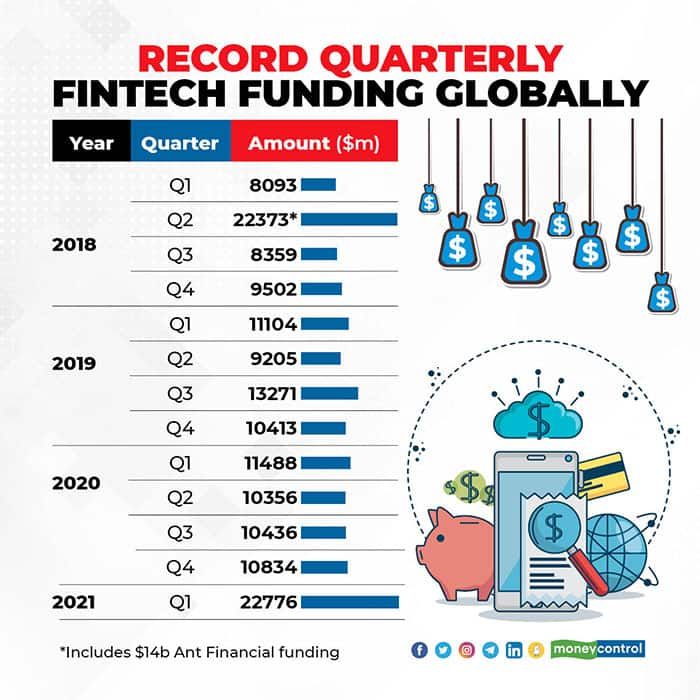

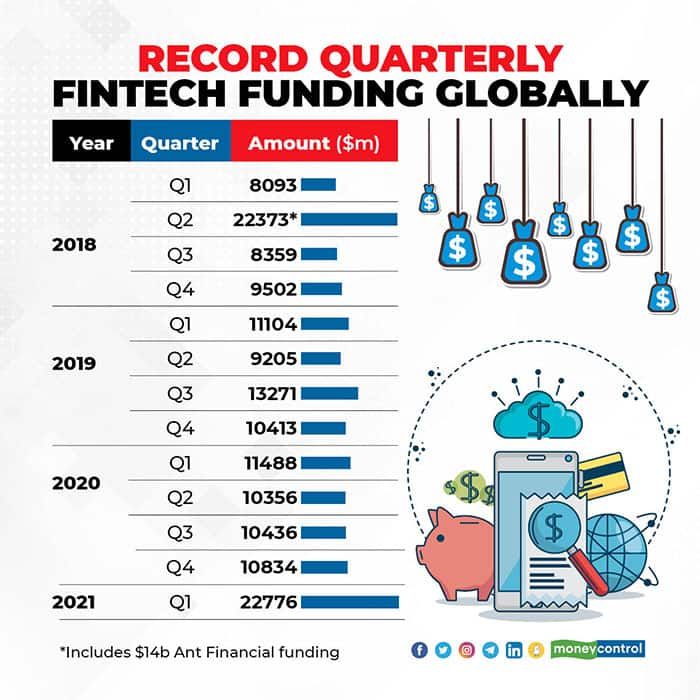

Fintech startups raised record $22.8 billion in Q1 2021: Report

Fintechs globally raised more than double the previous quarter, indicating the soaring demand for digital financial services during the pandemic, as more people stay at home. Robinhood, Stripe and many more touched record valuations and user numbers.

Mumbai / May 11, 2021 / 11:22 IST

Fintech firms globally raised a record $22.8 billion in the first quarter of 2021, more than double the previous quarter, according to a report from CB Insights, a data platform.

Fintechs raised $22.8 billion across 614 deals, compared to $10.8 billion across 560 deals in the last quarter of 2020. The record beats the $22.3 billion raised in the second quarter of 2018, which included Ant Financial’s historic $14 billion funding round in China.Large rounds of over $100 million, accounting for 69 percent of total funding in the quarter, drove the boom, at a time when digital payments, investing, insurance and more has become mainstream during the COVID-19 pandemic as people stay at home.Investing app Robinhood, payments firm Stripe, short term loan provider Klarna and Chinese financial security firm Paradigm raised the biggest rounds of the quarter- aggregating to $5.7 billion.

Story continues below Advertisement

However, fintech IPOs have broadly lagged the S&P 500 benchmark index, underperforming relative to other technology sectors and the stock market as a whole, the report said.Among sub-sectors of fintech, payments, digital lending, small and medium businesses and wealth management grew the fastest in terms of funding they received, while banking, capital markets and insurance saw investments slow down compared to the previous quarter. Invite your friends and family to sign up for MC Tech 3, our daily newsletter that breaks down the biggest tech and startup stories of the day

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!