In November 2013, Sequoia Capital India led a $37-million funding round in Zomato Media Private Limited, a restaurant recommendation platform that made money from advertisements. A listings business, an Indian version of Yelp.com, is how Sequoia and existing investor InfoEdge viewed the company in a deal valuing it at $150 million.

For the storied Silicon Valley investor, its best case scenario back then was Zomato becoming a $500 million company in a few years, according to people directly aware of discussions. Mind you, this was when Flipkart and InMobi were India’s only unicorns, businesses valued at a billion dollars or more.

Fast forward now,in just one week in April 2021, six unicorns were borthed and $1.5 billion raised by startups in India. Yet, back then, the thought of multiple billion dollar internet startups from India flabbergasted many.

“Listings looked like a very good business. It can generate profits soon,” one person who had evaluated the business in 2013 said.

Sequoia, despite being among the most aggressive and ambitious investors in the world and in India, might not have envisioned what Zomato would become. Today, the company is pursuing an $8 billion initial public offering (IPO), and potential returns of at least $400 million for Sequoia.

To put that $8 billion in content, Yelp, the equivalent of Zomato’s previous avatar, is a household name in the US, but its shares have plateaued at a $3 billion valuation the last five years.

Spectacular gains aside, what Zomato is today is not what its founders Deepinder Goyal and Pankaj Chaddah planned. Or what Sequoia and Info Edge envisioned years ago. Far from it.

They underwrote a listings platform, which was a profitable business. Zomato is anything but. But it a vastly bigger business.

The Zomato story is essentially the journey of an underdog that dreamed big, of its multiple failures and pivots, and how an unlikely— make that least likely —IPO candidate as recent as a year ago is now on the cusp of a historic public listing.

It is the story of how DC Foodiebay Online Services Pvt Ltd in 2008 became Zomato Ltd in 2021, a result of the indelible imprint on the company by CEO Deepinder Goyal.

Details for this article were sourced from people intimately involved in the company’s journey. They all spoke to Moneycontrol on the condition of anonymity. Sequoia declined to comment on a detailed query from Moneycontrol.

An Opportunity And FundingIIT Delhi batchmates Goyal and Chaddah, while they were colleagues at consultancy firm Bain and Co, saw that their office was bombarded with paper leaflets of different restaurants. They spotted an opportunity—why not launch an app to house the raft of restaurants?

The company first raised Rs 60 lakh from Info Edge, beginning a mutually beneficial partnership with Sanjeev Bikhchandani, one of India’s first generation technology entrepreneurs and the founder of Naukri.com.

Goyal then was shy, not thrilled with the limelight, who preferred writing to speaking. But he was an execution machine.

Executives say that once Goyal was set on an idea, nothing and no one could stop him. Yet, in the early years, he was brash and direct, telling people exactly what he thought of them.

At Zomato’s Gurgaon headquarters, he had a close group of friends/colleagues he would spend weekdays and weekends with, but other employees often felt alienated because of this. Even though that wasn’t the intention, some employees felt he preferred this closed group even when it came to key work matters—choosing a person to expand in a region, heading a new vertical, or other functions.

“He is an intense guy. Even back then I realised, this is not someone I would ever get into a street fight with. This is a guy who always wants to win. And probably will by sheer force of will,” says one person who knows him for the better part of a decade.

Those qualities would also serve Goyal well later on when it would face a struggle for survival against Swiggy.

International LoveSequoia’s investment in 2013 gave Zomato the fillip it wanted. Zomato expanded to a dozen countries, including the United Arab Emirates, Australia, Indonesia, Portugal, Chile, Ireland, New Zealand and Vietnam. No Indian internet startup before or since has ventured into many of these markets, and certainly not these many.

But Goyal’s ambition led Zomato to many forgettable acquisitions. Zomato’s over a dozen acquisitions include Poland’s Gastronauci, Italy’s Cibando and US-based UrbanSpoon- all to boost, and sometimes create its overseas restaurant discovery business.

From Turkey to Slovakia to New Zealand, Zomato bought these companies in a six-month acquisition frenzy. Nearly all of these businesses have now been shut down, according to Zomato’s IPO prospectus.

“(The years) 2013 to 2015 is when I think Deepinder got a little carried away. Overseas expansion has to have very strong rationale- some network effect or economies of scale. Just spending hundreds of millions is not the way to win it. A listings business can be profitable, but not necessarily large. So when you chase growth from everywhere, you’re trying to bend the fundamental business model, and are also compromising your economics,” another person close to Goyal said.

“Overseas expansion was just not needed. It was clear even then, but when you’re getting funded and riding the wave, wisdom is easier in hindsight,” the person said.

Nonetheless, in September 2015, Zomato became a unicorn, valued at a billion dollars when it raised $60 million from Singapore’s Temasek Holdings and Vy Capital. Less than a year later though, HSBC marked down Zomato’s valuation to $500 million, citing a low market share, saying that Zomato needs to build its own last mile logistics and win the ordering business, and that the US market is too crowded for Zomato to win.

Goyal expressed his disagreement in a searing blog post end email to employees debunking the HSBC report.

“There isn’t any food delivery company in the world which owns its last mile logistics fleet, operates at scale, and is profitable. These assumptions and statements in the HSBC report make it look like they’re coming from someone who doesn’t – and hasn’t bothered to – understand the space well,” Goyal said.

Five years later, Zomato isn’t a profitable food delivery firm, although it certainly owns a fleet and boasts massive scale.

Zomato has also made acquisitions (or attempted to) which have little to do with its core business, such as drone-based delivery firm TechEagle and sports fitness startup Fitso. TechEagle and Zomato parted ways last year, and Fitso’s role in Zomato’s larger plan is still unclear. It even got into ticketing for music concerts and events, competing with BookMyShow and Paytm.

Amid post merger integrations and the rise of an existential threat, Goyal faced his next big challenge, as a slew of senior executives left Zomato, something industry insiders hold up to question Zomato’s quality as an organisation even today. Its Chief Financial Officer, Chief Marketing Officer and successive Chief Product Officers, among others, left the firm in a span of 12 months.

In 2018 when co-founder Pankaj Chaddah left Zomato, rumours swirled around Goyal’s leadership, and whether his direct and (some say) domineering nature stood in the way of building a stable long-term company.

One person close to Chaddah said on the slew of exits, “In any startup, for every 10x you scale, a few senior people will leave you. It is a high pressure environment by design. You are reaching for the sky. That does not suit everyone. If two co-founders, a decade into the journey realise they are not able to fit in properly, then one has to give way. You take the path of least resistance.”

However, people inside and outside Zomato unanimously agree that Goyal has matured as a founder and a leader, maybe on his own terms, maybe slower than some would have liked him to, but matured all the same. There are still traces of the street fighter you wouldn’t want to face, but people describe a far more measured and responsible person, self aware in his dealings and trying hard to create a stable set of leaders at Zomato.

Zomato has held onto a set of leaders who have spent years in the company, including CTO Gunjan Patidar, new business head Mohit Gupta, supply head Gaurav Gupta, and people development head Akriti Chopra, among others.

“He is less likely to tell you to shut up if you say something he finds stupid. He will listen, be a little more diplomatic. He is much easier to work with today,” an investor said.

But the intensity remains, as it should with Goyal juggling the expectations of being a listed company, still being deeply unprofitable, and competing with a competitor named Swiggy that has over a billion dollars in the bank, and no plans to list anytime soon..

Survival threat to equal footingGoyal’s brashness, Zomato’s ambitions and the resulting topsy-turvy trajectory make the company markedly different from archrival Swiggy. They are as different as chalk and cheese.

Sriharsha Majety, Nandan Reddy and Rahul Jaimini started Bundl Technologies, a courier platform in 2014, quickly pivoting to food delivery a few months later. Swiggy’s DNA has been delivering things to your house.

That's why the company also expanded to delivering food, groceries, connecting to local kiranas and started Swiggy Genie, an on demand delivery service competing with Dunzo.

Zomato, on the other hand, wants everything to do with your food. You want to go to a restaurant, you search on Zomato. You can book a table on Zomato, reach the restaurant and can get discounts and freebies using Zomato Gold (now Pro). Or you stay in and order on Zomato. Or if you’re a restaurant, Zomato Hyperpure helps you source ingredients.

Zomato did not see the point or potential of food delivery, certainly not as its core business, until Swiggy’s growth threatened to wipe it out.

Zomato wanted to seriously do delivery only after they saw Swiggy scale up. Transactions are a much bigger market than listings. If people start using Swiggy for transactions (ordering), they could also eventually use Swiggy for recommendations. Zomato found itself cornered, and while Swiggy was burning millions of dollars, that seemed the only way to win the market.

Goyal realised that food delivery was the next big frontier, and he would have to do everything he can to win it. This realisation saved his company, and this is where his famed execution skills and an unwillingness to accept ‘no’ for an answer, came to his help.

To compete with Swiggy, Zomato had to strengthen its delivery and logistics network. Tracking orders live is common today, but Swiggy pioneered that feature. Its delivery executives, combined with smooth backend technology, were a force to reckon with.

To strengthen its delivery network, Zomato acquired Runnr, a food delivery startup. As buyout discussions went on, the two companies and Runnr’s investors- Nexus Venture Partners, Blume Ventures and Sequoia took time to finalise the contours of the deal- valuation, stock agreements, etc.

Midway through the talks, there was a difference in opinion between the two founders. This is common in deal discussions, but often the reason why deals take months to close and lots of discussions never result in an actual deal (such as the Swiggy Zomato merger). Goyal however was persistent and impatient, because he knew this deal was key to Zomato’s future.

“Deepinder went after the deal very aggressively. When discussions were slowing down, he called Mohit (Kumar, Runnr’s CEO) to his office and said, “We have to get this done. That persistence and intensity, realising his future lay in this deal, marked him out,” said a person involved in discussions.

People close to Swiggy say that it was well funded throughout, knew its business model extremely well, and saw no reason that a distant competitor could pivot to its business and actually challenge Swiggy for market share.

Even after the Runnr deal and a $200 million round from Ant, in late 2017, Swiggy led with a market share of 35-38% and 4 million orders a month, while Zomato lagged with a 25-30% share and 2.7-3 million orders a month. At that point, Swiggy was doing about 4 million orders a month while Zomato was doing 2.7-3 million.

It is largely due to Goyal’s fighting spirit that he closed the Runnr deal, managed to raise funds, compete, and lived to see another day. Many others including FoodPanda, UberEats and FreshMenu did not, either getting acquired, or not being able to scale up to expectations.

The perennial underdogIn the startup space, and particularly in a cash burning business like food delivery, funding swings the pendulum like nothing else. Companies may attribute their success to many reasons, but companies that failed almost always did because that next round of funding never came.

Swiggy was able to grow fast in its early years and not worry about making profits because it had a seemingly never-ending stream of blue-chip investors funding those losses such as Accel, SAIF Partners, Bessemer Venture Partners, Norwest, Naspers, Coatue, and Tencent, among others. Between Naspers, Coatue and Tencent, any of them could lead a $500 million round in Swiggy at any point. Such was their might.

Zomato, in comparison, found its first and only big backer (until recently) only in 2018, China’s Alibaba affiliate Ant Financial led a $150 million round. Even then, its cap table (list of investors) was never as strong- always a signaling risk in a hyper competitive market. In fact, Ant’s controlling rights became a roadblock in Zomato’s funding plans, even as Zomato was dependent on Ant for all its major funding until late last year. The government’s ban on Chinese investments last year made the equation trickier still.

While it has generally been seen as a close number two in the food delivery market by volume, in its IPO filing Zomato said it is the market leader in terms of average order value (AOV) from October 1, 2020 to March 31, 2021. Benchmarked to 100, its AOV is 711, compared to 362 for the rest of the industry.

Swiggy’s AOV is estimated to be about 30% lower, although one person close to Swiggy disagreed with Zomato’s AOV benchmarking.

“It is one thing to casually tell people that your AOV is significantly higher. That is market gossip. But saying this in the prospectus is a little unfair. Swiggy’s order value is marginally lower, and that too temporarily. After the pandemic, it should be neck and neck or Swiggy should be marginally better,” the person said.

Zomato’s consistent growth even while improving its economics (relatively speaking) has surprised many. Three investors told Moneycontrol that a few months ago when they evaluated both the food delivery firms, Zomato’s economics looked significantly better, and that they could see a path to breaking even in a couple of years.

“I would not have predicted this. They have gone from being underdogs to staking the claim for market leadership and actually going public. Who would have thought that a company gasping for survival a few years back will be opening the door for Indian tech listings today?” one investor says.

The Covid-19 pandemic has certainly helped it trim discounts, charge delivery fees and see customers order consistently from home despite higher prices.

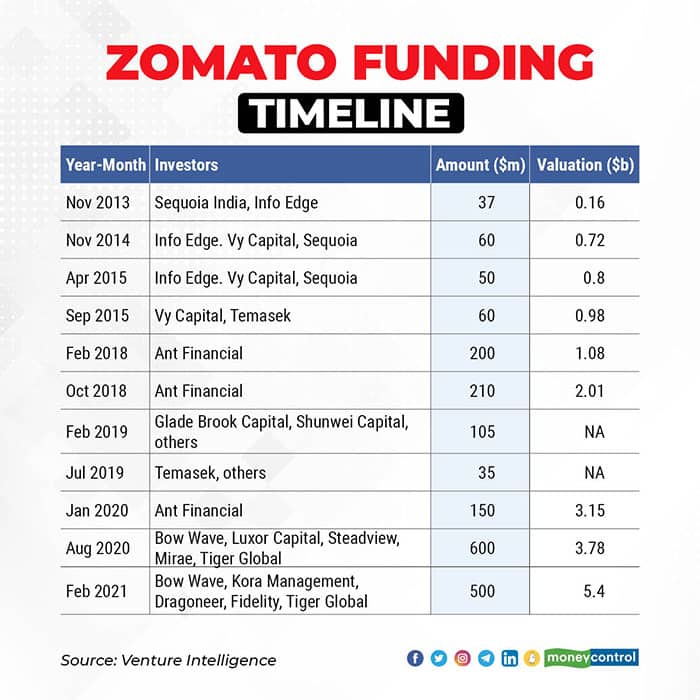

Zomato’s fundraising blitzkrieg late last year is also testament to its improved status as a company. It has raised close to $900 million in the last six months- more than its total funding the preceding decade—from investors such as Tiger Global Management, Steadview Capital, Mirae Asset, Temasek and Fidelity. Its valuation has also nearly tripled from $3 billion in January last year to $5.4 billion currently. It expects to list at a valuation of $6-8 billion in the coming weeks.

Zomato has totally raised $1.5 billion, far less than Swiggy’s $2.3 billion, which doesn’t include $450 million it is currently raising from Japan’s SoftBank Vision Fund.

What does the future hold?Amid the funding frenzy and valuation jumps, it is easy to forget that Zomato and Swiggy are both deeply unprofitable companies. Even with an improved financial position, Zomato posted a loss of Rs 684 crore for the first nine months of FY21 on a revenue of Rs 1367 crore. For FY20 it earned Rs 2604 crore in revenue and made a loss of Rs 2385 crore.

Zomato will burn at least Rs 2000-3000 crore more until it breaks even in the next couple of years, investors say. Whether stock market investors- used to regular profits and even dividends- will digest those numbers remains to be seen.

For years, Zomato’s advertising and restaurants business has produced cash flow, and to some extent subsided its delivery business. Investors have sometimes chosen Zomato over Swiggy because the listings business is profitable and improves the overall financial position of the company. For the nine months ended December 31, 2020, Zomato’s services (ads and subscriptions) accounted for Rs 198 crore in revenue, according to its DRHP, and it is presumably profitable, although the documents do not specify.

Investors are divided over how the Zomato IPO could perform. If its shares rise and get to an $8-10 billion valuation, not only will Zomato firmly be in the upper echelon of Indian internet startups, it will also make fundraising much cheaper for Zomato.

Goyal will have to dilute a far lesser stake to raise money, and cheap capital could trigger more investments into the business. On the other hand if its shares plateau at $5-6 billion and stay there for many quarters, raising money becomes much tougher, and Zomato may have to hunker down and make profitability its number one priority.

There is always the chance of a slip between the cup and the lip, but Zomato’s IPO could also indicate what other internet startups such as Policybazaar, Delhivery, Nykaa and Lenskart can expect. Few really thought Zomato would end up here on the verge of a public listing, more stable and more competitive than it has ever been before.

If Zomato lists, Goyal and his company will become the flag bearers of the Indian startup ecosystem.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.