B2B SaaS fintech company Perfios has announced the acquisition of IHX, a Bengaluru-based healthcare information exchange, to strategically expand its technology stack into the health insurance claims ecosystem.

This marks Perfios' third acquisition in the last three months, as it continues to broaden its capabilities across the banking, financial services, and insurance (BFSI) sector.

While the financial terms of the transaction were not disclosed, Perfios CEO Sabyasachi Goswami described the deal as a key step in the company's mid-to-long-term healthcare strategy.

Perfios, backed by Warburg Pincus and Kedaara Capital, plans to integrate its data intelligence and analytics capabilities with IHX’s platform to improve claim processing speed, operational visibility, and real-time decision-making for hospitals, insurers, and patients, while leveraging its network of 30,000 hospitals and 30 insurers.

The CEO said internal tests show that Perfios’ in-house AI models could significantly reduce claim processing times.

“What traditionally took a couple of hours will come down to under ten minutes — and in some cases, even four minutes — once the models are fully deployed,” he said. “The goal is near real-time processing, where hospitals, insurers, and patients can all access updates simultaneously.”

As healthcare demand grows and claim volumes rise, Goswami said faster claim settlement would become critical for the ecosystem. “Ultimately, the objective is to make healthcare access frictionless, even for the last person standing in the most remote parts of India.”

Founded in 2020, IHX provides a range of solutions including claims management, in-patient and out-patient management, marketing and inventory management, and revenue cycle management for hospitals. According to the company, it processes over 40% of India’s cashless health insurance claims, managing over 10 million transactions annually and representing $1 billion in claim value.

IHX’s platform connects 30,000 hospitals across 1,200 locations with more than 30 insurers, including names like Reliance Hospital, DY Patil Hospital, MGM Healthcare, and Jaslok Hospital.

As per Tracxn data, the platform has raised around $2.58 million from LogX Venture Partners and Quik Solutions and was valued at over $45 million back in 2023. It reported revenues of Rs 14.8 crore for the financial year ending March 31, 2024. Managing Director Mahesh Nagaraj said the partnership would enable the company to expand its network while leveraging Perfios’ technology stack and resources to drive further growth.

Goswami confirmed that IHX will continue to operate independently under its own brand and leadership, similar to Perfios’ previous acquisitions.

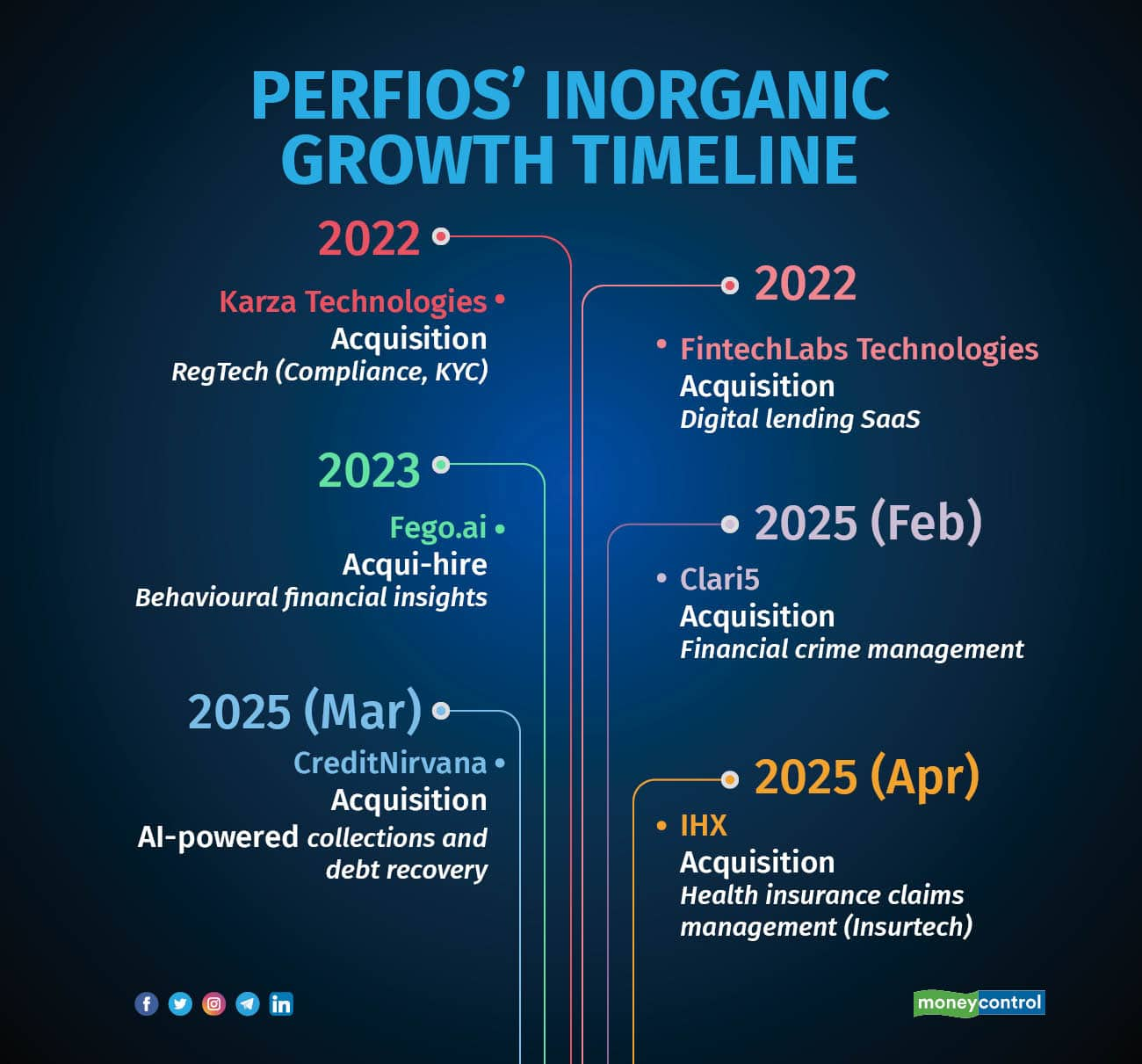

Inorganic strategy: Five deal, one acquihire since 2022The acquisition of IHX follows Perfios’ earlier deals to acquire Clari5, a banking fraud detection platform, and CreditNirvana, an AI-powered debt collections and recovery platform, both in 2025.

Earlier, in 2022, Perfios had acquired Karza Technologies, a SaaS-based RegTech company, and also acquired FintechLabs Technologies, a Noida-based provider of digital lending software solutions. In 2023, Perfios acqui-hired Chennai-based Fego.ai, a behavioural financial insights startup.

Including IHX, Perfios has made five strategic acquisitions and one acqui-hire since 2022 to strengthen its position across the BFSI and fintech value chain.

Goswami emphasised that while Perfios’ focus remains on BFSI, the company has always positioned itself as a “TechFin” player rather than a traditional fintech firm.

“Our DNA has always been tech-first. We design solutions to be industry-agnostic and geography-agnostic,” he said. “While BFSI is our focus, our tech stack is flexible enough to support adjacent sectors like healthcare.”

Perfios currently operates across 18 countries and is expanding its international footprint. Goswami said the company’s international revenue contribution is in the high double digits and could be nearing 20%, although there is no fixed revenue split target.

“Our priority is to build strong market presence and dominance wherever we operate,” he said.

The company continues to demonstrate robust financial performance, with revenues rising 37% year-on-year to Rs 558 crore in FY24, up from Rs 407 crore in FY23. Profits grew sharply, surging 9.2x to Rs 72 crore in FY24.

Founded in 2008, Perfios has scaled rapidly in recent years--reaching a $1 billion valuation in 2024 following an $80 million investment from Teachers’ Venture Growth, taking the total fundraise to $435.1 million, till date. It had previously raised $229 million led by Kedaara Capital.

Looking ahead, Goswami said Perfios is focused on building new product lines, with significant investments underway in AI-driven platforms, fraud detection, and consent management solutions to meet growing demands for data privacy and regulatory compliance.

“This is the time to invest in product innovation, just like we did during the pandemic, which positioned us strongly afterward,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.