet LNG. What do they have in common? To put it simply, all five companies are large cap (market capitalisation in excess of Rs 10,000 crore), have superior fundamentals (return ratios – return on equity and return on capital employed --consistently above 15 percent for the past 3 years) and are quoted at valuations that are significantly cheaper than the market. While cyclical companies do tend to get discounted multiples, some of their unique moats beckon attention.

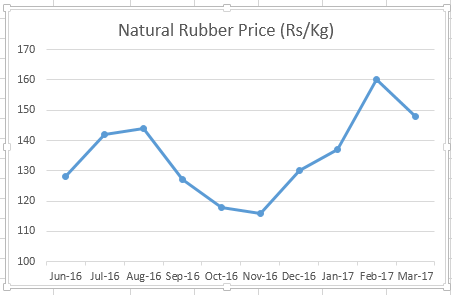

Tyre companies have been hit badly in recent times. While demonetisation hit their toplines, the steady increase in natural rubber prices hit margins as companies had to absorb cost in an environment of lacklustre demand. While the March quarter result will continue to exhibit the pain, we expect some moderation in the rubber price rise and expect companies to pass on a part of the input cost pressure once demand normalises. The weakness in financial results in the coming quarter might provide opportunities to build positions in fundamentally strong companies.

MRF has dominant presence in all segments (passenger and commercial vehicle tyre) as well as leadership position in the replacement market and commands a premium in all categories. Improved demand from rural areas, the revival of the mining sector and greater demand for farm tyres augurs well for the industry. While input price pressure (nearly 55 percent of sales) might impact near-term earnings, we do not expect runaway price rise in crude that impacts the nearly 30 percent of inputs that are derived from crude.

Apollo Tyres has not only gained leadership in the domestic auto tyre market but also created a global footprint through operations in South Africa and Europe. The company remains well placed to benefit from recovery in passenger & commercial vehicle demand. The industry is also hopeful of a favourable ruling on anti-dumping duties on imported Chinese truck radial tyres in the coming 1-2 months, and the recent US ruling not to impose anti-dumping duty on Chinese tyres will divert some tyres to the US market thereby benefiting Indian tyre manufacturers like Apollo.

The return on equity of an oil marketing company like BPCL (Bharat Petroleum Corporation Ltd) has shown steady improvement driven by improving operational efficiencies, product pricing freedom and no subsidy burden. Stock prices have rallied primarily due to consistent earnings upgrades rather than multiple upgrades. We believe, over time, a company like BPCL may see multiple re-rating as consumption-linked retail plays. The marketing business earnings should lend comfort to investors on the back of auto fuel deregulation, continued lack of intervention from the government, robust fuel consumption trends in India, and recent moves by the government on raising prices of even hitherto politically sensitive fuels such as kerosene and LPG.

Gas acceptance is rising amongst industries as well as the end-consumer. A regulatory push will also increase the use of gas as a clean energy fuel. We see Petronet LNG as one of the top beneficiaries of these trends. While domestic gas production will continue to be muted, LNG demand will rise in FY18 led by higher offtake from industrial consumers (steel, refining, petrochemical), CGDs (city gas distribution) and power. A growing regulatory push favouring a shift to gas as well as improved competitiveness of gas over diesel/petrol will continue to boost volume.

The inexpensive valuation of L&T Infotech (the sixth largest IT Company in India) partially addresses the US protectionism related near-term concern. The company has an impressive new management team that can mine a high-quality client base and solid execution in traditional services and strong account management. The company boasts of a strong client base and works with 51 Fortune 500 clients. L&T Infotech has a solid presence in verticals of banking, insurance and manufacturing and is building automation and digital capabilities as future growth drivers.

Investors should keep any eye on these companies and use the ensuing volatility to own these high quality businesses. In the coming days, we will show case companies from the mid and small cap space that offer twin qualities of sound financials and reasonable valuation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!