Due to the Centre's reduction of excise duty, the value-added tax (VAT) cuts announced by some states on petrol and diesel prices recently are only by default as most states levy ad valorem VAT on oil, according to a report.

States still have fiscal space to reduce fuel prices further, according to the latest Ecowrap report from the State Bank of India’s Economic Research Department.

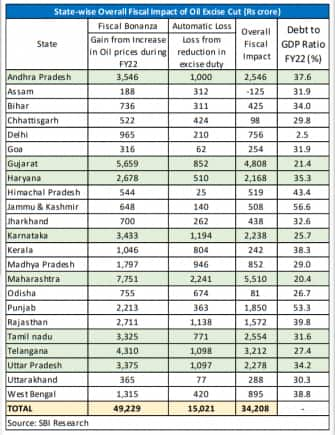

The report said that the states have gained Rs 49,229 crore from VAT revenue on fuel when oil prices were increasing and the states will forego Rs 15,021 crore when the oil price has been downwardly adjusted through excise cut.

"This implies that gains still outstrip the revenue forgone by Rs 34,208 crore and hence states can further cut the oil prices," the report said.

It further said that Maharashtra has gained the most due to the recent increase in oil prices, followed by Gujarat and Telangana. "The average VAT on petrol in Maharashtra, Telangana, and Andhra Pradesh is around 29.6 percent," it said.

If the cushion of Rs 34,208 crore from oil excise is entirely adjusted, the report noted that states on average can still cut diesel prices by at least Rs 2 per litre and petrol prices by Rs 3 per litre each without impairing their VAT revenue from oil.

"Bigger states like Maharashtra which have lower debt to GDP ratio have significantly large fiscal space for lowering their tax on diesel and petrol by even up to Rs 5," it said.

The report authored by Soumya Kanti Ghosh, SBI's Group Chief Economic Adviser, highlighted that state finances have improved significantly post-pandemic and the states have the necessary resources to adjust taxes if required.

Ghosh added that the recent measures by the government would ease inflation by 35-40 bps.

Ghosh noted that the ultimate solution to reduce the complexities in oil tax structure and bring down extreme volatility in oil revenues would be to bring it under the ambit of GST.

The government on May 21 cut the excise duty on petrol by Rs 8 per litre and on diesel by Rs 6 per litre amidst rising inflation. The move led to a reduction of petrol rates by Rs 9.5 per litre and diesel by Rs 7 a litre.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.