On 16 January, social media company Sharechat joined a bunch of startups that laid off employees, seemingly to beat a crippling slowdown in business. The mood at the townhall held right after was understandably sombre. Nearly 600 employees were let go and the management faced a volley of tough questions from upset employees.

The management said it selected the employees who were fired based on the redundancy of roles. If that were the case, employees asked, why were the absent chief technology officer and the chief operating officer being given a long rope?

Both the top positions were held by co-founders Bhanu Pratap Singh (CTO) and Farid Ahsan (COO). These roles are critical in a company such as Sharechat, which competes with Meta. While the chief technology officer needs to ensure that the algorithms are good enough to grab eyeballs and keep users engaged, the chief operating officer has to worry about monetisation and marshalling resources to fend off rivals.

Singh and Ahsan ceased to actively participate in the company for nearly two years, according to multiple people familiar with the operations of Sharechat, which was founded in 2015. Things have changed from the time the trio used to share a flat together. While Singh became more aloof gradually, Ahsan has moved cities and on to other things like angel investing.

This is concerning as startup co-founders typically distribute different functions amongst themselves — and are expected to stay aboard till a major exit event, such as an acquisition or an initial public offering.

After Moneycontrol approached the company for comments, a spokesman said it required more time to respond. The company then revealed that Farid and Singh had stepped down officially, this week.

As we spoke with multiple employees and investors, it has become increasingly clear that the social media unicorn, which was valued at $5 billion in its last funding round and is backed by the likes of Twitter, Google, Lightspeed and Temasek, is dealing with a leadership crisis.

According to a former employee, Singh had always seemed disinterested in the company’s affairs. Although he would be present at company offsites, the CTO of the tech start-up, which competes with Facebook and Instagram, was unavailable for meetings and reviews.

Singh once told some employees his aim in life was to make Rs 20 crore and chill. He and his co-founders have actually ended up doing better than that as they sold shares worth around Rs 80 crore in a recent funding round, according to a source.

Sharechat declined to comment on the specific number of the secondary share sale, although it responded to other queries. The company’s responses will follow information gathered from our reporting.

Meanwhile, a string of senior executives left the company over the last year, including chief commercial officer Ajit Varghese, senior vice president Gaurav Mishra, director of product management Siddharth Mishra, human resources vice president Sudhir Nair, content operations head Armaan Azaad, machine learning & monetisation director Mandar Rahurkar, and others.

Amid these departures, Ahsan lost his appetite to engage in the daily humdrum of running the company, sometime around the second wave of Covid, according to people familiar with the matter.

“He lost a family member and went on leave for a few months. When he came back, Farid could not keep up with the pace… Or maybe he did not want to,” said a former Sharechat staffer.

Another source said that since then, Ahsan has shifted base from Bengaluru to Mumbai, and focussed on his angel investments in startups. In 2022, his investments included crypto platform Pillow, healthtech startup Curelink, and Web3 creator platform Fanztar.

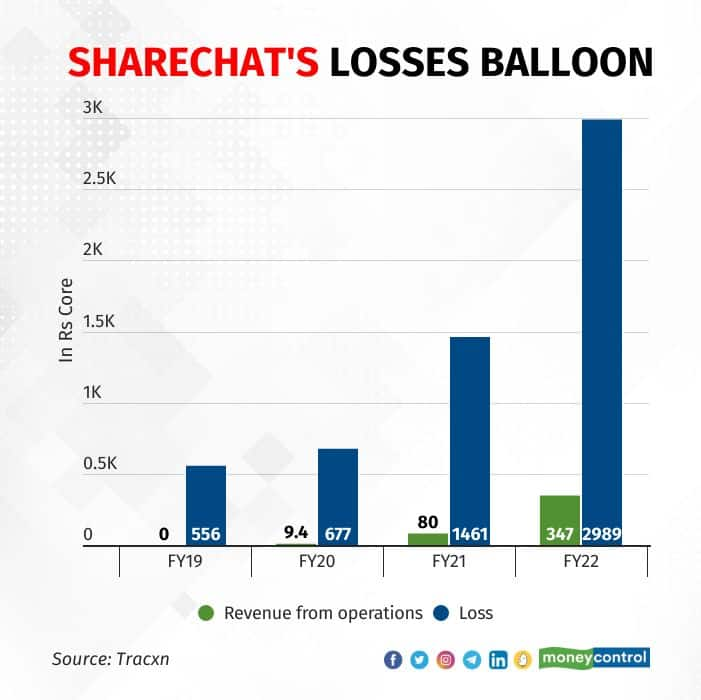

Meanwhile, Sharechat’s financial fortunes took a hit. Its losses widened two-fold to Rs 2,989 crore in FY22 — and revenue lagged well behind at Rs 347 crore. The company’s monthly cash burn peaked in the $25-30 million range last year.

Eight years after being founded, such numbers paint a picture of a company that is yet to figure out how it wants to make money.

When Sharechat was launched by the trio from IIT Kanpur, it was an early mover in the vernacular content space. As the company’s user base grew to a few hundred monthly active users, it mopped up hundreds of millions of dollars in funding from the bluest of blue chip investors, including Twitter and Google.

The founders dreamt of building a tech giant. As recently as 2021, Twitter had even wanted to acquire the company.

However, the big turning point came in the middle of 2020, amid the first wave of Covid. Following border skirmishes between Indian and Chinese soldiers, the government decided to ban short video platform TikTok and a host of other Chinese apps.

Sharechat jumped at the opportunity and created a short-video app of its own called Moj. Along with several other domestic short-video apps, such as Josh, Roposo and Chingari, it racked up millions of users within a short span of time, as the government made a clarion call for Atmanirbhar Bharat.

But lady luck has stopped smiling at the company of late.

In the absence of the two co-founders and an unstable top deck of managers, the bulk of the responsibility has fallen on the shoulders of 28-year-old founder and chief executive officer Ankush Sachdeva.

Over the years, chief financial officer Manohar Charan, who joined the company in 2019 as a vice president in the finance function after brief stints at Uber and Zomato, has become one of Sachedeva’s trusted lieutenants.

“As a non-founder executive, he has become quite powerful within the company. This has also meant that he, along with Ankush, makes decisions on content operations, product, marketing etc,” said a source.

Key exits

Sachdeva has struggled to find such loyal and hands-on managers to help him navigate the waters in other areas such as product, tech and monetisation.

For example, Sharechat hired Ajit Varghese, a senior executive at a company owned by advertising giant WPP, as chief commercial officer in December 2020 to lead the monetisation efforts. His reporting manager was co-founder Ahsan.

Varghese did not stay for the long haul. He left in December to join Hotstar.

A note on his LinkedIn profile says that he helped Sharechat “drive 7X revenue growth in 2021 and 2022 by helping brands discover and drive growth via Bharat users…” (more on the revenue front later).

Varghese declined to comment on this story.

Sharechat had also hired senior Silicon Valley executives, such as former Uber product head Gaurav Mishra, in late 2020. But he left a year later. Another hire in this bucket was Mandar Rahurkar, who has since left to head machine learning at US-based food-delivery giant Doordash.

“It seemed that the thinking was that Silicon Valley people would bring in a culture shift… Perhaps, shape the company in the mould of investors like Twitter and Google,” said an industry veteran.

Another important senior executive that Sharechat failed to retain was Debdoot Mukherjee who left to join e-commerce unicorn Meesho in March 2022, after a stint of almost three years. According to three former employees, Mukherjee was instrumental in developing Sharechat’s artificial intelligence chops.

The most important piece of tech for a social media platform is its ranking and recommendation engine. It determines what content is shown to a user — and in what order — so that his attention can be held for the longest time. Industry executives say that Sharechat’s artificial intelligence-based recommendation algorithm is the best among its Indian peers.

The TikTok conundrum

Sharechat also hired a lot of former TikTok employees. It is important to note that the company’s short-video app Moj was launched days after the Chinese short-video app was banned in India in June 2020. After the government refused to budge on removing the ban, TikTok had to let go of most of its India employees.

The desi short-video apps that shot to fame in the immediate aftermath, such as Moj, and Dailyhunt’s Josh and Chingari, pounced on the opportunity to hire ex TikTokers, said industry executives.

“The market was superhot and all of us were betting on the sales folks of TikTok because they had scaled the model like never before,” said a source.

Although Sharechat did not hire any tech or product employees from the Chinese app, it onboarded a lot of marketing, sales, PR and other folks from the company at exuberant salaries. Eventually, the ex-TikTokers were fired when the tide turned.

“ShareChat has always hired top talent from across various companies and educational institutions. We have also strived to ensure that our remuneration is in line with industry standards,” the company told Moneycontrol when asked about its TikTok hires.

To be fair, the tech hiring market heated up in 2020 and 2021 as investors pumped billions of dollars into startups. Prospective hires were soliciting offers from multiple companies at the same time, and went with the highest bidder.

Sharechat, too, participated in the excesses of the time. Having raised hundreds of millions of dollars in the digital gold rush of Covid, it didn't shy away from competing toe-to-toe on tech and product salaries.

Middle-management hires fetched salaries of near about Rs 1 crore in cash compensation, apart from a similar amount in stock options. Someone who joined Sharechat as a fresher in the product team might have been paid Rs 16-17 lakh per annum at the time, according to former employees.

Setting cash on fire

But, the exuberance did not stop at doling out fat salaries.

Just after Covid struck and employees started to work from home, Sharechat began giving its staff Zomato vouchers worth Rs 250 every day. As the company grew bigger, its employee base peaked to 2,600 heads.

Some back-of-the-envelope math would show that it was incurring almost Rs 2 crore of monthly expenses on the coupons. In startup-venture capital parlance, the coupon expenses had an annual run rate of Rs 24 crore — or around $3 million.

“Just a while back, Elon Musk was shocked to find that Twitter was spending millions of dollars on free lunches for employees. I guess he should take a look at Sharechat also,” said one of the sources quoted above.

(Twitter, which Musk acquired last year, has invested around Rs 630 crore across multiple funding rounds in Sharechat, according to Tracxn data. It currently holds a 6.8 percent stake in the company.)

Twitter’s board nominee in Mohalla Tech, Sharechat’s parent company, resigned from the microblogging platform and hence had to leave the board. Twitter has the right to nominate a member to the board at any point, Sharechat told Moneycontrol.

Sources in the know said that Sharechat was burning about $25-30 million cash every month for most of last year. However, with the shutting down of its gaming platform Jeet and the recent layoffs, the monthly cash burn is estimated to have come to around $15 million.

According to industry executives, all the domestic short-video apps shelled out large amounts of money to attract Instagram influencers. The strategy was to seed a large number of creators and bring their follower bases to the platforms.

“But, the problem was that all the indigenous short-video apps exclusively targeted the Tier 2, 3 and beyond audience. While consumer brands took some early bets on them by giving ads, they soon realised that these apps were not driving any business,” said an expert who liaises between influencers, brands and social media platforms.

Another former Sharechat employee agreed with this evaluation.

“Employees would say ‘Yeh toh dehaati app hain (it’s a rural app).’ They tried to rectify it with Moj by making it aspirational. But it is not an easy thing to do,” said the Sharechat employee.

However, these nuances were lost on the company’s management and investors when it raised over $500 million at a valuation of about $5 billion, in its Series H round. But now that the heady days of tech investments have gone, investors are asking questions about profitability and revenue growth.

By all accounts, it would be a tough ask for Sharechat to grow into its valuation.

According to a former executive of the company, the valuation math for social media companies is pretty straightforward — it is the number of daily active users (DAUs) multiplied by the lifetime value (LTV) of a user.

Sharechat currently has a DAU base of around 95 million and the typical LTV in the sector is around $25. That would mean that the company’s valuation should be around $2.4 billion.

“Even the LTV of $25 is a stretch. If you look at the bulk of the ads in Tier 2 and 3, it would be on things like astrology and weight-loss products. It is very difficult to move up the value chain there", said the executive.

A look at Sharechat’s financial performance validates this prognosis.

Interestingly, although the company had raised $100 million in its Series C funding round at a valuation of over $458 million in September 2018, it did not record any revenue from operations in FY19, according to Tracxn data.

In the next financial year (FY20), Sharechat made Rs 9 crore in operating revenue and registered a loss of Rs 677 crore. While revenue grew almost nine times to Rs 80 crore in FY21 (the first fiscal of the Covid-led boost), losses ballooned to Rs 1,461 crore.

In FY22, the company saw its revenue jump more than four times to Rs 347 crore, but losses spiralled to Rs 2,989 crore. In simple terms, one could say that Sharechat had spent around Rs 9 for a rupee of revenue during the period.

According to a source, the company is currently at an annual revenue rate of $100 million (approximately Rs 800 crore) and trying to achieve profitability, largely due to investor pressure. While ShareChat is doing decently in terms of revenue, Moj is struggling a bit in terms of monetisation due to competition from Instagram Reels, YouTube Shorts, and Josh.

"ShareChat has seen its revenue grow rapidly since 2021 when we launched our monetisation efforts. Since then our ads business as well as other revenue mechanisms have seen immense growth and we look forward to our revenue numbers rising in parallel," a company spokesperson said, responding to questions about its revenue projection for FY23.

Hard questions

“It has simply been overspending all throughout — and for no significant moat,” said a former employee.

Sharechat has not been able to capture a very large share of the Hindi audience, which is perceived to be a bit more aspirational than regional language audiences. While the company has done very well in some eastern and southern regions, Meta-owned Instagram has pushed the pedal in Hindi and is the winner by far.

One way Sharechat has tried to deal with the Hindi problem is by acquiring short-video peer MX TakaTak, in what was reportedly a $600-700 million deal. While Sharechat was always strong in the southern states, MX TakaTak had a good presence in the north.

With the acquisition, MX TakaTak brought along its 150 million monthly active users (MAU), who were subsumed into the Moj app. The combined MAU base of Sharechat thus shot up to over 400 million.

“Some credit is also due to the work that was done by Moj’s tech and product orgs (teams) — both the AI engine and the bells and whistles, like filters that they created… What we built was as good as possible, sitting here in India,” said one of the former executives.

“Yet, the question of poor fundamentals remains. If they continue to burn cash the same way, they may soon have to undertake a second round of layoffs, unless there’s a funding round in the next few months,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.